ICI Viewpoints

How America Supports Retirement: The Incentive to Save Is Not Upside Down

Fourth in a series of ICI Viewpoints.

In my new book, How America Supports Retirement: Challenging the Conventional Wisdom on Who Benefits, and the first three ICI Viewpoints in this series, I’ve demonstrated that Social Security’s benefit formula drives participation in tax-deferred employer-sponsored retirement plans; that the full system of government support for retirement is progressive; and that those in higher tax brackets don’t enjoy greater “bang for their buck” from tax deferral.

In this article, the fourth and final posting, I’ll tackle another widely held belief about tax deferral: that the current tax system provides an “upside-down” incentive to save—a greater incentive to save for higher earners than for lower earners.

This myth is rooted in a fundamental misunderstanding. The incentive to save is not created by the income tax; rather, it comes from the return on investments available in the capital and credit markets. A normal income tax actually reduces the incentive to save, by taxing investment returns provided by the market. Tax deferral eliminates this disincentive by effectively taxing investment returns at a zero rate—making the incentive to save more equal for all workers, regardless of their marginal tax rate.

What Is the Incentive to Save?

Before measuring the incentive to save, it is important to define what the phrase means.

Individuals can do one of two things with their income every year: they can spend it, or they can save it. Thus, if I want to increase my savings this year, I must reduce my spending.

The reward for reducing spending today is that I can increase my spending in the future—that’s my incentive. Thus, to measure my incentive to save, I must answer the following question: if I reduce spending by $1 today, how much can I increase spending in the future?

An Income Tax Creates a Disincentive to Save

Because it taxes investment returns, the normal income tax structure discourages saving. This can be illustrated by comparing the tradeoff between current spending and future spending for two workers with $1,000 of wages who are deciding between 1) spending the money today and 2) setting it aside in a taxable investment account for 20 years that pays 6 percent interest annually. To keep matters simple, the example assumes that workers’ marginal tax rates do not change throughout the 20-year period.

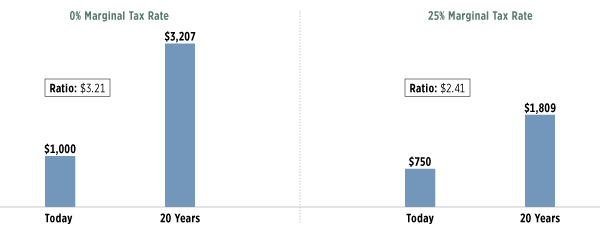

Figure 1

An Income Tax Discourages Savings

Amount of after-tax income generated by $1,000 of compensation in the current year and in 20 years, assuming an investment in a taxable account that pays 6 percent interest annually

Note: Marginal tax rates are assumed to remain the same throughout the 20-year period.

Source: ICI calculations

As shown in the figure above, a worker with a zero marginal tax rate could spend the entire $1,000 today. Alternatively, the worker could save the entire $1,000 in a taxable investment account. After 20 years, assuming the tax rate is still zero, the worker would have $3,207 to spend.

For the worker with a zero marginal rate, the incentive to save is this: if I reduce spending by $1 today, I can increase spending by $3.21 ($3,207 divided by $1,000) in 20 years.

What about a worker with a 25 percent marginal tax rate? This worker could not spend the entire $1,000 today—they’d have to pay $250 of income tax first, and would have $750 left over to spend. Alternatively, the worker could save the $750 in a taxable investment account. If the investment generated interest payments of 6 percent every year and incurred a 25 percent tax on that interest income, after 20 years the worker would have $1,809 to spend.

So, for the worker with a 25 percent marginal rate, the incentive to save is this: if I reduce spending by $1 today, I can increase spending by $2.41 ($1,809 divided by $750) in 20 years.

An example like this makes it easy to see that an income tax reduces the incentive to save and that lower earners actually have the highest incentive to save when it comes to saving in a taxable account. Economists call the gap that an income tax introduces between the rate of return paid by the market and the rate of return received by investors a “tax wedge.”

