News and Resources

New EBRI/ICI Report Sheds Light on How Savers Use Target Date Funds in 401(k) Plans

Washington, DC; September 9, 2021—A growing number of investors save for retirement through target date funds (TDFs), according to a new joint report from the Investment Company Institute (ICI) and the Employee Benefit Research Institute (EBRI). The report provides insight into how the use of TDFs varies by 401(k) plan participant age and job tenure.

TDFs hold a diversified portfolio of both stocks and bonds and also rebalance to become less focused on growth and more focused on income as the fund approaches and passes the target date, which is usually included in the fund’s name.

Key findings from the report, “Target Date Funds: Evidence Points to Growing Popularity and Appropriate Use by 401(k) Plan Participants,” include:

- The prevalence of TDFs has risen over time as both the percentage of 401(k) plans offering (79 percent in 2018) and the percentage of 401(k) participants investing in TDFs (56 percent in 2018) have grown considerably.

- TDFs are designed to be a complete asset allocation solution and the vast majority (94 percent) of 401(k) participants investing in TDFs held one TDF at year-end 2018.

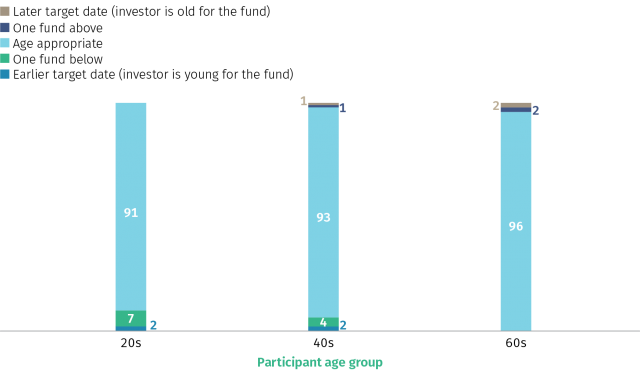

- The majority of 401(k) plan TDF investors have most of their assets in a single TDF that is appropriate for their age.

- Younger 401(k) savers are more likely to hold TDFs, and hold a higher concentration of assets in those funds. Younger 401(k) savers are more likely to have been offered TDFs when they enrolled in the plan or may have been automatically enrolled into these funds as a default investment, compared with older participants.

- Overall, 401(k) plan TDF investors had slightly higher allocations to equities than 401(k) savers not using TDFs, although the difference was more pronounced among younger investors. Older 401(k) plan participants had similar allocations to equities whether they were TDF investors or not.

“Target date funds offer diversification across stock and fixed-income investments, making them an attractive investment option for all age groups saving for retirement,” said Sarah Holden, ICI senior director of retirement and investor research. “This detailed look into 401(k) plan participants’ use of TDFs reveals that 401(k) plan participants are being strategic in their use of TDFs, mainly focusing on one fund appropriate to their age.”

Majority of 401(k) Participants Holding One Target Date Fund Held Fund Appropriate to Their Age

Percentage among 401(k) plan participants holding one target date fund by participant age, year-end 2018

Note: 401(k) plan participants invested in the target date fund with the target date closest to the year that they turn 65 are considered in their age-appropriate target date fund. Individual investors may have a different target retirement age in mind, or may be seeking more focus on growth (choosing a later target date than their age suggests) or more focus on income (choosing an earlier target date than their age suggests). See Figures 8 and A4 for additional detail.

Source: Tabulations from EBRI/ICI Participant-Directed Retirement Plan Data Collection Project

“The increased availability of TDFs in 401(k) plans, combined with the trend to use them as default investments when savers are auto-enrolled in a plan, has driven much of the growth in their use over time,” said Jack VanDerhei, EBRI research director. “A recently hired 401(k) plan participant today will typically have a broad array of TDFs to select from, allowing them to choose an appropriate TDF to meet their goals for an earlier or later retirement date or to suit their risk tolerance.”

About the Report

The EBRI/ICI Participant-Directed Retirement Plan Data Collection Project gathers information about individual 401(k) plan participant accounts. As of December 31, 2018, the EBRI/ICI database includes statistical information on 14.6 million 401(k) plan participants in 90,987 plans, which hold $1.1 trillion in assets, and covers 25 percent of the universe of active 401(k) participants, 15 percent of plans, and 21 percent of 401(k) plan assets. The project is unique because it includes data provided by a wide variety of plan recordkeepers and, therefore, represents the activity of participants in 401(k) plans of varying sizes—from very large corporations to small businesses—with a variety of investment options.