ICI Viewpoints

A Look Inside ETFs and ETF Trading

Investors in exchange-traded funds (ETFs) are trading shares with each other far more than they are turning to authorized participants to create or redeem shares.

On average, the primary market—where authorized participants place orders with ETFs to create new shares and redeem existing shares—accounts for less than 10 percent of daily ETF market activity, and involves less than 0.5 percent of the industry’s $1.8 trillion in assets. The other 90 percent takes place in the secondary market, where investors trade existing ETF shares with each other on exchanges and other venues.

Moreover, on most trading days, the vast majority of ETFs don’t create or redeem shares at all. Looking at ETFs across several asset classes in both equities and bonds, we examined more than 200,000 “fund days”—the sum of the number of ETFs in operation on each trading day across the period from January 3, 2013, through June, 30, 2014—and found that about three-quarters of the fund days showed no primary market activity.

Primary Market Activity Relative to Total Trading Across the ETF Industry

Daily; January 3, 2013, to June 30, 2014

| Investment objective |

Primary market relative |

||||

| Equity |

9 |

||||

| Domestic |

9 |

||||

| Large-cap |

7 |

||||

| Small-cap |

9 |

||||

| Other domestic |

16 |

||||

| International |

8 |

||||

| Emerging markets |

6 |

||||

| Other international |

11 |

||||

| Bond |

19 |

||||

| Domestic |

19 |

||||

| Domestic high-yield |

17 |

||||

| Municipal |

16 |

||||

| Other domestic |

19 |

||||

| International |

22 |

||||

| Emerging markets |

22 |

||||

| Other international |

24 |

||||

| Total |

10 |

||||

*Computed as the ratio of average daily creations and redemptions to the sum of average daily creations and redemptions and average daily volume.

Note: Data exclude currency ETFs, ETFs not registered under the Investment Company Act of 1940, hybrid ETFs, and ETFs that invest primarily in other ETFs.

Sources: Investment Company Institute and Bloomberg

These findings—among others in our new ETF paper, “Understanding Exchange-Traded Funds: How ETFs Work”—help put into perspective questions regarding the roles that ETF creation and redemption activity and ETF secondary market trading may play in the markets for equities and bonds that ETFs hold in their portfolios. In the secondary market, most investors don’t interact with ETFs directly and don’t generate trading in the funds’ underlying securities, because only ETF shares are trading hands.

There’s been brisk growth in the ETF industry and an accompanying spike in interest in these funds. Consequently, regulators, academics, and the media have increasingly expressed a desire to better understand how ETFs affect the markets for various asset classes, how they behave under stressed market conditions, and more. ICI plans to examine these complex concerns in a series that will focus on the policy and research issues surrounding ETFs. To set the stage for this examination, we created this first paper in the series as a primer to help stakeholders understand the basics of ETFs—how they are created and traded, the regulatory framework they operate under, how transactions involving them are cleared and settled in the primary market, and how investors choose to access liquidity in them.

Remarkable Growth of a Remarkable Product

The success of ETFs is not new. Since they were introduced in 1993, demand has grown steadily, especially over the last decade. From year-end 2003 through the end of June 2014, ETF assets rose from $151 billion to more than $1.8 trillion, and the number of funds from 119 to 1,364—both roughly twelvefold increases. In addition, ETFs’ percentage of the long-term fund market (ETFs combined with equity, bond, and hybrid mutual funds) has quadrupled over the same time period, from less than 3 percent to more than 12 percent.

What has contributed to this strong demand? Some of it is a result of specific features of ETFs that investors find attractive, including:

- Intraday tradability. Investors can buy or sell existing ETF shares at market-determined prices during trading hours. This feature gives investors liquidity and quick access to a range of asset classes.

- Price transparency. An ETF’s price in the secondary market generally is a close approximation to the market value of its underlying securities. This fairly tight relationship makes ETFs a convenient and easy option for investors who want to minimize the possibility that the share price could trade at a substantial premium or discount (as can happen in a closed-end fund).

- Tax efficiency. Typically, only a small percentage of ETFs have distributed capital gains. Most ETF investors don’t incur capital gains taxes until they sell their shares.

- Access. Investors can use ETFs to gain exposure to markets or asset classes that otherwise would be difficult or impossible for them to obtain. For example, investors can overcome obstacles to foreign ownership of securities in many international markets by simply buying an ETF that has exposure to those foreign markets.

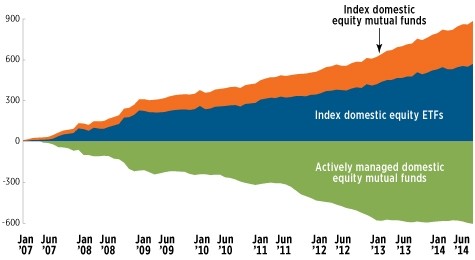

General trends in investing and money management also have contributed to the growing popularity of ETFs. Investor demand for index-oriented products, especially in the domestic equity space, has been strong for the past several years. From January 2007 through June 2014, $855 billion in net new cash and reinvested dividends flowed into index domestic equity mutual funds and ETFs, while $595 billion flowed out of actively managed domestic equity mutual funds.

Some of the Outflows from Domestic Equity Mutual Funds Have Gone to ETFs

Cumulative flows to and net share issuance of domestic equity mutual funds and ETFs, billions of dollars; monthly, 2007–2014*

*Data are through June 2014.

Note: Equity mutual fund flows include net new cash flow and reinvested dividends.

Source: Investment Company Institute

Other general trends in which the use of ETFs fit well include financial advisers’ increasing use of asset allocation models and a movement toward external compensation for financial advisers (when the client pays the adviser directly for services).

More to Explore

As the ETF industry continues to expand in both size and scope, we expect interest in these funds to expand as well. Future papers in our ETF series will move the discussion from background to complex policy concerns, including examining what role, if any, secondary market trading in ETFs plays in amplifying general market volatility or transmitting financial stress; exploring whether the arbitrage mechanism used by authorized participants and other ETF investors has any connection to volatility in an ETF’s underlying securities; and analyzing ETF fees and expenses.

Rochelle Antoniewicz is Senior Director of Industry and Financial Analysis at ICI.

Jane Heinrichs is associate general counsel for ICI.