ICI Viewpoints

Three Bs or Not Three Bs: Revisiting Claims That Investment Grade Corporate Bond Funds Pose Financial Stability Risks

In the past year, regulators have expressed concerns that regulated funds with a mandate to invest in investment grade corporate bonds might pose risks to financial stability. Most recently the focus has been on funds’ holdings of BBB-rated corporate bonds, the lowest category still considered investment grade. A case in point is the Bank for International Settlements’ (BIS) March 2019 Quarterly Review.

The BIS report features an analysis of “Investment mandates and fire sales: the case of mutual funds and BBB bonds,” with a chart purporting to explain “Mutual funds and the fire-sale risk of BBB bonds.” The report suggests that investment grade corporate bond funds—those mutual funds or UCITS with a mandate to invest primarily in investment grade corporate bonds—have ramped up dramatically the portion of their portfolios devoted to BBB-rated bonds, from around 20 percent in early 2010 to about 45 percent in 2018. The report then contends that if “enough issuers were abruptly downgraded from BBB to junk status, mutual funds and, more broadly, other market participants with investment grade mandates could be forced to offload large amounts of bonds quickly.”

To ICI—based on our knowledge of funds—these claims seem surprising. So we looked at the data for US regulated funds. Here’s what we found:

- US investment grade corporate bond funds’ holdings of BBB-rated corporate bonds rose much more modestly than the BIS suggests, from 26 percent of these funds’ holdings in 2010 to 33 percent in 2018. That increase occurred between 2010 and 2013—unlike the steady upward increase the BIS depicts—and the share has been fairly steady since.

- Using the same assumptions the BIS used in its analysis—a period of bond downgrades resembling the 2007–2008 global financial crisis—we estimate that even in such extreme conditions, US investment grade corporate bond funds would sell only a negligibly small fraction of the average daily trading volume of BBB-rated bonds. That’s hardly a “fire-sale” event.

US Corporations Are Issuing More BBB Bonds

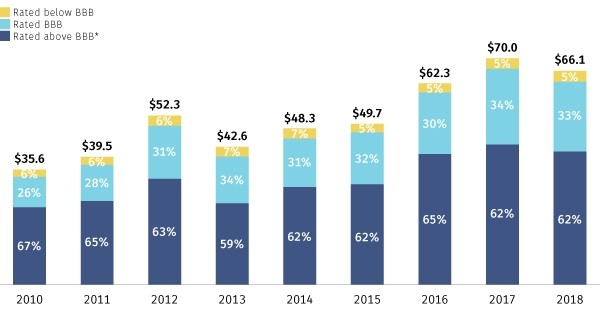

Figure 1 depicts the evolution of the investment grade corporate bond market by credit quality. The share of the market that is BBB-rated rose from 39 percent in 2010 to 50 percent in 2018.

Given this change in market composition, it would not be too surprising to find that funds with a mandate to invest in investment grade corporate bonds now hold a larger share of their portfolios in BBB-rated bonds. Bond market indexes would reflect this evolution—so an index fund with a mandate to track the investment grade corporate bond market would likely have raised the share of BBB-rated bonds in its portfolio in step with the overall market. An actively managed investment grade corporate bond fund might have increased its proportion of BBB-rated bonds more or less than that, depending on the fund manager’s decisions.

Figure 1

BBB Bonds Are a Larger Share of US Investment Grade Corporate Bond Market

Billions of US dollars and percentage of total

Source: Investment Company Institute tabulation of Intercontinental Exchange data

US Investment Grade Corporate Bond Funds’ Holdings of BBB-Rated Bonds Are Too Small to Disrupt the US Corporate Bond Market

Based on Morningstar data, we estimate that at the end of 2018, investment grade corporate bond funds held 33 percent of their portfolios in BBB-rated corporate bonds, up modestly from 26 percent in 2010 (Figure 2). Moreover, rather than reflecting a steep ongoing upward trend, that modest increase occurred between 2010 and 2013, and the share has been fairly steady since—raising questions about why it should draw regulatory attention now. Even with the modest overall increase, these funds still hold a very small share of the BBB-rated corporate bond market. We estimate that at the end of 2018, US investment grade corporate bond funds held just $22 billion, which (based on Figure 1) was less than 0.7 percent of the $3,200 billion outstanding in BBB-rated corporate bonds. Even a “fire sale” by investment grade corporate bond funds—if that were to happen—wouldn’t be likely to create much downward pressure on bond prices.

Why do we think so? Well, because the dollar amount of such sales would be small in comparison to the US daily trading volume of BBB-rated corporate bonds. Here’s how we get to that result:

- We start with the fact that US investment grade corporate bond funds held $22 billion in BBB-rated corporate bonds.