Deferral Removes the Wedge

Tax deferral removes the disincentive to save that is inherent in an income tax. To illustrate this, let’s calculate the same tradeoffs between current and future spending that we calculated in Figure 1, but assume that the compensation saved for 20 years is tax-deferred.

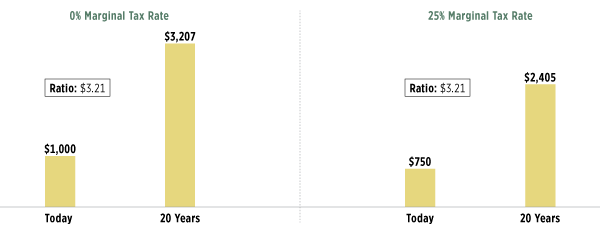

Figure 2

Tax Deferral Removes the Disincentive to Save

Amount of after-tax income generated by $1,000 of compensation in the current year and in 20 years, assuming an investment in a tax-deferred account that pays 6 percent interest annually

Note: Marginal tax rates are assumed to remain the same throughout the 20-year period.

Source: ICI calculations

The situation for the worker with a zero marginal tax rate is unchanged: the worker can spend the entire $1,000 today, or put the entire $1,000 in a tax-deferred retirement plan and spend $3,207 in 20 years. As with the taxable investment, the incentive to save is this: if I reduce spending by $1 today, I can increase spending by $3.21 ($3,207 divided by $1,000) in 20 years.

For the worker with a 25 percent marginal tax rate, the situation is quite different. After paying taxes, the worker could still spend $750 today. But now the worker has the alternative to contribute the entire $1,000 to a tax-deferred account. After 20 years of earning tax-deferred interest of 6 percent, the account balance would be $3,207. When the funds are withdrawn, however, the worker would pay a tax of 25 percent, or $802, leaving them with $2,405 to spend.

What is the incentive to save for the worker with a 25 percent marginal tax rate? Once again, compare the money available for future spending ($2,405) with the amount the worker could spend today ($750). The ratio ($2,402 divided by $750) is 3.21. In other words, for the worker in the 25 percent tax bracket, the incentive to save with a tax-deferred account is exactly the same as for the worker with a zero tax rate: if I reduce spending by $1 today, I can increase spending by $3.21 in 20 years.

By effectively taxing all investment returns at a zero rate, tax deferral removes the “tax wedge” between the market rate of return and the rate of return received by investors. And tax deferral removes that wedge for all investors—regardless of their tax bracket.

As the illustration above demonstrates, far from providing an upside-down incentive to save, tax deferral equalizes the incentive to save across workers, regardless of a worker’s marginal tax rate.

Challenging the Conventional Wisdom

My primary goal in writing How America Supports Retirement: Challenging the Conventional Wisdom on Who Benefitswas to help clarify the nature of the U.S. retirement system. Many retirees rely on resources from both Social Security and employer plans. In addition to illustrating how Social Security and tax deferral work together to provide retirement resources, the analysis in the book illustrates that the combined benefits of the two programs are progressive.

In addition, I was able to use the analysis to illustrate that two widely held, and often repeated, beliefs about tax deferral are incorrect. First, the reason that higher earners benefit more from retirement plans is not that they get more benefits on every dollar, but because they contribute more dollars. Second, far from providing an upside-down incentive to save, tax deferral equalizes the incentive to save across workers.

The research in this book builds on previous research done by Sylvester Schieber, who concluded a discussion of this topic in his 2012 book, The Predictable Surprise with the following admonition: “We need to view the system from a more holistic perspective.” I hope my research will encourage more work that takes a comprehensive view of the U.S. retirement system—and helps to clear away the myths.

Additional Resources:

How America Supports Retirement

Other Posts in This Series:

- How America Supports Retirement: Tackling the Myths That Surround Us

- How America Supports Retirement: No, Benefits Are Not “Tilted” to the Higher Earners

- How America Supports Retirement: What Do Tax Rates Have to Do with the Benefits of Tax Deferral? Less Than You Think

- How America Supports Retirement: The Incentive to Save Is Not Upside Down

Peter Brady is a Senior Economic Adviser at ICI.