ICI Viewpoints

U.S. Prime Money Market Funds Remain Cautious with Respect to Eurozone Holdings

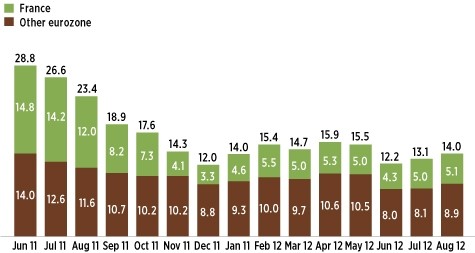

Over the summer, prime money market funds marginally increased their holdings of eurozone issuers: from 12.2 percent of assets in June (chart) to 14.0 percent of assets in August. This increase was driven primarily by a rise in holdings of French assets (up to 5.1 percent from 4.3 percent in June) and in holdings of German assets (up to 5.1 percent from 4.1 percent in June).

Since November 2011, this share of eurozone holdings has hovered in the 12 to 16 percent range—roughly half of June 2011 levels—and maturity of these holdings remains very short-term. For example, 84 percent of prime money market funds’ French holdings matured in thirty days or less at end August 2012, compared to 37 percent in June 2011.

U.S. Prime Money Market Funds’ Holdings of Eurozone Issuers

Percentage of prime funds’ total assets, end of month

Note: Data exclude prime money market funds not registered under the Securities Act of 1933.

Sources: Investment Company Institute tabulation of data provided by Crane Data.

Prime Money Market Funds’ Holdings by Home Country of Issuer

August 30, 2012

| Country | Billions of dollars | Percentage of total assets |

| World Total | $1,408 | 100% |

| Europe | 451.1 | 32.1 |

| Eurozone | 196.9 | 14.0 |

| France | 71.2 | 5.1 |

| Germany | 71.5 | 5.1 |

| Netherlands | 45.9 | 3.3 |

| Belgium | 2.0 | 0.1 |

| Austria | 5.2 | 0.4 |

| Spain | 0.6 | 0.0 |

| Luxembourg | 0.4 | 0.0 |

| Italy | 0.1 | 0.0 |

| Non-eurozone | 254.2 | 18.1 |

| UK | 105.4 | 7.5 |

| Sweden | 64.9 | 4.6 |

| Switzerland | 64.1 | 4.6 |

| Norway | 19.8 | 1.4 |

| Americas | 674.9 | 47.9 |

| USA | 510.5 | 36.3 |

| Canada | 163.7 | 11.6 |

| Chile | 0.6 | 0.0 |

| Venezuela | 0.1 | 0.0 |

| Asia and Pacific | 274.5 | 19.5 |

| Japan | 164.1 | 11.7 |

| AUS/NZ | 99.6 | 7.1 |

| Singapore | 8.8 | 0.6 |

| India | 0.4 | 0.0 |

| China | 1.4 | 0.1 |

| Korea | 0.2 | 0.0 |

| Supranational | 1.2 | 0.1 |

| Unclassified | 6.2 | 0.4 |

Note: Calculations are based on a sample of 113 funds, representing an estimated 98.4 percent of prime funds' assets.

Source: Investment Company Institute tabulation of data provided by Crane Data

For more on money market funds, please visit ICI’s Money Market Funds Resource Center.

Emily Gallagher is an ICI assistant economist.

Chris Plantier is a senior economist in ICI’s Research Department.