Funds Take Investor-Centric, Nuanced Approach Toward Proxy Voting

New ICI Report Shows Funds Vote Carefully and Conscientiously

Washington, DC; July 29, 2019—Funds cast their votes on proxy proposals offered at portfolio companies in the interests of fund shareholders and consider a wide range of factors when voting on proposals, according to a new Investment Company Institute (ICI) report. “Proxy Voting by Registered Investment Companies, 2017” updates ICI’s 2010 work on proxy voting by looking at how funds voted on prominent proxy issues over the past seven years, particularly the 2017 proxy season.

“As fiduciaries, funds take their proxy voting responsibilities seriously,” said ICI Chief Economist Sean Collins. “ICI’s report shows that fund advisers do not mechanically vote or take a one-size-fits-all approach toward voting. Instead, they consider their voting guidelines and take into account many different factors to ensure their decisions advance shareholders’ interests.”

Funds’ Voting Decisions: More Than Meets the Eye

ICI’s publication discusses the two types of proposals on companies’ proxy ballots—management and shareholder proposals—and analyzes funds’ voting behavior on the different types of proposals during the 2017 proxy season.

- Management proposals are sponsored by corporate boards of directors; are dominated by such issues as director elections, audit firm ratification, and executive compensation; and constitute the vast majority of proxy proposals.

- Shareholder proposals are initiated by shareholders; tend to focus on various topics such as environmental, social, and governance (ESG) issues; and make up a tiny, but high-profile, fraction of proxy proposals.

According to the report, management proposals accounted for 98 percent of proxy proposals in 2017, and funds voted in favor of those proposals 94 percent of the time. Meanwhile, shareholder proposals accounted for the remaining 2 percent of proposals and funds voted in favor of them 35 percent of the time (page 12).

The paper notes that these statistics may mask the high level of due diligence fund advisers perform when casting proxy votes. For example, 94 percent support for management proposals likely reflects the fact that most management proposals are not controversial. In addition, closer examination of funds’ votes on director election (page 14), executive compensation (page 14), and climate-related proposals (pages 18–23 and below) shows the numerous factors advisers consider when deciding how to vote on proxy proposals.

Funds’ Votes on Climate-Related Proposals Demonstrate Thoughtful, Nuanced Analysis

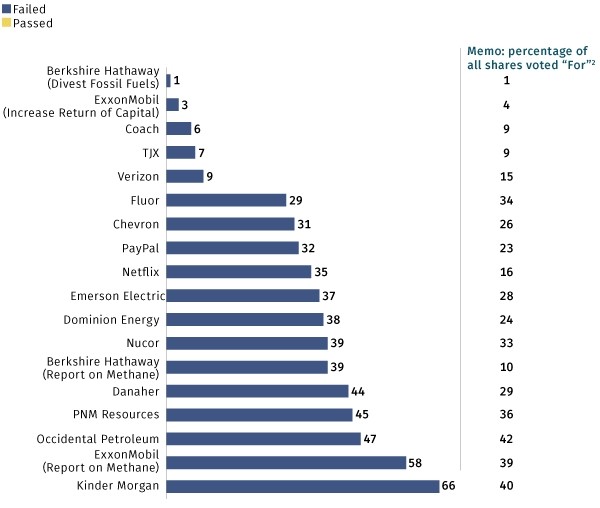

Fund advisers consider many different factors when voting, including a proposal’s details, the company that the proposal applies to, the context, and a fund’s investment objectives (pages 11 and 16). ICI’s case study of how funds voted on climate-related shareholder proposals at 18 different companies shows how funds’ considerations of these factors resulted in thoughtful and nuanced votes (pages 20–23).

For example, shareholders submitted two similar proposals to Coach and TJX, asking for reports on each company’s potential for achieving net-zero greenhouse emissions by a certain date. As shown in the figure below, funds voted “For” the Coach and TJX proposals 6 and 7 percent of the time, respectively, suggesting that funds reached their voting decisions, in part, by assessing the companies and their proxy materials, which indicated the companies had already made significant progress toward achieving net-zero greenhouse admissions (page 22).

The figure also shows that none of the 18 proposals passed, even in cases where funds provided strong support (ExxonMobil and Kinder Morgan), underscoring a critical point: fund votes do not necessarily determine vote outcomes. This may be reflective of ICI’s research showing that regulated funds account for less than one-third of the overall share of US corporate equity, while other institutional and retail investors account for more than two-thirds (pages 2–3).

Percentage of Funds Voting “For” Other Climate-Related Shareholder Proposals

By company, percent1

1Measured as the number of US-registered investment companies recording a “For” vote for proposals in a given category, divided by the total number of votes that funds cast.</>

2Measured as the number of shares voting “For,” divided by the total number of shares voted, including shares owned by shareholders who abstained from the vote.

Note: This figure represents votes cast by US-registered investment companies on proxy proposals for companies in the Russell 3000 Index during the 2017 N-PX reporting year (fiscal year July 1, 2016, to June 30, 2017). This figure excludes votes on securities listed on foreign stock exchanges.

Source: Investment Company Institute tabulations of ISS Corporate Services Data

ICI Methodology

ICI’s analysis covers proxy votes cast in 2017 by 371 fund advisers on behalf of mutual funds, closed-end funds, exchanged-traded funds, and mutual funds underlying variable annuities, on proposals offered for companies in the Russell 3000 Index. In the 2017 proxy season, funds cast more than 7.6 million votes, and the average mutual fund voted on about 1,500 proxy proposals.