ICI Viewpoints

Americans Trust in Their 401(k) Plans

Defined contribution (DC) plans have long been a key component of Americans’ retirement savings. And with more than $5 trillion in assets and about 54 million active participants, 401(k) plans are the most common type.

401(k) plans offer a wide array of investment options (28 options, on average). They often include employer contributions, as well as provide the flexibility of a 401(k) plan loan feature. In fact, nearly nine out of 10 participants are part of plans that offer these features.

Successful retirement saving often relies on a paycheck-by-paycheck commitment over the course of a career, and employees who participate in 401(k) plans put themselves on the path to a secure retirement. ICI recently asked Americans about their views regarding DC plans; their responses, described and analyzed in “American Views on Defined Contribution Plan Saving, 2016,” show that DC-owning households appreciate the savings and investment features of their plans.

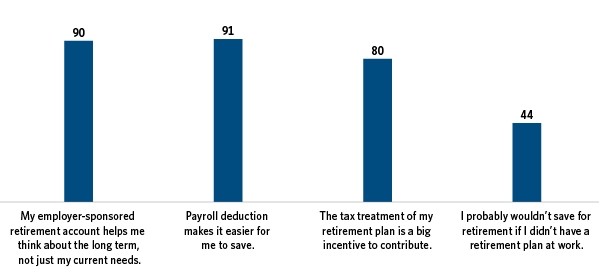

Participants Agree: DC Plans Make Saving Easier

401(k) plans offer access to payroll deduction, tax-advantaged saving, and an opportunity to save for retirement with each paycheck. Households with DC plan accounts indicate that they appreciate these benefits. Ninety percent of DC-owning households agree that their DC plan account helps them think about the long term, not just their current needs (see Figure 1, below); 91 percent agree that payroll deduction makes it easier to save; and 44 percent agree that they probably wouldn’t save for retirement if they didn’t have their DC plan at work. These results highlight the important role that employers play in promoting retirement saving.

Figure 1

DC-Owning Households Appreciate the Savings Features of DC Plans

Percentage of DC-owning households agreeing with each statement, fall 2016

Note: The figure reports the percentage of DC-owning households who “strongly agreed” or “somewhat agreed” with the statement. The remaining households “somewhat disagreed” or “strongly disagreed.”

Source: ICI tabulation of GfK KnowledgePanel® OmniWeb survey data (fall 2016)

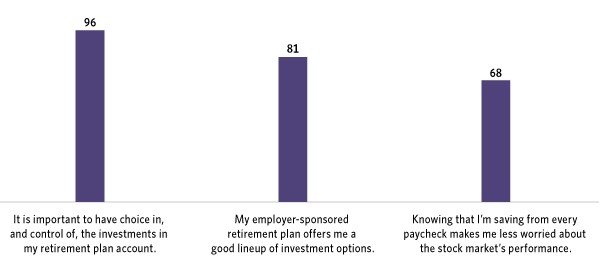

In setting up a 401(k) plan, an employer selects the investment options to offer—typically stock, bond, and money market investments, and products that hold a diversified mix of investments. Plan participants select from the plan’s options.

Nearly all DC-owning households (96 percent) appreciate the choice and control offered by their DC-account investments, while most (81 percent) agree that their plan offers a good lineup of investment options (see Figure 2, below). More than two-thirds indicate that knowing that they’re saving from every paycheck makes them less worried about the stock market—helping them to continue investing even when the stock market is down, and putting them in a position to ride the market up when it rises.

Figure 2

DC-Owning Households Appreciate the Investment Features of DC Plans

Percentage of DC-owning households agreeing with each statement, fall 2016

Note: The figure reports the percentage of DC-owning households who “strongly agreed” or “somewhat agreed” with the statement. The remaining households “somewhat disagreed” or “strongly disagreed.”

Source: ICI tabulation of GfK KnowledgePanel® OmniWeb survey data (fall 2016)

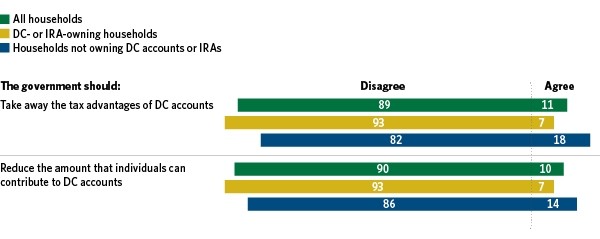

Survey respondents also registered overwhelming support for the current tax treatment of their plan, as well as control over retirement plan assets and income—both while working and in retirement. For example, nine in 10 US households opposed taking away the tax advantages of DC accounts or reducing the individual contribution limits of DC accounts (see Figure 3, below). Even among households not currently owning DC accounts or individual retirement accounts (IRAs), more than eight in 10 were opposed to taking away the plans’ tax advantages or reducing their contribution limits.

Figure 3

Most US Households Oppose Reducing Tax Advantages of DC Accounts

Percentage of US households agreeing or disagreeing with the statement by ownership status, fall 2016

Note: The “agree” column includes the percentage of households that “strongly agreed” or “somewhat agreed” with the statement, and the “disagree” column includes the percentage of households who “somewhat disagreed” or “strongly disagreed.”

Source: ICI tabulation of GfK KnowledgePanel® OmniWeb survey data (fall 2016)

Full details on the survey and additional results can be found in “American Views on Defined Contribution Plan Saving, 2016,” while more information about 401(k) plans—including FAQs, videos, and publications—can be found in ICI’s 401(k) Resource Center.

Sarah Holden is the Senior Director of Retirement and Investor Research at ICI.