ICI Viewpoints

Understanding Interest Rate Risk in Bond Funds

Mutual funds and exchange-traded funds (ETFs) that invest in bonds—like all other funds—involve investment risks. For investors in bond funds, one significant concern is interest rate risk. In general, interest rate risk reflects the possibility that the value of a bond will change when prevailing interest rates rise or fall. The value of a bond generally moves in the opposite direction from interest rates: for example, when interest rates rise, prices for fixed-rate bonds will fall.1 Because bond funds are made up of a collection of individual bonds, bond fund investors should expect an increase in the level of interest rates to have a negative impact on the value of their investment.

Why does this matter? Long-term interest rates reached their lowest recorded levels in July 2016 and were on a steady upward trend until early December. Rates dipped recently, but that could be short-lived if global trade tensions ease and the outlook for economic growth remains robust. Investors should be aware of the effects rising interest rates could have on their bond fund investments.

Can Interest Rate Risk Be Quantified?

Interest rate risk is commonly measured by duration—the degree of sensitivity of a bond’s price to rate movements. If interest rates were to change tomorrow, duration (commonly expressed in years) tells us how much the price of a bond should change in the opposite direction. For example, if a bond has a duration of eight years, an increase of 1 percentage point in prevailing interest rates alone would reduce the price of this bond by 8 percent. In general, the longer a bond’s remaining maturity, the higher its duration will be and the more its price will change as interest rates change. Although longer-term bonds fluctuate in value more than shorter-term bonds for a given change in interest rates, they also tend to have higher yields, owing in part to their inherently higher interest rate risk.

Duration in a bond fund is generally determined by taking the weighted average of the durations of all the bonds the fund holds in its portfolio. For a bond fund with a duration of four years, a 1 percentage point increase in interest rates alone would be expected to lower the overall net asset value of the fund by 4 percent.

When we look at broad trends in bond funds at ICI, we often look at bond fund duration on an aggregated basis by estimating an asset-weighted average duration, which gives more weight to the durations of bond funds with greater assets. In this context, we believe an asset-weighted average is appropriate because it reflects where bond fund investors actually are putting their money.

What Is the Average Duration of Bond Funds and How Has It Changed?

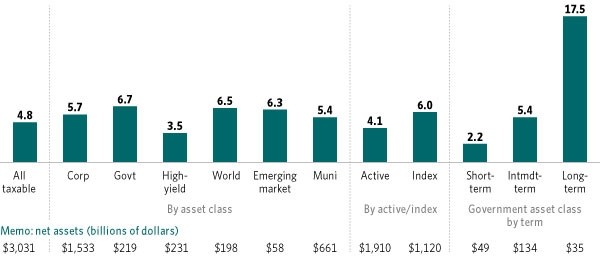

As of September 2018, the average duration of taxable bond funds was 4.8 years (Figure 1). Taxable bond funds, though, represent many different types of funds, each with potentially different durations. For example, short-term government bond funds had an average duration of 2.2 years as of September 2018, while long-term government bond funds had an average duration of 17.5 years.

Corporate bond funds, which consist primarily of investment grade debt securities, had an average duration of 5.7 years as of September 2018. By contrast, high-yield bond funds, which consist primarily of riskier, below–investment grade debt securities, had an average duration of 3.5 years. For a number of reasons, below–investment grade firms generally issue shorter-term debt than investment grade firms do, and so average durations for high-yield bond funds tend to be on the lower end of the spectrum.

Figure 1

Bond Fund Durations Differ by Investment Objective

Asset-weighted average effective duration in years, September 30, 2018

Note: Duration is measured as an asset-weighted average. Data exclude funds that invest primarily in other funds.

Source: Investment Company Institute tabulations of Morningstar data

For some types of bond funds, their current average durations are not much different from those in September 2007, prior to the start of the financial crisis (Figure 2). Note, for example, the small changes in average durations for actively managed taxable bond funds, short-term government bond funds, and emerging market bond funds.

By contrast, average durations of index, world, and government bond funds are noticeably higher than their September 2007 levels. The biggest jump: the average duration of long-term government bond funds currently stands at 17.5 years, up from 11.9 years in September 2007.

