ICI Viewpoints

Stock Ownership in the United States: It’s Main Street

US household activity in the stock market has undergone a transformation over the past three decades. The old idea that investing in the stock market is just for the wealthy is vastly out of date.

In the late 1980s, less than a third of US households held stocks. Now, a majority do. This growth in stock-owning households has occurred across all income quintiles. In fact, the most rapid growth has taken place among lower-income Americans: today nearly four in 10 stock-owning households have annual incomes of less than $68,000.

That stock ownership comes in many forms—directly, through a brokerage account, or indirectly, through mutual funds, exchange-traded funds (ETFs), closed-end funds, and other managed accounts. And the rapid growth in retirement savings accounts such as 401(k) plans and individual retirement accounts (IRAs) has fueled this trend.

Stock Ownership Is Growing

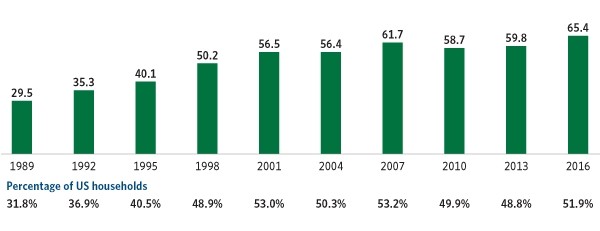

The Federal Reserve Board Survey of Consumer Finances reports that a majority (52 percent) of US households owned stocks in 2016, up from about 32 percent in 1989 (Figure 1). This means that 65.4 million US households owned stocks, directly or indirectly through funds.

Figure 1

Reach of Stock Ownership Has Dramatically Expanded in the United States

Stock ownership, millions of US households

Note: Stock ownership includes directly held shares as well as stocks held indirectly through mutual funds, ETFs, closed-end funds, and other managed accounts; inside and outside of retirement accounts.

Source: Investment Company Institute tabulations of the Federal Reserve Board Survey of Consumer Finances

Stock Ownership Is Widespread

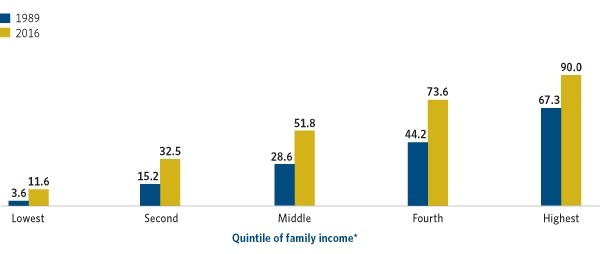

Households across all income groups are invested in stocks. Thanks in large part to the availability of 401(k) plans and IRAs, lower- and middle-income households are much more likely to hold stocks today than they were three decades ago. In 2016, more than 11 percent of households in the lowest income quintile owned stocks, up from only 4 percent in 1989 (Figure 2). More than 32 percent of households in the second-lowest income quintile owned stocks in 2016, compared with 15 percent in 1989. And more than 50 percent of households in the middle-income quintile owned stocks in 2016, compared with less than 30 percent in 1989.

Figure 2

Lower-Income Households Have Seen the Biggest Changes in Stock Ownership Rates

Stock ownership, percentage of US households by family income quintile

*See Figure 3 for income levels for 2016 quintiles.

Note: Stock ownership includes directly held shares as well as stocks held indirectly through mutual funds, ETFs, closed-end funds, and other managed accounts; inside and outside of retirement accounts.

