ICI Viewpoints

Bond Mutual Fund Outflows: A Measured Investor Response to a Massive Shock

In recent months, we have seen many high-profile analyses arguing that bond mutual funds amplified stresses in financial markets during the start of the COVID-19 pandemic in March 2020. These analyses conclude that bond mutual funds therefore may require structural regulatory reforms. But as the information in this ICI Viewpoints and others to follow indicates, policymakers should not jump to that hasty conclusion.

In a series of posts, we will demonstrate that the evidence about what happened to financial markets in March 2020 is still far too mixed and preliminary to conclude that new regulation is appropriate for bond mutual funds. Given the importance of bond mutual funds to retail investors and to the US and global economies, it is critical that we have all the data and insights—measured and applied correctly—before regulators start considering policy recommendations to reform these funds.

We’ll start with a key question: what caused the record redemptions from US bond mutual funds in March 2020? Did those redemptions reflect, as some analysts contend, a heightened and growing responsiveness on the part of bond mutual fund investors, a trend that makes those investors more prone to redeem heavily in times of turmoil and threatens financial stability? Or were those redemptions simply proportional to the once-in-a-century shock during that turbulent month?

Our findings indicate that bond mutual fund investors behaved in March 2020 much as they always have in response to financial market shocks: redeeming moderately in proportion to the size of the shocks they face. It’s just that in March 2020, they faced a massive and unprecedented economic and financial market shock. And, although investors redeemed 5.2 percent of their bond fund assets, they actually retained 94.8 percent.

These findings undermine the claim that bond mutual fund investors pose a growing threat to the stability of markets.

The Debate: Has Bond Mutual Fund Investors’ Behavior Changed?

The COVID-19 shock was unique and all-encompassing: while it was first and foremost a health crisis, it pummeled both the real economy and the financial sector. Seeking shelter from the downturn, volatility, and uncertainty, investors around the world scrambled for liquidity. This included trying to sell longer-dated bonds in exchange for cash, or for overnight or very short-term debt.[1] These efforts, all responses to the COVID-19 developments, created singular effects in financial markets.

Some analysts have argued that these singular effects may have been amplified by the actions of bond mutual fund investors,[2] and that those investors in recent years have become more reactive to market conditions—that is, that they respond more strongly to negative fund performance.[3] As we discuss here, percent outflows from bond mutual funds in March 2020 hit a one-month record. But the drop in bond prices also shattered records from the past three decades.

Drop in Bond Prices During COVID-19 Turmoil Shattered Records

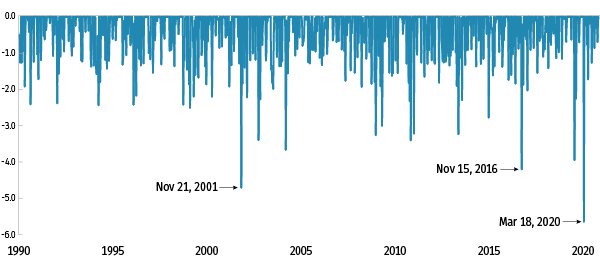

Figure 1

Reflecting Stresses from COVID-19, Treasury Bonds Suffered Deep Losses in Early- to Mid-March 2020

Total return on 10-year Treasury bonds, 1990 to 2020, seven business day periods*

* The figure plots those seven-day periods where the return on the 10-year Treasury bond index was negative. The S&P 10-year Treasury bond index starts on December 29, 1989.

Source: Investment Company Institute calculations based on S&P 10-year Treasury bond total return index

It is well-established that flows to bond mutual funds tend to track bond returns.[4] One of the most unusual aspects of the COVID-19 market turmoil was that bond prices fell at a record pace—even for US Treasury bonds, the safest of safe havens, whose prices normally rise during times of crisis. Indeed, Treasury bond prices dropped more during the seven business days from March 9 to March 18 than in any other similar period in the past 30 years (Figure 1). Given that drop, prices on all other bonds also were bound to fall by large amounts.

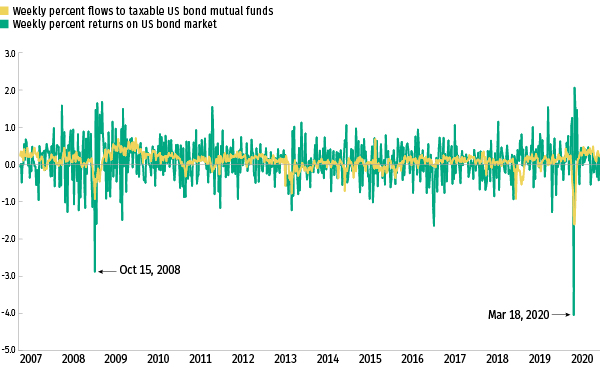

Bond price declines did indeed shatter records in March 2020. Figure 2 plots weekly percent returns on taxable US bonds from January 2007 to December 2020. Consistent with the record decline in Treasury bond prices shown in Figure 1, prices on taxable US bonds dropped 4.0 percent the week ending March 18, 2020, which was easily the largest one-week decline in the past 30 years. The second largest one-week decline occurred during the global financial crisis, when prices on taxable US bonds dropped 2.9 percent the week ending October 15, 2008. Notably, the bond market dropped more, and bond funds saw larger outflows, during the week of March 18, 2020.

