News Release

Private-Sector Retirement Plan Income Has Become More Prevalent, Not Less

ICI Study Examines Trends in Retiree Income Since 1975

Washington, DC, October 17, 2013 - Across all income groups, retirement income generated by private-sector retirement plans has become more prevalent—not less prevalent—since the mid-1970s, when sweeping new retirement plan reforms were enacted, according to the annual update of an Investment Company Institute study released today.

The study, “A Look at Private-Sector Retirement Plan Income After ERISA, 2012,” finds that in 2012 about one in three of retirees received income—either directly or through a spouse—from private-sector retirement plans, compared with approximately one in five in 1975. Among those with income from private-sector plans, the median amount was slightly more than $6,300 in 2012, compared with roughly $4,800 (in constant 2012 dollars) in 1975.

“Contrary to conventional wisdom, more retirees are receiving more income from private pensions today compared with 1975,” said Peter Brady, ICI senior economist and coauthor of the report.

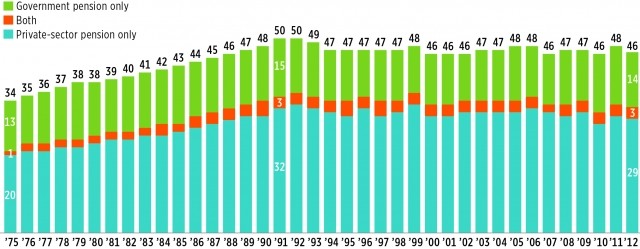

Receipt of Income from Pension by Type of Pension

Percentage of retirees* with type of pension, 1975–2012

*Individuals aged 65 and older with nonzero income and not working; for married couples, neither the individual nor the spouse was working. Sample excludes highest 1 percent and lowest 1 percent of the income distribution.

Source: ICI tabulations of the March Current Population Survey

Other Key Findings: Access, Coverage, Role of Social Security

- Access to private-sector retirement plans has been fairly steady since 1979. Although it varies with the business cycle, the share of private-sector workers at employers with retirement plans averaged 54 percent from 1979 (the first available data) to 2012. Though overall coverage has been consistent, an increasing share of private-sector workers has worked for employers that sponsor defined contribution (DC) pension plans, and a decreasing share has worked for employers that sponsor defined benefit (DB) pension plans.

- Coverage by a DB plan does not always result in retirement income. The historical prevalence of retirement income from private-sector DB plans may be overstated by looking only at pension coverage, rather than receipt of pension income. Although many retirees may have worked for companies that offered DB plans at some point in their career, the combination of vesting rules and back-loaded benefit accrual has resulted in many retirees getting little or no retirement income from these plans.

- Social Security remains the foundation of retirement security in the United States. Social Security benefits represent the largest component of retiree income and the predominant income source for lower-income retirees. In 2012, Social Security benefits represented 58 percent of total retiree income and 87 percent of total income for retirees in the lowest 40 percent of the income distribution.

The study was coauthored by Brady and ICI associate economist Michael Bogdan. Supplementary figures with additional detail can be found on ICI’s website.