Four-Fifths of Large ERISA 403(b) Plans Had Employer Contributions

New BrightScope/ICI research also shows 403(b) plans offer employees a wide variety of investment options

Washington, DC; January 21, 2021—Four-fifths of large 403(b) plans subject to the Employee Retirement Income Security Act of 1974 (ERISA) had employer contributions and nearly three-quarters of large ERISA 403(b) plan participants were in plans that offered employer contributions in 2017, according to a joint research study released today by BrightScope and the Investment Company Institute (ICI). The study, “The BrightScope/ICI Defined Contribution Plan Profile: A Close Look at ERISA 403(b) Plans, 2017,” examines 403(b) retirement plan design and investment lineups.

“Most large ERISA 403(b) plans had employer contributions into employees’ accounts, highlighting these employers’ commitment to retirement saving,” said Sarah Holden, ICI senior director of retirement and investor research. “These employer contributions, which are often designed as matching contributions, help workers build their retirement nest eggs and encourage retirement savings among the workforce.”

403(b) retirement plans, offered by public schools and universities, nonprofit employers, and church organizations, allow employees to save through tax-deferred contributions. Employers offering 403(b) plans can choose to make contributions by either matching employee contributions or making automatic contributions to their employees’ accounts. The DOL Form 5500 Research File data indicate that 80 percent of large ERISA 403(b) plans had employer contributions in 2017, up from 71 percent in 2009.

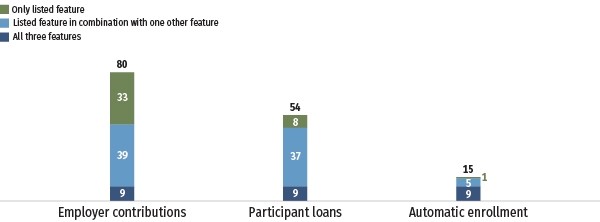

Plan Sponsors Often Select Combinations of 403(b) Plan Design Features

Percentage of large ERISA 403(b) plans, 2017

Note: The sample is 5,934 plans with 5.7 million participants and $469.4 billion in assets. The results include plans that filed Form 5500 Schedule H (typically plans with 100 participants or more). A plan was determined to allow participant loans if any participant had a loan outstanding at the end of plan year 2017.

Source: Investment Company Institute tabulations of US Department of Labor 2017 Form 5500 Research File

403(b) Plans Offer Employees a Wide Variety of Investment Options

The study also finds that the average large 403(b) plan subject to ERISA offered 26 “core” investment options in 2017. The average large ERISA 403(b) plan offered 11 core equity funds, two core bond funds, and nine core target date funds. Nearly all plans offered domestic equity, international equity, and domestic bond funds in their core investment offerings.

“403(b) plans offer employers significant flexibility to customize plans to attract and retain workers, choosing plan features like automatic enrollment, employer contributions, and the ability to take plan loans,” said Brooks Herman, associate director of ISS Market Intelligence. “403(b) plan sponsors also offer robust investment lineups, generally including a variety of actively managed and index investment options, which is attractive to participants and can help them accumulate substantial retirement savings.”

Additional Findings:

- Mutual funds were the most common investment vehicle in large ERISA 403(b) plans, holding 60 percent of assets in large ERISA 403(b) plans in 2017. Variable annuities held 21 percent of assets, and fixed annuities held 19 percent.

- Mutual fund expenses tend to be lower in larger plans and have trended down over time in large ERISA 403(b) plans. In 2017, the average asset-weighted expense ratio for domestic equity mutual funds (including both actively managed and index funds) was 0.69 percent for large ERISA 403(b) plans with less than $1 million in plan assets, compared with 0.37 percent for plans with more than $1 billion in plan assets.

- Index funds are widely available in large ERISA 403(b) plans and represented 27 percent of assets in large ERISA 403(b) plans in 2017. Index funds held the greatest share of assets in the largest ERISA 403(b) plans: 34 percent of the assets of ERISA 403(b) plans with more than $1 billion in plan assets were invested in index funds.

- Target date funds have become more common in large ERISA 403(b) plans since 2009. In 2009, about half of large ERISA 403(b) plans included target date funds in their core investment lineups; this rose to more than four-fifths of plans by 2017. Over the same period, the percentage of assets invested in target date funds increased from 7 percent to 24 percent.