Figure 2

Bond Mutual Fund Flows Tend to Track Bond Market Returns

Percent, weekly, weeks ending Wednesday

Note: Taxable US bond mutual funds includes investment grade, multisector, government, high-yield; and excludes municipal bond funds or bond funds with an international, global, or emerging markets focus. Percent flows are calculated as weekly fund flows divided by those funds’ assets at the end of the previous month. Percent return on the US bond market is the weekly percent change in the Bloomberg Barclays US Aggregate Total Return bond market index, which is an index of total returns on taxable US bonds.

Sources: Investment Company Institute and Bloomberg

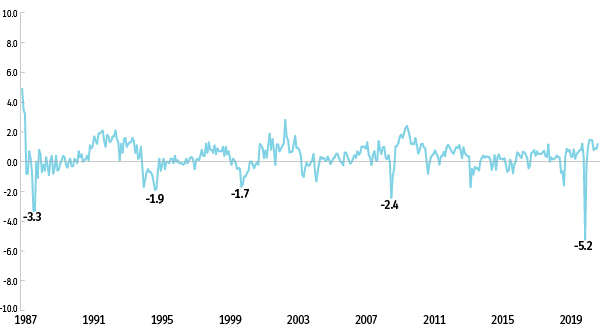

Figure 3

The Massive Shock to Financial Markets Triggered Outflows from Bond Mutual Funds

Monthly flows as a percentage of previous month’s assets

Note: This chart represents monthly flows to all bond mutual funds, divided by previous month’s assets.

Source: Investment Company Institute

Given the Massive Shock, How Did Bond Fund Investors React?

Given the sheer magnitude of the economic and financial shocks to the bond market in March 2020, it would have been truly remarkable had investors in bond mutual funds not reacted. Investors did react, redeeming 5.2 percent of those funds’ assets (Figure 3).[5]

But were those outflows out of proportion to the size of the shock? Some analysts say yes.[6] They argue that bond fund investors have become more reactive in recent years to market developments, perhaps boosting March 2020 outflows relative to what previously might have been expected.

We believe there’s another possibility that better fits the data: fund investors reacted about as they have in the past. They redeemed relatively modestly in proportion to the size of the financial market shock—it’s just that in March 2020 they faced a massive shock.[7]

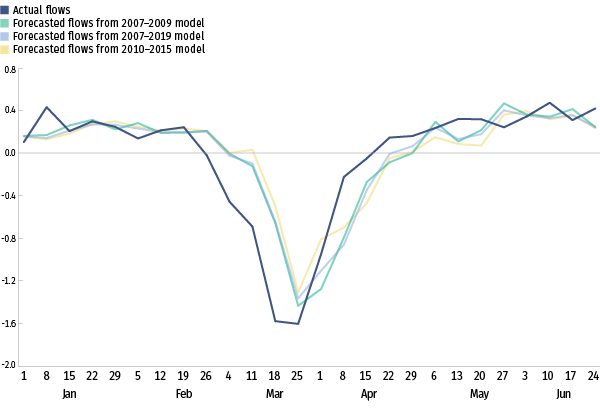

To assess these competing alternatives, we turned to a statistical forecasting model. Our model gauges how flows to bond mutual funds that focus on taxable US bonds respond to four factors: bond market returns, stock market returns, stock market volatility, and recent past percent flows to bond funds. To gauge whether investor behavior has changed, we estimate this model using data from three different periods: 2007 to 2019; 2007 to 2009; and 2010 to 2015. The period 2007 to 2019 stretches from one year before the global financial crisis of 2008-2009 to just before the onset of the COVID-19 crisis. The second period, 2007–2009, focuses only on the global financial crisis. The third period, 2010–2015, focuses on the post–global financial crisis period, but stops several years before the COVID-19 crisis to better gauge whether, in the past five years, investors have become more sensitive to bond market conditions.

Figure 4

Actual and Forecasted Bond Mutual Fund Flows During COVID-19

Weekly percent flows, weeks ending Wednesday

Note: Taxable US bond mutual funds includes investment grade, multisector, government, high-yield; and excludes municipal bond funds or bond funds with an international, global, or emerging markets focus. Percent flows are calculated as weekly fund flows divided by those funds’ assets at the end of the previous month. Predicted flows are based on a four-variable vector autoregression estimated using weekly data on fund percent flows, percent changes in Bloomberg Barclays US Aggregate Total Return bond market index, changes in the Cboe Volatility Index (VIX), and percent changes in the Wilshire 5000 stock index over the period from January 3, 2007, to January 1, 2020; the vector autoregression includes four lags of each variable.

