Tax Data Show High Rate of Retirement Plan Participation

Washington, DC, May 4, 2020—A new Investment Company Institute (ICI) analysis shows that 65 percent of workers aged 26 to 64 participated in an employer-sponsored retirement plan in 2017 either directly or through a spouse. The study, “Who Participates in Retirement Plans, 2017,” uses data recently published by the IRS Statistics of Income (SOI) Division to analyze participation in employer-sponsored retirement plans. To be considered an active participant in a retirement plan, a worker must have contributed to or have had an employer contribute to a defined contribution (DC) plan, or been covered by a defined benefit (DB) plan.

“Contrary to conventional wisdom, most American workers will accumulate retirement resources through employer plans by the time they retire,” said ICI Senior Economic Adviser Peter Brady. “The tax data show that studies relying on household survey data often understate participation. Perhaps more importantly, the data show that participation increases with both age and income. What this means is that many younger and lower-income workers who are not participating in a plan today will do so later in their careers.”

Workers Focused on Saving for Retirement Are More Likely to Participate

The report finds that a strong majority of workers who have both the desire and the means to save for retirement participate in an employer plan.

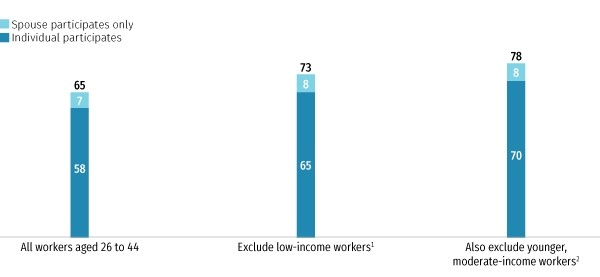

Looking at all workers aged 26 to 64, 65 percent participated in a retirement plan either directly or through a spouse. That is, 58 percent participated in a retirement plan where they worked, and another 7 percent did not but had a spouse who did.

If workers with very low income (less than $20,000 per person) are excluded, the rate increases to 73 percent. These workers may rationally choose not to save for retirement because Social Security benefits alone will replace a large share of their earnings.

If younger workers (aged 26 to 44) with slightly higher income (up to about $40,000 per person) are also excluded, the rate increases to 78 percent. These workers may want to save for retirement but may rationally choose to delay doing so until they are older, when their earnings will typically be higher and other priorities—education, starting a family, buying a house—have been taken care of.

Retirement Plan Participation Increases with Income and Age

Percentage of taxpayers with a Form W-2 who are active participants in a retirement plan or who have a spouse who is an active participant, 2017

1Low-income workers is defined as workers with adjusted gross income (AGI) less than $20,000 for non-joint returns or with AGI less than $40,000 for joint returns.

2Younger, moderate-income workers is defined as workers aged 26 to 44 with AGI from $20,000 to $40,000 for non-joint returns or with AGI from $40,000 to $75,000 for joint returns.

Source: IRS Statistics of Income Division

Other key findings include:

- Younger and lower-income households are more likely to report that they save primarily for reasons other than retirement—for example, a home purchase, for the family, or education. Economic analysis suggests that these preferences are rational. Older and higher-earning workers are more likely to save primarily for retirement and thus are more likely to prefer having a portion of their compensation in the form of retirement benefits rather than fully in cash.

- Tabulations of administrative tax data offer an alternative source for retirement plan participation statistics. The most commonly cited statistics on retirement plan participation are derived from the Annual Social and Economic Supplement (ASEC) to the Current Population Survey (CPS). Recent changes to that survey underscore the need for more reliable measures of retirement plan participation. Specifically, comparisons with tax data suggest that the ASEC understated the participation rate by about 5 percentage points from 2008 to 2013. The difference increased after 2013—following a revision to the survey questionnaire used for the ASEC—and stood at 18 percentage points in 2017.