ICI Viewpoints

Does Liquidity in ETFs Depend Solely on Authorized Participants?

ICI recently conducted a survey of its members that sponsor exchange-traded funds (ETFs) to collect information on authorized participants (APs)—typically market makers or large institutional investors with an ETF trading desk that have entered into a legal contract with an ETF to create and redeem shares of the fund.

The following ICI Viewpoints is a summary of the complete report, The Role and Activities of Authorized Participants of Exchange-Traded Funds. For a broader overview of ETFs, see Understanding Exchange-Traded Funds: How ETFs Work.

ETF Liquidity in the Primary Market

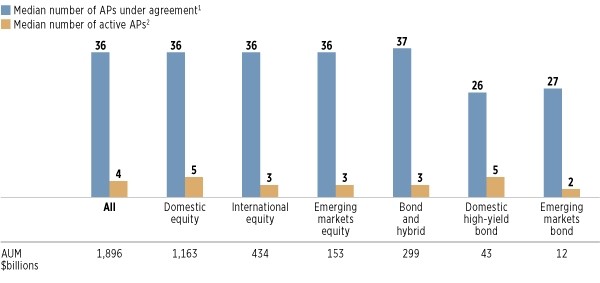

Some have expressed concern that the primary market in ETF shares depends too much on a limited number of active APs, and that this dependence could add stress to the financial markets if one of these active APs were to step away from creating and redeeming ETF shares. Two recent instances of an active AP stepping away—Knight Trading Group in August 2012 and Citigroup in June 2013—demonstrate that there are many APs ready and willing to keep the ETF primary market functioning smoothly (Figure 1).

Figure 1

For Most ETFs, There Are Many APs Available to Keep the Primary Market Running Smoothly

1 APs are entities that have a legal contract with an ETF distributor to create and redeem ETF shares.

2 For purposes of the survey, an AP was deemed active in an ETF if it had conducted at least one creation or redemption in that particular ETF’s shares in the previous six months.

Source: Investment Company Institute

It is important to remember that even if no APs had stepped forward to create and redeem in either of these cases, the affected ETF shares would have traded like closed-end funds. Impacts would have been contained to the affected ETFs and not transmitted to other ETFs or the underlying securities markets.

ETF Liquidity in the Secondary Market

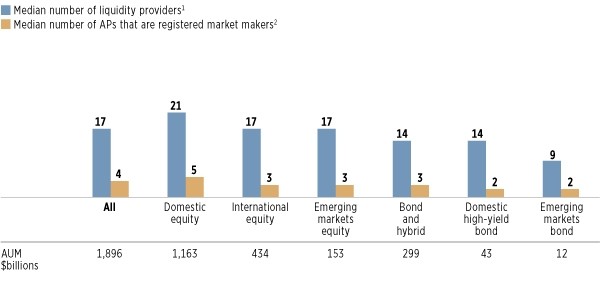

One common misperception is that APs that are registered market makers are the only entities that provide liquidity in the trading of ETF shares in the secondary market. In fact, there are a host of other entities that provide liquidity in ETF shares (Figure 2).

Should a registered market maker come under stress, these entities can help facilitate trading of ETF shares in the secondary market. For example, this was the case when Knight Trading Group—a registered market maker for more than 400 U.S.-listed ETFs that ranged in size and across investment objectives (domestic and international, equity, fixed income, and commodity)—came under pressure in the summer of 2012.

Domestic equity ETFs have the most liquidity providers. But other types of ETFs—such as emerging markets equity, domestic high-yield bond, and emerging markets bond—also have multiple liquidity providers in the secondary market.

Figure 2

There Are Many ETF Liquidity Providers in the Secondary Market

1 For purposes of the survey, liquidity provider was defined as an entity that regularly provides two-sided quotes in an ETF’s shares.

2 A registered market maker is registered with a particular exchange to provide two-sided markets in an ETF’s shares.

Source: Investment Company Institute

Shelly Antoniewicz is the Deputy Chief Economist at ICI.

Jane Heinrichs is associate general counsel for ICI.