Sources: Investment Company Institute and Bloomberg

Figure 4 shows the results. The blue line plots actual weekly percent flows. The other lines plot forecasts from the model based on data from those three periods. As is often the case with forecasting models, the forecasts lag a bit behind the actual values, declining and subsequently recovering a bit later. The key point, however, is that the patterns and magnitudes in the forecasts look very similar to the actual flows from bond mutual funds—whether the model is based on long or short periods, or periods where markets are roiled or relatively calm. In other words, it wasn’t that investors became more reactive, but that they reacted moderately in proportion to a record-breaking downturn in the markets combined with a huge jump in market volatility.

To conclude:

- The record one-month outflows from bond mutual funds in March 2020 reflected the immense size of the shock from COVID-19 to the real economy and the financial sector, not a fundamental change in fund investor behavior.

- Fund investors are unlikely to redeem at the percentage pace seen last March unless there is another shock of the same magnitude as COVID-19.

This suggests that policy focused on structural reforms for mutual funds is in danger of doing more harm than good, by imposing large costs on investors and markets year in and out to protect against a once-in-a-century cataclysm.

Taking a Deeper Look at Bond Mutual Funds During COVID-19

In subsequent ICI Viewpoints we plan to take up a range of issues related to the experiences of bond mutual funds in March 2020, including:

- What is the strength and quality of the evidence that bond mutual funds amplified shocks to financial markets? What’s the evidence that the size of any effect was economically material?

- Has the narrative that funds amplified the shock been driven in part by a misinterpretation of published data—data, for example, on mutual funds’ net acquisitions of Treasury and investment grade corporate bonds—or confusion about bond fund categorizations (e.g., confusing “investment grade corporate bond funds” with “investment grade bond funds”)?

- How do bond mutual funds manage their portfolios to meet shareholder redemptions?

- What explains the strong demand for bond mutual funds over the past decade? Is it, as some have argued, that investors have been motivated primarily by a search for higher yields? Or has demand been driven by more fundamental factors (e.g., growth in target date funds, demographics, the long bull stock market)?

- Are there fundamental reasons—e.g., tax considerations, risk and difficulty of timing the markets, saving for long-term goals—to expect investors’ flows to bond funds to be more stable than is often credited?

A theme that will emerge in these ICI Viewpoints is that the evidence about what happened to financial markets in March 2020 is still far too mixed and preliminary to conclude that regulatory intervention is indicated for bond mutual funds. A related theme is that relevant analyses must be scrutinized with a sharp and critical eye; otherwise, regulators risk basing policy recommendations on flawed data, misimpressions, and misunderstandings, potentially to the detriment of millions of retail investors who rely on funds to save for the long term.

Other Posts in This Series

- Bond Mutual Fund Outflows: A Measured Investor Response to a Massive Shock

- Growth in Bond Mutual Funds: See the Whole Picture

- Growth in Bond Mutual Funds: A Question of Balance

[1] See “The Impact of COVID-19 on Economies and Financial Markets,” Report of the COVID-19 Market Impact Working Group (Washington, DC: Investment Company Institute, October 2020), available at www.ici.org/pdf/20_rpt_covid1.pdf.

[2] See, for example, Federal Reserve Board, Monetary Policy Report, February 19, 2021, arguing that “open-end investment funds, particularly those that invest substantially in corporate and municipal debt…experienced large, sudden redemptions in March 2020, which contributed to strains in broader short-term funding markets and fixed-income debt markets.”

[3] See, for example, Frank Hespeler and Felix Suntheim, “The Behavior of Fixed-Income Funds During COVID-19 Market Turmoil,” Global Financial Stability Notes, International Monetary Fund, December 2020, arguing that “results thus point to an increased inclination of investors to redeem their [bond mutual fund] shares when perceiving mounting valuation risk for their investments as they did during the COVID-19 episode. Such behavior suggests that feedback mechanisms from the devaluation in securities prices to capital withdrawals by investors may have intensified and could have led to runs on funds.” See also Antonio Falato, Itay Goldstein, and Ali Hortaçsu, “Financial Fragility in the COVID-19 Crisis: The Case of Investment Funds in the Corporate Bond Markets,” NBER Working Paper 27559, December 2020, arguing that their evidence indicates “there was an increased sensitivity of [bond mutual fund] flows to performance in the COVID-19 crisis” and that “investors responded much more strongly to negative performance of their funds when making outflow decisions during the crisis."

[4] See Figure 3.8 in 2020 Investment Company Fact Book: A Review of Trends and Activities in the Investment Company Industry, Washington, DC: Investment Company Institute, available at www.ici.org/pdf/2020_factbook.pdf.

[5] The patterns of flows to taxable US bond mutual funds (taxable US bond mutual funds includes the following categories: investment grade, multisector, government, high-yield) looks very similar overall, but outflows were a bit smaller in March 2020 at 4.9 percent compared to 5.2 percent for all bond mutual funds.

[6] See Hespeler and Suntheim (2020) and Falato, Goldstein, and Hortaçsu (2020).

[7] In the jargon of economics, suppose fund flows = θ × size of market shock, where θ is the responsiveness of fund flows to a given sized market shock. The question here is whether fund flows were larger because of a change in behavior, as would be indicated by an increase in θ, or whether investor behavior was unchanged, but the size of market shock was abnormally large because of COVID-19 events.

Sean Collins is Chief Economist at ICI.