Target Date Funds Remain Popular Investment in 401(k) Plans

Younger plan participants most likely to hold them

Washington, DC; March 4, 2021—Target date funds are a popular choice for 401(k) plans’ investment lineups, according to an updated joint study released today by the Investment Company Institute (ICI) and the Employee Benefit Research Institute (EBRI). The study, “401(k) Plan Asset Allocation, Account Balances, and Loan Activity in 2018,” found that younger 401(k) plan participants have large allocations to target date funds, being both more likely to hold—and holding more of their accounts in—target date funds than older participants. At year-end 2018, 62 percent of 401(k) participants in their twenties held target date funds, compared with half of 401(k) participants in their sixties. On average, 401(k) participants in their twenties held about half of their 401(k) plan account assets in target date funds, compared with about 23 percent for 401(k) participants in their sixties.

Target date funds are also used at a higher rate among recently hired plan participants. Among those with two or fewer years of tenure, 57 percent held target date funds, compared with 54 percent of participants with more than five to 10 years of tenure, and 36 percent of participants with more than 30 years of tenure. Target date funds are designed to offer a diversified portfolio that focuses on growth for younger participants and automatically rebalances to focus more on fixed-income investments for workers as they near—and enter—retirement.

“Target date funds continue to be popular and widely used because they are a convenient investment choice for retirement savers,” said Sarah Holden, ICI senior director of retirement and investor research. “By offering both portfolio diversification at every point in time and automatic rebalancing over time, they help savers of all ages manage their asset allocations as they build their retirement nest eggs.”

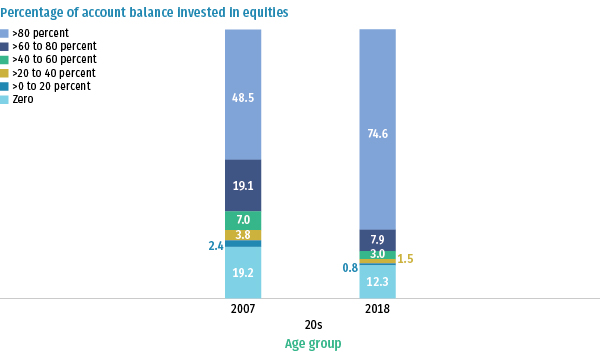

Equity Ownership by Younger 401(k) Plan Participants Increased Between 2007 and 2018

Percentage of 401(k) participants in their twenties, year-end 2007 and year-end 2018

Note: Equities include equity funds, company stock, and the equity portion of balanced funds (including target date funds). Funds include mutual funds, bank collective trusts, life insurance separate accounts, and any pooled investment product primarily invested in the security indicated.

Source: Tabulations from EBRI/ICI Participant-Directed Retirement Plan Data Collection Project

The updated study also shows that more 401(k) plan participants held equities at year-end 2018 than before the financial crisis of 2008. Data show that equities are an especially popular investment choice for younger plan participants. About three-quarters of participants in their twenties had more than 80 percent of their 401(k) plan accounts invested in equities at year-end 2018, up from less than half of participants in their twenties at year-end 2007. In comparison, about 14 percent of participants in their sixties and 44 percent of 401(k) plan participants overall had more than 80 percent of their 401(k) plan accounts invested in equities at year-end 2018.

About 63 percent of 401(k) assets were invested in stocks at year-end 2018, through equity funds, the equity portion of balanced funds (including target date funds), and company stock (the stock of their employer). An additional 28 percent of 401(k) assets were in fixed-income securities, such as stable value investments, bond funds, money funds, and the fixed-income portion of balanced funds.

“Equities continue to be an attractive investment choice for 401(k) plan participants,” said Jack VanDerhei, EBRI research director. “This is largely driven by younger plan participants who remain focused on growth as they invest in their futures.”

Other findings in the study include:

- Average 401(k) account balances increase with participant age and tenure. For example, at year-end 2018, participants in their forties with more than two years and up to five years of tenure had an average 401(k) balance of about $36,000, while participants in their sixties with more than 30 years of tenure had an average 401(k) account balance of more than $306,000.

- 401(k) participants’ investment in company stock continued at historically low levels. Only 5 percent of 401(k) plan assets were invested in company stock at year-end 2018. This share has fallen by 74 percent since 1999, when company stock accounted for 19 percent of assets.

- A minority of 401(k) participants had loans outstanding. At the end of 2018, 19 percent of all 401(k) participants who were eligible for loans had loans outstanding against their 401(k) accounts, unchanged from 2016.

About the Study

The study is based on the EBRI/ICI database of employer-sponsored 401(k) plans, compiled through a collaborative research project undertaken by the two organizations since 1996. The project is unique because it includes data provided by a wide variety of plan recordkeepers and, therefore, represents the activity of participants in 401(k) plans of varying sizes—from very large corporations to small businesses—with a variety of investment options. The 2018 EBRI/ICI database includes statistical information on 14.6 million 401(k) plan participants in 90,987 plans, which hold $1.1 trillion in assets, and covers 25 percent of the universe of active 401(k) participants.

Full results of the annual EBRI/ICI 401(k) database update are posted on each organization’s website, at www.ebri.org and www.ici.org/research/investors/ebri_ici.