ICI Viewpoints

Bond Fund Flows: A Little Perspective on the Big Bond Market

It’s been a long two months for bond fund investors.

The sharp run-up in interest rates since late April has caused many bond funds to experience their first losses in several years. Then, to rub salt into the wound, some commentators have placed the blame for rising bond yields and falling prices on fund investors themselves, pointing to the outflows from bond funds as evidence that fund investors were driving the markets.

Trouble is, these outflows haven’t been particularly large. ICI weekly estimates, which cover more than 95 percent of industry assets, show that outflows from bond mutual funds in June totaled a little more than $60 billion. Data from IndexUniverse show outflows from bond ETFs were about another $8 billion. With nearly $3.8 trillion invested in bond funds, these outflows amount to less than 2 percent of fund assets. Nor are they unprecedented: when interest rates have risen sharply in the past, bond funds have had outflows. The outflows that we have seen recently, when compared to total bond fund assets, have been in line with past periods of sharply rising interest rates.

Interest Rates Are Driving Bond Flows

So what does the evidence show about the relationship between these outflows and higher interest rates?

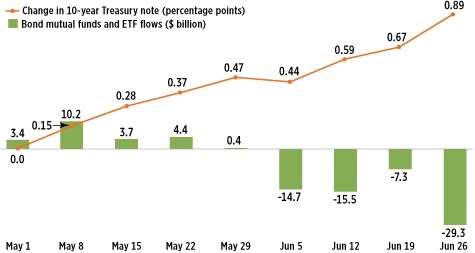

First, let’s look at how closely bond fund flows are linked to interest rate changes. Long-term Treasury yields began to rise in early May, following comments from numerous Federal Reserve officials indicating that the Fed’s massive bond-buying program would begin to slow if the economy continued to improve. By the end of that month, yields on the 10-year Treasury note had climbed nearly one-half of a percentage point—yet overall flows to bond funds remained positive.

Flows of Bond Funds and ETFs and Cumulative Change in 10-Year Treasury Note

Billions of dollars; weekly; May 1, 2013–June 26, 2013

Sources: Investment Company Institute and IndexUniverse

As interest rates continued their climb in June, bond returns began to turn negative, and bond funds started to have outflows. Throughout the month, however, outflows followed—not preceded—changes in rates. Outflows were moderate at the beginning of the month and slowed for the week ending June 19. On that day, following the Federal Open Market Committee’s meeting, the 10-year Treasury yield jumped 13 basis points—and shot up another 19 basis points the next two days. Bond fund outflows accelerated only after the rate hikes: outflows from bond ETFs, for example, were concentrated in the days following these large interest rate increases.

These data clearly show that outflows from bond funds were caused by rising interest rates, rather than the other way around.

Bond Outflows Too Small to Affect Markets

The second question is whether the outflows were large enough to have affected the markets.

One measure involves the amount of bond trading by the primary dealers—the large brokerage houses that are authorized to trade with the Federal Reserve. Each day these dealers, on average, trade about $700 billion of bonds—including Treasury, government agency, corporate, and municipal bonds—with clients, and billions more in trades among themselves. Their client trading in government securities alone averages more than $600 billion per day. Over the course of a month, their gross trading volume with clients runs close to $15 trillion.

How do bond funds’ outflows stack up in this market? Facing outflows of less than 2 percent of their assets, it’s possible that many bond funds could have met redemptions simply by drawing down cash or other liquid assets: bond mutual funds were holding more than $200 billion in short-term liquid assets at the end of May. Even if bond funds had to sell securities to meet shareholder redemptions, the $70 billion in net outflows in June would have equaled less than 1 percent of the trading volume of the primary dealers.

Bond fund outflows might have had a greater impact on markets where there is less trading—such as municipal securities. Even there, however, outflows from bond funds would have accounted for less than 10 percent of the primary dealers’ trading. And those numbers overstate the impact of bond fund trading because they exclude bond trading at regional brokerages, which play a large role in the municipal securities market.

Based on this data, it is safe to say that recent bond outflows have had minimal impact on broader markets and liquidity.

More to Come

As interest rates rise, we will continue to see outflows from bond funds. But it’s important to look at the data and to understand flows in the full context of broader markets. Even with some outflows, we believe that investors will continue to want bond exposure. Among other things, demand for bonds will be driven by an aging population looking for diversification out of stocks and by investment vehicles such as target date funds, which allocate a certain portion of their investments to the fixed-income sector.

Brian Reid was Chief Economist of the Investment Company Institute.