- We then apply the assumptions that the BIS used: during a wave of bond downgrades similar to that seen during the 2007–2008 global financial crisis, 11 percent of BBB-rated bonds would eventually be downgraded to junk status, with 10 percent of those downgrades occurring nearly simultaneously. The BIS further assumes funds would be “forced” to sell 33 percent of these downgraded bonds quickly.

- Next, we did the math: according to BIS’s assumptions, funds would have to sell—or, as the BIS contends, quickly “offload”—$80 million of the downgraded bonds ($22 billion x 0.11 x 0.10 x 0.33).

- We then estimated the average daily trading volume. BIS says that the average daily trading volume of corporate bonds in 2018 was about $25 billion. But BBB-rated bonds make up only a portion of the corporate bond market: the Financial Industry Regulatory Authority (FINRA) estimates the average daily trading volume in BBB-rated bonds was about $10.9 billion in late 2018.

- The result? If investment grade corporate bond funds were “forced” to quickly offload $80 million in downgraded bonds, that would amount to just 0.73 percent of the daily average trading volume in BBB-rated bonds ($80 million/$10,900 million). It seems very unlikely that such sales would create much downward pressure on bond prices.

Figure 2

Share of BBB-Rated Bonds in US Investment Grade Corporate Bond Funds Rose Modestly

Billions of US dollars and percentage of total

* Includes bonds that are rated above BBB, as well as other residual items (e.g., any equities that such funds may hold).

Note: Investment grade corporate bond funds are defined as those in the Morningstar category “Corporate Bond,” which excludes high-yield bond funds and is composed of funds whose investment mandate is primarily investment grade corporate bonds. In any given period, some funds that report assets do not report the credit quality distribution of their bond holdings. In those cases, we estimate their holdings of BBB-rated bonds by applying the average fraction from funds that do report credit quality to the total net assets of funds that do not.

Source: Investment Company Institute tabulation of Morningstar Direct data

Solving the Puzzle: The BIS Had in Mind the Universe of BBB Bond Holders, and Not Just Mutual Funds

So how does the BIS justify its headlines linking mutual funds to “fire sales” of BBB-rated bonds that would disrupt the corporate bond market? The BIS says that downgrades could result in “portfolio rebalancing in excess of daily turnover in corporate bond markets.” But our analysis shows that, even using the BIS’s assumptions, investment grade corporate bond funds—the funds the BIS focuses on—hold too small a share (less than 1 percent) of the BBB-rated corporate bond market to ignite a fire sale.

The puzzle can be solved by revisiting this key phrase in the BIS’s article: “mutual funds and, more broadly, other market participants with investment grade mandates could be forced to offload large amounts of bonds quickly” [emphasis added]. In aggregate, market participants hold $3,200 billion in BBB-rated bonds. If we assume all market participants who hold BBB-rated bonds have investment mandates that would “force” them to sell any downgraded bonds—an assumption that seems highly implausible—and we adopt the BIS’s assumptions, market participants might quickly sell $11.6 billion in downgraded bonds ($3,200 billion x 0.11 x 0.10 x 0.33). That would amount to 106 percent of the daily trading volume in BBB-rated debt, consistent with the BIS suggestion that sales of BBB-rated bonds could in a downturn exceed the average daily trading volume of such bonds.

Conclusion

In other words, the only way that the BIS can conclude that downgrades could fuel “fire sales” in “excess of daily turnover in corporate bond markets” is to assume that all market participants—and not just mutual funds—would quickly sell downgraded bonds. Yet the BIS headlines and charts focus solely on mutual funds.

There are two problems with this. The first is the idea that all investors would feel compelled—presumably by their “mandates”—to quickly sell downgraded bonds. That’s just an assumption. More likely, although some investors might be selling, others, looking for bargains and consistent with their investment mandates, would be buying.

The second problem is that the BIS seems to confuse mutual funds with the entire market. The agency is not alone. As we have noted before, regulators and academics frequently inflate the role of regulated funds, assuming that funds account for an oversize portion of market activity—if not all market activity. As the most transparent and visible market participants, funds tend to draw attention—and criticism—far out of proportion to their actual role.

It makes sense for regulators to follow data and trends to watch for emerging risks. But regulators must test their hypotheses and present their results with balance and care. The BIS’s exaggeration of the role of mutual funds doesn’t show either.

Shelly Antoniewicz is the Deputy Chief Economist at ICI.

Sean Collins is Chief Economist at ICI.

Rachel Graham is Associate General Counsel & Corporate Secretary at ICI.

Christof Stahel is senior economist at ICI.