Focus on Funds

Trends in Closed-End Funds

The August 15, 2014, edition of Focus on Funds features ICI Senior Economist Shelly Antoniewicz discussing the key points of a recently released ICI research report on closed-end funds.

Transcript

Stephanie Ortbals-Tibbs, ICI Director, Media Relations: Welcome to Focus on Funds, the Investment Company Institute’s weekly roundup of industry news, ICI activities, and research findings.

ICI has released its latest research on closed-end funds, including new information on fund flows, and on the investors in these funds. I spoke with ICI Senior Economist Shelly Antoniewicz about the paper’s findings.

Shelly Antoniewicz, ICI Senior Economist: We tried to look at long-term trends, and one of the things that we saw is that equity closed-end funds are a growing share, and have been a growing share, of the closed-end fund market.

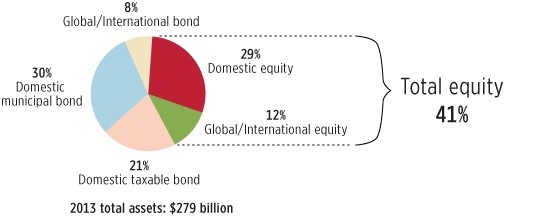

Equity Funds’ Growing Share of the Closed-End Fund Market

Percentage of closed-end fund total assets, year-end 2013

Source: Investment Company Institute

So, at the end of 2013, they were about 40 percent of closed-end fund assets, and that’s up from about 25 percent a decade ago.

Now, still, bond funds are the majority of closed-end fund assets.

Stephanie Ortbals-Tibbs: Can we also touch on what’s new in this paper? In addition to tracking some things that people look to from year to year, there’s some new information.

Shelly Antoniewicz: We changed some things up and we have collected some new information, particularly on different types of preferred share classes out there. We collected information on the different types of preferred share classes, we also collected information on different types of leverage. There’s structural leverage and portfolio leverage.

We found that about two-thirds of closed-end funds are using some type of leverage. Now, that said, closed-end funds still have very strict limits on the amount of leverage that they can have in their portfolio because they are a ’40 Act–registered product.

And so the average for funds that are using structural leverage…they have about a 27 percent leverage ratio. So, very, very low compared to other non–’40 Act funds that use leverage.

Closed-end fund investors tend to be older individuals who are retired from their lifetime occupation. They also tend to be a little bit more affluent than your typical mutual fund shareholder or even directly held equity shareholder.

Stephanie Ortbals-Tibbs: That’s this week in funds. See you next week.