ICI Viewpoints

Why Long-Term Fund Flows Aren’t a Systemic Risk: Past Is Prologue

First in a series of Viewpoints on long-term funds and systemic risk

A recent Brookings Institution conference on Asset Management, Financial Stability, and Economic Growth aired the “active policy debate on how to regulate asset managers to maximize economic growth without endangering financial stability.” The conference provided interesting insights on whether or not “long-term mutual funds”—funds that invest primarily in stocks, bonds, or both—could potentially pose threats to financial stability. One question discussed at the conference was whether long-term funds might experience large outflows during a financial crisis, adding pressure on financial markets.

As my colleague Chris Plantier and I have recently discussed, this is an old and recurring concern about mutual funds that dates all the way back to the Great Depression—but it is not borne out in the data. This blog post reviews the evidence demonstrating—as ICI Chief Economist Brian Reid pointed out at the Brookings conference―that outflows from long-term funds have historically been muted during even the worst financial crises.

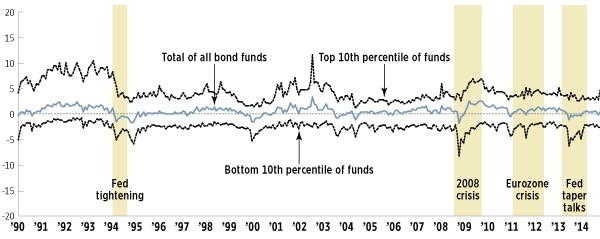

Modest Outflows from Bond Funds Even During Times of Market Stress

Net new cash flow as a percentage of assets; monthly, January 1990–October 2014

Source: Investment Company Institute

Because regulators most recently have focused their concerns on outflows from bond funds, let’s examine monthly flows into and out of U.S.-registered bond funds since 1990. The blue line in the figure above shows the flows to bond funds taken as a whole as a percentage of the total assets of bond funds. Ten percent of bond funds had outflows greater than the lower dashed line, while 10 percent had inflows greater than the upper dashed line. The shaded areas mark episodes of market turmoil.

As shown by the figure, outflows from bond funds were moderate even during episodes of market turmoil. To be sure, some bond funds experienced greater outflows than others, but some of those outflows were simply recycled as inflows into other bond funds, in what Reid described at the Brookings conference as akin to a “closed-loop system.”

The most recent example of bond funds’ response to market turmoil is the so-called Taper Tantrum episode in the summer of 2013. From May to August 2013, long-term interest rates rose very sharply, as market participants interpreted incoming data and Federal Reserve comments as indications that the Fed might soon begin scaling back its large-scale purchases of assets and perhaps raise short-term interest rates. Increases in long-term rates mean lower prices on existing bonds and, therefore, lower returns on bond funds—changes that could lead bond fund investors to redeem.

But average outflows from bond funds during these months were quite muted, never exceeding 2 percent of these funds’ assets. And as the blue line shows, even in the worst month of this period only 10 percent of funds had outflows exceeding about 6.25 percent of their assets. Put another way, 90 percent of funds had either modest outflows (less than 6.25 percent of assets) or they had inflows.

Even during the financial crisis of 2007–2008—the worst such crisis since the Great Depression—aggregate outflows from bond funds never totaled more than 2.5 percent of bond fund assets in any month. Given the severity of this crisis, this seems to be strong evidence against the likelihood that bond funds could experience outflows sizable enough during any crisis to create knock-on effects for financial markets.

The “Things Have Changed” View

Are historical fund flows a good guide to future fund flows? Skeptics—including some regulators and some participants at the Brookings conference—question the value of past fund-flow data as a guide to future fund flows, suggesting that things have changed in recent years. This “things have changed” view implies that we should ignore historical data on fund flows because some crucial factor is fundamentally different now.

One reason things may be different, commentators have suggested, is that there are now more investors and assets in bond funds. But this concern is also an old and unfounded worry. For example, a 1959 cover story in Time magazine discussed whether fund outflows could destabilize markets, noting that “in the last decade, funds have become the fastest-growing, most competitive, and most controversial phenomenon of the U.S. financial world. Ten years ago they had fewer than a million shareholders with $1.5 billion invested. Last week they had nearly 3.9 million with $14 billion invested.”

Well, since 1959, the number of fund investors has grown to more than 90 million. Assets in long-term funds exceed $12 trillion. And yet the intervening decades have never seen the destabilizing impact on long-term funds predicted in 1959. Clearly, the recent growth in number of bond fund investors and assets is no reason to dismiss past fund flows as a guide to the future.

Another version of the “things have changed” view involves investor behavior. Financial experts at the International Monetary Fund have suggested that investors are now more likely to redeem heavily than in the past. Others have suggested that even if investor behavior has not changed to date, there is no guarantee that it won’t change tomorrow. In other words, long-term fund investors haven’t yet redeemed heavily during market stresses, but there is no way to guarantee that won’t happen in the future. According to that view, we should dismiss the historical data on fund flows because they provide no guidance about the future.

If these are the arguments, economics as a discipline is in deep trouble. A fundamental tenet of economics is that people’s behavior is relatively stable over time. It is on that basis that economists routinely use historical data to predict people’s future behavior.

One example involves risk aversion. Economists generally assume that individuals are risk-averse. Why? After all, there is no genetic test for “risk aversion.” One reason is that risk aversion is consistent with the historical data. For example, we have not yet seen U.S. consumers en masse dropping their life savings on the lottery—behavior that is consistent with risk aversion.

But there is no way to guarantee that won’t happen tomorrow. And, what’s more, things have changed: we now have way more lotteries with much bigger prizes. Does that mean we should take seriously the possibility that the populace might arise tomorrow morning and risk every nickel on Powerball? Of course not.

In just the same way, given that history indicates that investors don’t redeem en masse from long-term mutual funds, it is reasonable to assume that investors’ past behavior is prologue to their future habits.

Yet another version of the “things have changed” view is the suggestion that financial markets themselves have changed. One issue raised is that broker-dealers are unable to commit as much capital now to making markets in securities as they did in the past, due to enhanced prudential regulations. This implies that equity and bond markets may be less liquid and, consequently, that fund redemptions now might have a greater effect on stock and bond prices than in the past. If that is the concern, the most direct and obvious way to address it is to seek ways to improve liquidity in the stock and bond markets.

In sum, the suggestions that “things have changed” and that we should ignore the historical stability of fund flows as predictive of future flows (especially during a crisis) isn’t compelling. When it comes to fund flows, the past is prologue.

And, because past posts—such as this one—are prologue to future posts, in a subsequent ICI Viewpoints analysis, we will take up a related but often ignored issue: the things that haven’t changed that will mitigate redemptions from long-term funds during future market stresses. Among other things, these include tax laws, fund characteristics (e.g., redemption fees or “round-tripping” restrictions), the risks involved in trying to time the markets, and—perhaps most important—a core characteristic of long-term fund investors: that they are predominantly retail investors and often have investment horizons measured in decades.

Sean Collins is Chief Economist at ICI.