ICI Viewpoints

Marginal Tax Rates and the Benefits of Tax Deferral

Second in a series of posts about retirement plans and the policy proposals surrounding them.

In a previous Viewpoints post, I discussed the difference between tax deferral—the tax treatment applied to retirement savings—and tax deductions and exclusions, such as the mortgage interest deduction or the exclusion of employer-paid health insurance premiums from income. The difference is often overlooked or misunderstood, leading to inaccurate analysis and harmful policy proposals.

To recap:

- Tax deductions or exclusions affect taxes only once—in the year in which income is deducted or excluded.

- A taxpayer’s benefit from a deduction or exclusion is simply the amount of income deducted or excluded multiplied by the taxpayer’s marginal tax rate. So for a taxpayer in the 25 percent tax bracket, a $1,000 deduction yields a benefit (tax savings) of $250.

- Tax deferral, by contrast, affects taxes over many years. A worker gets an up-front benefit from excluding retirement plan contributions from income in the year of the contribution. In addition, he or she also gets a benefit from deferring taxes on investment returns within the plan. But the taxpayer also pays taxes on withdrawals from the plan. If the taxpayer’s marginal rate is the same in retirement as it was when the contribution was made, the tax paid in retirement offsets the up-front benefit of the contribution in present-value terms.

- Thus, the benefit of tax deferral to the taxpayer is that investment returns effectively are subject to a zero rate of tax. (If this isn’t clear, see my example comparing a traditional retirement plan to a Roth account.)

A Poorly Understood Benefit

Many analysts apparently don’t understand this difference, and thus improperly lump tax deferrals in with deductions and exclusions in their commentary and policy proposals.

For example, in “Fixing Upside-Down Tax Breaks Should Be a No-Brainer, But…”, Monique Morrissey, a retirement analyst at the Economic Policy Institute, says, “Current tax breaks are very poorly targeted. For the same dollar contribution to a 401(k), high income taxpayers in the 35 percent tax bracket get a tax break that’s three-and-a-half times larger than the tax break received by moderate-income taxpayers in the 10 percent bracket.”

That’s wrong. It may be true of tax deductions or exclusions—but it’s not true for 401(k) contributions or other tax-deferred compensation.

Time Is on Your Side

Because the benefit of tax deferral is roughly equivalent to getting a zero rate of tax on investment returns, and because investment returns compound over time, the amount of benefits a taxpayer receives from tax deferral depends more on the length of time that a contribution remains invested than on the taxpayer’s marginal tax rate.

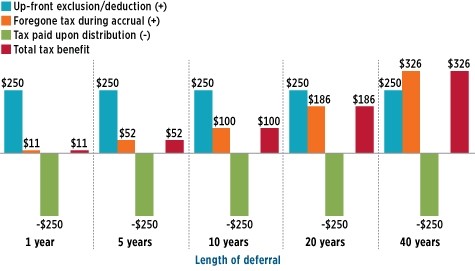

The chart below, taken from my ICI white paper, The Tax Benefits and Revenue Costs of Tax Deferral, illustrates the tax benefits that accrue to a worker with a 25 percent marginal tax rate (both while contributing and in retirement) who contributes $1,000 to a retirement account, with the benefits calculated for holding periods ranging from one year to 40 years. Because deferral affects taxes in multiple years, all results are expressed in terms of present value (their value in the year of the contribution). For simplicity, the calculations assume that the contribution is invested in bonds paying interest of 6 percent.

Tax Benefits Increase with Length of Deferral

Present value of tax benefit of a one-time deferral of $1,000 of compensation, by length of deferral

Note: The marginal tax rate is equal to 25 percent in all periods and applies to contributions, investment income, and distributions. Compensation of $1,000 is used to fund the contribution, resulting in a deferral of $1,000. The contribution is invested in bonds that pay interest annually. The nominal interest rate on the bonds and the discount rate are 6 percent.

Source: Investment Company Institute calculations

The chart shows that for any holding period, the tax paid on retirement distributions (the green bar) precisely offsets the tax deferred in the year of the contribution (the blue bar) in present-value terms. The net benefit is the tax that isn’t paid during the years when the account is invested (the orange or red bars).

As illustrated, that benefit depends on the length of deferral.

For example, if the funds are withdrawn after only one year of tax deferral, the benefit would be worth about $11 at the time of the contribution. As the length of deferral increases, the total amount of tax that would have been paid on the interest increases, and so does the benefit of deferral. In the year the contribution is made, the present value of those taxes would be $52 after five years, $100 after 10 years, and $186 after 20 years.

Note that, except for very long holding periods, the tax benefit derived from a $1,000 retirement contribution would be less than the $250 tax benefit the taxpayer would get from a $1,000 deduction or a $1,000 exclusion.

The Complex Relationship Between Tax Benefits and Tax Rates

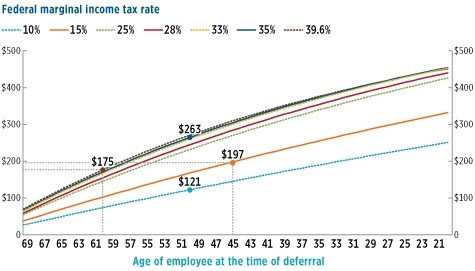

How do marginal tax rates affect the benefit? The chart below shows the tax benefits of a one-time contribution of $1,000 by age of a worker, assuming withdrawals are taken slowly throughout retirement. For any given age, taxpayers with higher tax rates get a greater benefit, but the benefits do not increase proportionally with tax rates. Moreover, the differences in the benefit by tax bracket are dwarfed by the differences by age (with the worker’s age determining the length of the holding period).

Present Value of Tax Benefit by Federal Marginal Tax Rate and Age

Present value of the tax benefit of a one-time deferral of $1,000 of compensation by age at the time of deferral; deferral invested in bonds; inflation-indexed immediate life annuity purchased at age 70

Note: Tax benefit calculations assume investment in a portfolio that is 100 percent bonds earning 6 percent nominal interest annually. Inflation is 3 percent a year. Contributions remain in the account until age 70. At age 70, the account balance is used to purchase an inflation-indexed immediate life annuity. Calculated benefits include benefits under federal income tax only. Tax rates are assumed to be the same at the time of deferral, the time investment income is earned, and the time of distribution.

Source: Investment Company Institute calculations

The differences between the tax benefits of deferral for taxpayers in different brackets are not as large as with deductions and exclusions. For example, for 50-year-olds, the benefit for a worker in the 35 percent bracket ($263) is a bit more than twice the benefit enjoyed by someone in the 10 percent bracket ($121)—not 3.5 times as much, as a simple calculation based on the marginal tax rates would imply. Regardless of age, the difference in tax benefits from a $1,000 retirement contribution between a worker with a 39.6 percent marginal tax rate and a worker with a 28 percent rate (the vertical distance between the brown dashed line and the red solid line) is never more than $26 (reached at age 48) and can be as low as $11 (at age 20 and again at age 69)—not the $116 implied by the 11.6 percent difference in tax rates.

(For an explanation of why benefits are not proportional to marginal tax rates, see the paper mentioned previously.)

In fact, as the chart shows, a 60-year-old in the 39.6 percent marginal tax bracket actually gets less tax benefit from a $1,000 deferral ($175) than a 45-year-old in the 15 percent bracket ($197). When it comes to deferrals, time is often more important than tax rates.

The next post in this series will show that proposals to limit the up-front tax benefit of tax deferrals are fundamentally flawed.

Additional Resources:

The Tax Benefit and Revenue Costs of Tax Deferral

Other Posts in this Series:

Peter Brady is a Senior Economic Adviser at ICI.