News Release

Financial Conduct Authority Urged to Recognise ‘Highly Competitive’ UK Fund Market

ICI Global Research Finds Dynamic Market, Identifies Concerns with FCA Report Research

London, 20 February 2017–The fund market in the United Kingdom has the hallmarks of a highly competitive industry, according to an ICI Global analysis filed with the UK Financial Conduct Authority (FCA). As a result of these findings, ICI Global cautions FCA regulators to proceed carefully on reforms intended to address questions the authority has raised regarding competition.

‘ICI Global agrees with the FCA about the importance of robust competition within the fund industry,’ said ICI Global Managing Director Dan Waters, ‘but we fundamentally disagree on the basic conclusion of the report that the UK fund industry is not competitive. The FCA seeks with its report to depict a highly uncompetitive market that the data, including the FCA’s own findings, simply don’t support. Indeed, much of the evidence in the report is consistent with a market where fund providers compete vigorously for investor business. We hope our analysis will assist the FCA in reconsidering the research underpinning its report, in order to avoid regulation that could distort markets and reduce investor choice.’

ICI Global’s comments respond to the FCA’s Asset Management Market Study Interim Report, which reviewed the asset management sector and made recommendations designed to address the authority’s concerns about fund market competition. ICI Global’s key findings include:

The UK Fund Management Industry Is Highly Competitive

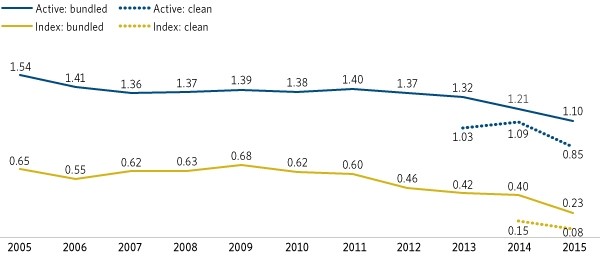

ICI Global’s analysis demonstrates that UK funds operate in a large, lively marketplace in which funds compete fiercely for investors and fees are steadily falling. ICI Global provided a breakdown of industry data reinforcing that UK investors in active and passive funds have incurred lower charges over time.

Ongoing Charges Figures (OCFs) for UK Equity Funds Available for Sale in the United Kingdom

Percentage of assets, 2005–2015

Note: Data that are ‘bundled’ include distribution fees and data that are ‘clean’ exclude distribution fees. Data include all sterling-denominated share classes of UK equity funds available for sale in the United Kingdom but exclude funds of funds. OCFs for each year are measured on an asset-weighted basis, weighting the OCF of a given share class by the assets in that share class.

Source: Investment Company Institute tabulations of Morningstar Direct data

Fund Providers Compete on Price and Other Features

ICI Global’s comments describe how fund providers contend vigorously for investors’ business on the basis of price, fund returns, risks, features, services, and styles. Investing requires active management at some level, such as in the form of asset allocation within a fund (e.g., as provided by an asset allocation fund) or outside a fund (e.g., through a ready-made portfolio of index tracker funds).

‘Investors choose funds for reasons far more nuanced than simply trying to beat a benchmark, and the data show that investors are benefitting from head-to-head competition among active and passive funds in today’s diverse fund marketplace,’ said Waters. ‘Investment markets work best when there’s robust disclosure that lets investors choose. Regulators should not tip the scales in favour of one investment product over another.’

ICI Global Supports Further FCA Review of Fund Intermediation

ICI Global praised the FCA for its plans to further study the retail distribution of funds, calling an understanding of how funds are purchased and sold by investors ‘essential.’ The organisation is encouraging the FCA review to include the role and activity of intermediaries, including platforms, and financial advisers who provide recommendations and manage portfolios. ICI Global also noted that relatively little time has passed since the Retail Distribution Review was fully implemented and that competitive dynamics continue to evolve in the marketplace.

FCA Should Study a Range of Global Approaches to Fund Governance

The FCA report expressed interest in fund governance reforms, including considering US regulated fund governance. Though robust fund governance can promote competition, US fund boards are primarily a tool to address and mitigate conflicts of interest. ICI Global recommends that any governance reforms be assessed primarily from that perspective. ICI Global also encouraged the FCA to review the analysis by the International Organization of Securities Commissions, demonstrating there are a range of sound approaches to fund governance.

Brexit and Regulatory Initiatives Add Complexity

Lastly, ICI Global cautioned that there are numerous regulatory initiatives being planned or implemented that are affecting funds and investors in the United Kingdom. At the same time, Britain is poised to begin negotiations to leave the European Union.

‘New regulatory initiatives during a period of unprecedented disruption could harm rather than benefit competition and investors,’ said Waters.