ICI Viewpoints

Closed-End Fund Assets Up 7 Percent in 2010

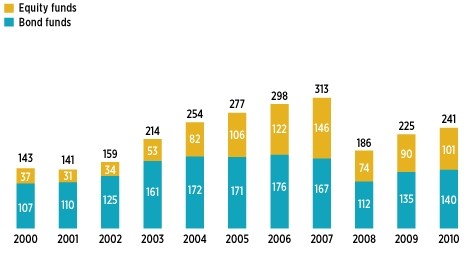

Total closed-end fund assets were $241 billion at year-end 2010, up 7 percent from year-end 2009, according to our recently released annual research report on the closed-end fund market. On net, closed-end fund assets increased by $16 billion during 2010.

Closed-End Fund Total Net Assets Increased to $241 Billion

Closed-end fund total net assets by investment objective, billions of dollars, year-end, 2000–2010

Note: Components may not add to the total because of rounding.

Source: Investment Company Institute

The report contains much more detail, but here are a few key findings:

- Bond closed-end funds accounted for more than half of all closed-end fund assets. Bond funds have traditionally accounted for a majority of closed-end fund assets. At year-end 2010, bond closed-end fund assets were $140 billion, or 58 percent of closed-end fund assets. However, assets in equity closed-end funds grew from 26 percent a decade ago to 42 percent of all closed-end fund assets at year-end 2010.

- At year-end 2010, there were 624 closed-end funds. The number of closed-end funds has decreased since 2007, after several years of steady increases. Two-thirds of closed-end funds were bond funds at year-end 2010.

- Closed-end fund investors tended to have above-average household incomes and financial assets. An estimated 2.1 million U.S. households held closed-end funds in 2010. Households that owned closed-end funds tended to include affluent, experienced investors who owned a range of equity and fixed-income investments.

Besides reading the full report, those interested in closed-end funds can find more information in our closed-end funds FAQs. On our stats page, we provide quarterly updates on closed-end assets data.

Daniel Schrass is an Economist at ICI.

Judy Steenstra is senior director of statistical research at ICI.

Dorothy Donohue is ICI's deputy general counsel, securities regulation.