ICI Viewpoints

Mutual Funds: Rated E for Everyone

Investing is subject to many misconceptions, including the notion that only wealthy households own mutual funds. As US households’ ownership of mutual funds has grown over the past four decades, the need to correct myths about who owns mutual funds has also grown.

In 1980, far fewer than one in 10 US households owned mutual funds. Now, more than four in 10 do. This expansion of mutual fund ownership has occurred across households hailing from all income and age groups, as they find diversified and cost-effective mutual fund investing can help them realize a wide array of important financial goals.

Mutual Fund Ownership Has Gone Mainstream

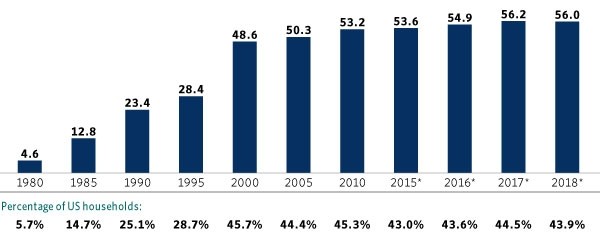

Results from a nationally representative survey of US households find that about 44 percent of US households owned mutual funds in mid-2018, up from about 6 percent in 1980 (Figure 1). This means that 56.0 million US households, or nearly 100 million individual investors, owned mutual funds in mid-2018.

Figure 1

Reach of Mutual Fund Ownership Has Dramatically Expanded in the United States

Millions of US households owning mutual funds, selected years

* Starting in 2014, the Annual Mutual Fund Shareholder Tracking Survey was revised to include cell phones as well as landlines.

Sources: Investment Company Institute Annual Mutual Fund Shareholder Tracking Survey and US Census Bureau

Every Income Group…

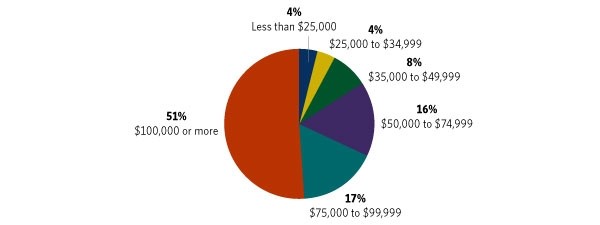

Households across all income levels own mutual funds. In mid-2018, 63 percent of US households with household income of $50,000 or more owned mutual funds and 17 percent of US households with household income less than $50,000 owned mutual funds. About half of mutual fund–owning households had household incomes of less than $100,000, and 16 percent had incomes less than $50,000 (Figure 2).

Figure 2

About Half of Households Owning Mutual Funds Have Moderate or Lower Incomes

Percentage of mutual fund–owning households by household income,* 2018

* Total reported is household income before taxes in 2017.

Source: Investment Company Institute Annual Mutual Fund Shareholder Tracking Survey

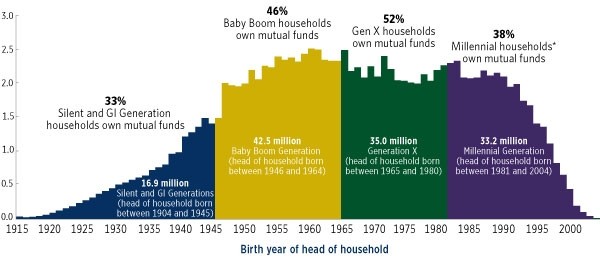

Every Generation…

Mutual fund ownership spans all generations but is the highest among the Baby Boom Generation and Generation X—groups now in their peak earning and saving years. In 2018, 46 percent of the 42.5 million households headed by a Baby Boomer owned mutual funds (Figure 3), and Baby Boom households were 34 percent of households owning mutual funds. A little more than half of the 35.0 million households headed by a member of Generation X owned mutual funds in 2018, and Generation X households were 32 percent of households owning mutual funds.

Thirty-eight percent of the 33.2 million households headed by Millennials owned mutual funds and Millennial households were 23 percent of all mutual fund–owning households. Among households headed by the Silent and GI Generations, 33 percent owned mutual funds; they made up the remaining 11 percent of mutual fund–owning households.

Figure 3

Mutual Fund Ownership Occurs Across All Generations of Households

Millions of US households by birth year of head of household, 2018

* The Millennial Generation is aged 14 to 37 in 2018; however, survey respondents must be 18 or older.

Note: In 2018, there were 127.6 million US households.

Sources: ICI tabulations of the US Census Bureau’s Current Population Survey and Investment Company Institute Annual Mutual Fund Shareholder Tracking Survey

Every Financial Goal…

The reasons behind the growth in mutual funds is as varied as the people who own them. Easy access to employer-sponsored retirement plans has been a significant factor; the majority of first-time mutual fund purchases occur through such plans. Households also often invest in mutual funds through their individual retirement accounts (IRAs). In fact, in mid-2018, 59 percent of defined contribution plan assets were invested in mutual funds, as were 47 percent of IRA assets.

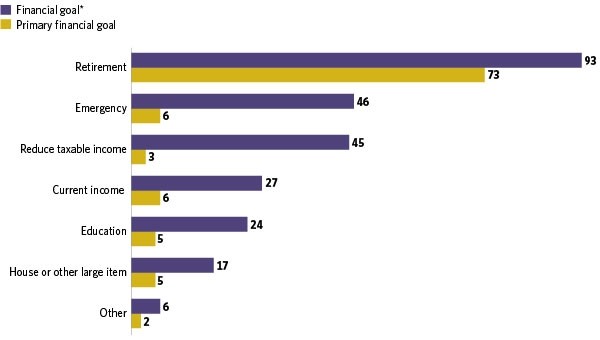

Ninety-three percent of mutual fund–owning households indicated that saving for retirement was one of their financial goals, with 73 percent indicating retirement saving was their primary financial goal (Figure 4). But mutual funds address investment goals across investors’ lifecycles: 46 percent of mutual fund–owning households indicated they were saving for emergencies, 24 percent were saving for education expenses, and 17 percent were saving to buy a house or other large item.

Figure 4

Mutual Funds Help Investors Save for a Variety of Financial Goals

Percentage of mutual fund–owning households, 2018

* Multiple responses are included.

Source: Investment Company Institute Annual Mutual Fund Shareholder Tracking Survey

Mutual fund–owning households reach for diversification, often investing in the stock market through stock funds—both domestic and international, both indexed and actively managed—and through balanced funds, including target date funds. Stock funds are the most commonly owned type of mutual fund (held by 88 percent of mutual fund–owning households), followed by money market funds (held by 57 percent), bond funds (held by 44 percent), and balanced funds (held by 36 percent).

Fund owners have a high level of confidence in mutual funds, with nearly nine out of 10 mutual fund–owning households indicating they are confident mutual funds can help them meet their investment goals.

Mutual Fund Ownership Is for Everyone

The rapid growth and spread of mutual funds—now serving almost 100 million Americans and their families—should come as no surprise. These funds provide what savers need: professionally managed, diversified, well-regulated, cost-effective tools to realize a wide range of financial goals. Those goals are shared by Americans of all incomes and ages—and mutual funds work well for them all.

Sarah Holden is the Senior Director of Retirement and Investor Research at ICI.