Figure 2

Current Bond Funds’ Average Durations Compared with Pre–Financial Crisis Levels

Asset-weighted average effective duration in years, selected dates

| Category | September 2007 | September 2018 | Change |

| All taxable | 4.5 | 4.8 | ↑ 0.3 years |

| Active taxable | 4.5 | 4.1 | ↓ 0.4 years |

| Index taxable | 4.8 | 6.0 | ↑ 1.2 years |

| Corporate | 5.1 | 5.7 | ↑ 0.6 years |

| Government | 4.3 | 6.7 | ↑ 2.4 years |

| Short-term | 2.0 | 2.2 | ↑ 0.2 years |

| Intermediate-term | 4.5 | 5.4 | ↑ 0.9 years |

| Long-term | 11.9 | 17.5 | ↑ 5.5 years |

| High yield | 4.1 | 3.5 | ↓ 0.6 years |

| World | 4.7 | 6.5 | ↑ 1.8 years |

| Emerging market | 6.5 | 6.3 | ↓ 0.2 years |

| Municipal | 5.9 | 5.4 | ↓ 0.5 years |

Note: Duration is measured as an asset-weighted average. Data exclude funds that invest primarily in other funds.

Source: Investment Company Institute tabulations of Morningstar data

Why Have Durations in Long-Term Government and Index Bond Funds Risen?

Changes in the composition of outstanding US bonds in the past decade have resulted in higher durations for long-term government and index bond funds. Faced with funding historically large fiscal deficits, the US government has expanded the amount of marketable Treasury debt outstanding from $4.4 trillion at fiscal year-end 2007 to $15.3 trillion at fiscal year-end 2018. To take advantage of historically low long-term interest rates, the US Treasury tilted issuance of its bonds to the longer end of the maturity range. For example, Treasury bonds with 20 years or more of remaining maturity rose from 5 percent of total marketable Treasury debt outstanding at fiscal year-end 2007 to 12 percent by fiscal year-end 2018. Thus, it’s not surprising that durations of long-term government bond funds have increased over the past 10 years.

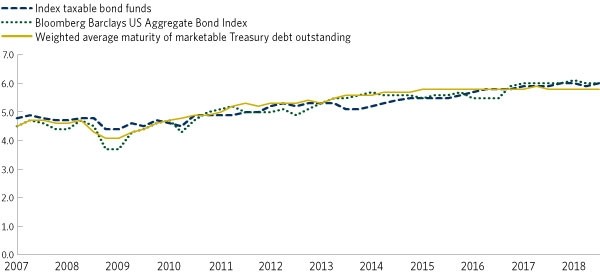

US Treasury actions also were the primary driver behind the steady increase in average duration for index taxable bond funds (Figure 3). Many of the funds in this category track broad-based bond indexes, such as the Bloomberg Barclays US Aggregate Bond Index, which reflect the composition of outstanding US dollar-denominated corporate and government bonds. With the rapid expansion in Treasury debt over the past decade, Treasury bonds now account for 40 percent of US corporate and government bonds outstanding, up from 18 percent at fiscal year-end 2007. In addition, the US Treasury’s tilt to longer-term issuance pushed the weighted average maturity (which is related to duration) of outstanding marketable Treasury debt up from 4.7 years to 5.8 years over the same period. The end result has been a step-up in duration of the Bloomberg Barclays US Aggregate Bond Index from 4.6 years to 6.0 years and a similar rise in duration for taxable index bond funds.

Figure 3

Average Duration of Index Taxable Bond Funds Has Increased in Line with Major Bond Index

Asset-weighted average in years, selected categories; quarter-end, 2007–2018*

*Data are as of September 30, 2018.

Note: Duration is measured as an asset-weighted average. Data exclude funds that invest primarily in other funds.

Sources: Morningstar, Bloomberg, and US Department of the Treasury

The Impact on Bond Fund Investors

As interest rates rise, bond fund investors are likely to see the value of their funds fall, with the degree of that impact determined by the fund’s duration. But the news isn’t all bad for those investors. It’s important to keep in mind that a bond fund also earns income through interest received on the bonds held in its portfolio. This interest income helps to offset, either partially or entirely, the decline in the value of a bond fund from an increase in interest rates.

1Investors seeking bonds have a choice: they can buy existing bonds that are already on the market with their coupon interest rate set at the time of issuance, or newly issued bonds with coupons set at today’s rates. If rates have risen since the existing bonds were issued, the old coupon interest rate produces a smaller yield than the newly issued bonds offer. To compete, sellers of existing bonds must lower their prices, producing yields (coupon divided by the selling price) that are competitive with current interest rates.

Shelly Antoniewicz is the Deputy Chief Economist at ICI.

James Duvall is an Economist at ICI.