ICI Global

2020 Investor Trends Drive Fixed Income UCITS Ongoing Charges Down, Equity UCITS Hold Steady

Latest Report on EU Funds Shows Ongoing Charges Down Markedly Since 2013, but More Effective Single Market Would Benefit Cross-Border Fund Distribution

Brussels, 22 September 2021—Average ongoing charges for equity and fixed-income UCITS domiciled in the European Union continue to hold steady or decrease, according to newly issued research from the Investment Company Institute. The global trade body’s report, “Ongoing Charges for UCITS in the European Union, 2020,” analyses the trends in average ongoing charges and the forces behind them. The ongoing charge is the fund’s total annual ongoing cost as a percentage of its total net assets.

The report finds that:

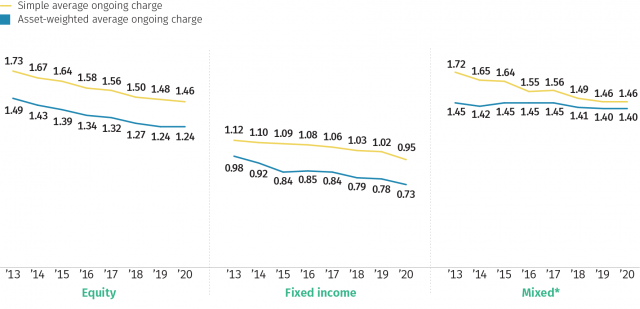

- In 2020, average ongoing charges of fixed-income UCITS experienced a sharp decrease, while the average ongoing charge for equity UCITS held steady.

- Average ongoing charges of equity and fixed-income UCITS exchange-traded funds (ETFs) also decreased in 2020, likely related to economies of scale as assets in UCITS ETFs surged.

- Average ongoing charges for fixed-income UCITS dropped 26 percent between 2013 and 2020, while average ongoing charges for equity UCITS decreased by 17 percent.

“UCITS are a global success story, offering investors many advantages including professional management, a strong regulatory framework, and a wide range of investment options,” said ICI Global Chief Counsel Jennifer Choi. “UCITS are a cost-effective and valuable tool for Europeans looking to invest and save over the long-term.”

Investor Choices Influenced 2020 Trends in Ongoing Charges

Average ongoing charges of fixed-income UCITS fell from 0.78 percent in 2019 to 0.73 percent in 2020, in large part because investors gravitated towards fixed-income fund categories with lower ongoing charges. Fixed-income UCITS that invest primarily in investment grade debt received the majority of net inflows, and these funds tend to have below-average ongoing charges.

Average ongoing charges of equity UCITS held steady at 1.24 percent between 2019 and 2020, likely due to increased popularity of sector equity funds. Sector equity funds, which received 70 percent of total net inflows to UCITS equity funds, tend to cost more to manage than other products. This demand offset the economies of scale that equity UCITS likely earned from the substantial growth in net assets they experienced in 2020.

Investors in UCITS Pay Below-Average Ongoing Charges

Percent

* Mixed funds invest in a combination of equity and fixed-income securities.

Note: Data exclude exchange-traded funds.

Source: Investment Company Institute tabulations of Morningstar Direct data

“The latest data reflect one of the many strengths of UCITS, the wide array of choices they offer investors,” said ICI Economist James Duvall, a co-author of the report. “And UCITS investors choose from a diverse range of funds to best meet their needs.”

Cross-Border Funds Promote Economies of Scale, but Face Higher Costs

The report also underscores the importance of cross-border funds, which help foster competition and allow for a greater ability to gain economies of scale. Net assets of cross-border funds domiciled in the European Union continued to grow in 2020, rising to €6.7 trillion by year-end and making up nearly two-thirds of total UCITS net assets. But despite their scale—the average size of a cross-border equity fund was €634 million, nearly three times the average size of €225 million for a single country equity fund—ongoing charges of cross-border funds tend to be higher than for single country funds. This is because fixed costs, on average, tend to be higher in cross-border funds as a result of different marketing requirements among EU Member States and additional administrative costs. In 2020, the average estimated fixed cost for cross-border equity funds was 24 percent of the total ongoing charge, compared with 18 percent for single country funds. Ongoing regulatory reforms eliminating barriers to the cross-border distribution of UCITS across the European Union provide the opportunity for further growth and economies of scale.

About ICI Global

ICI Global carries out the international work of the Investment Company Institute, the leading association representing regulated funds globally. ICI’s membership includes regulated funds publicly offered to investors in jurisdictions worldwide, with total assets of US $42.0 trillion. ICI seeks to encourage adherence to high ethical standards, promote public understanding, and otherwise advance the interests of regulated investment funds, their managers, and investors. ICI Global has offices in London, Brussels, Hong Kong, and Washington, DC.