Source: Investment Company Institute tabulations of the Federal Reserve Board Survey of Consumer Finances

Lower- and Middle-Income Households Make Up a Significant Share of Stock Owners

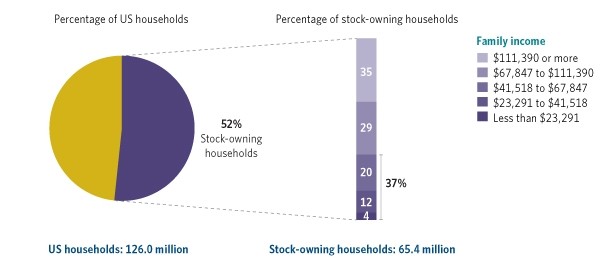

Nearly four in 10 households that own stocks are lower- to middle-income households. As Figure 3 shows, in 2016, among households that owned stocks, 37 percent had family incomes of less than $68,000. Another 29 percent of stock-owning households had family incomes between about $68,000 and about $111,000.

Figure 3

Nearly Four in 10 Stock-Owning Households Had Family Income Less Than $68,000

Percentage of US stock-owning households by family income, 2016

Note: Stock ownership includes directly held shares as well as stocks held indirectly through mutual funds, ETFs, closed-end funds, and other managed accounts; inside and outside of retirement accounts. The income breaks are the amounts that divide the entire US household population into quintiles.

Source: Investment Company Institute tabulations of the 2016 Federal Reserve Board Survey of Consumer Finances

Retirement Savers Often Focus on Stock Investing

A key to building a nest egg for retirement is investing for diversification and growth. Not surprisingly, millions of Americans across all income groups help prepare themselves for retirement by investing in stocks through 401(k) plans or IRAs. As of 2016, about 55 million Americans participated in 401(k) plans, and as of 2015, more than 58 million held investments in IRAs. Of these, the vast majority invested a portion of their retirement accounts in stocks, often in large part through mutual funds (stock funds and balanced funds, including target date funds).

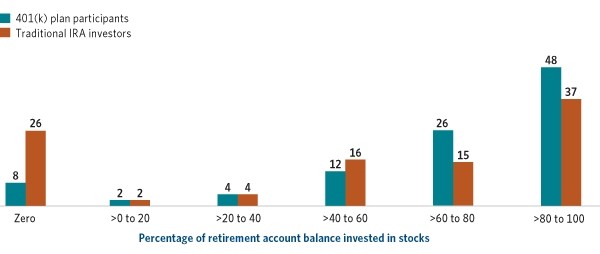

At year-end 2016, data indicate that more than nine in 10 participants in 401(k) plans held at least some stocks through their plans, and nearly half had more than 80 percent of their 401(k) plan account balance invested in stocks (Figure 4). A similar picture emerges for traditional IRA investors: about three-quarters of traditional IRA investors held at least some stocks in their accounts and nearly four in 10 had more than 80 percent of their traditional IRA balance invested in stocks. Overall, about two-thirds of 401(k) plan assets and traditional IRA assets were invested in stocks.

Figure 4

Vast Majority of Retirement Savers Hold Stocks, Often in High Concentrations

Percentage of 401(k) plan participants or traditional IRA investors by concentration of account in stocks,

year-end 2016

Note: 401(k) plan participants may hold stocks through stock funds, balanced funds (including target date funds), and company stock (the stock of the employer). In the 401(k) analysis, funds include mutual funds, collective investment trusts, separately managed accounts, and any pooled investment. For traditional IRA investors, stock holdings are through shares of stocks, stock funds, and balanced funds (including target date funds). In the traditional IRA analysis, funds include mutual funds, ETFs, and closed-end funds.

Sources: EBRI/ICI Participant-Directed Retirement Plan Data Collection Project and The IRA Investor Database™

Stock ownership may conjure up images of Wall Street—but that’s misleading. It’s time to recognize that people all up and down America’s Main Streets own stocks and are counting on stock ownership to help realize their financial goals. Since the 1980s, retirement savings have increasingly been gathered through 401(k)s, other defined contribution workplace plans, and IRAs—all vehicles that put hard assets in the hands of working Americans and retirees. As a result, more Americans own stock today than in the past—and stock ownership has become increasingly common for lower- and middle-income households.

Sarah Holden is the Senior Director of Retirement and Investor Research at ICI.