Japanese and International Experiences

Welcoming Remarks

Global Retirement Saving Summit

Paul Schott Stevens

President and CEO

Investment Company Institute

23 April 2015

Conrad Hotel, Tokyo

Good afternoon and welcome, everyone.

Thank you for joining us for what we trust will be a thought-provoking summit about how retirement systems are evolving around the world, and about how defined contribution plans and regulated funds can help build retirement resources.

I have been anticipating this event for some time—not only because I welcome the insights of our esteemed keynote speaker and panelists, but also because I have looked forward with great pleasure to returning to Japan.

I first came to Tokyo in 1990 as a US Japan Leadership Fellow. As a Fellow, I lived here for almost four months. During that time I traveled throughout the country, interacted with members of the Diet and senior officials of government ministries, met with prominent journalists and noted scholars, and immersed myself in Japanese customs and culture.

I have had many occasions to return to Japan since then, but none in recent years. So, I am happy to be back again.

Of course 25 years ago, I could not have predicted that I would return to Tokyo to discuss what has become an important issue for societies around the globe: the challenge of building adequate retirement resources.

As you all know, this is an especially critical issue for Japan. According to a 2013 economic survey by the OECD, Japan has the oldest population in the world—and it continues to age rapidly.

Thus, pension reform has a special urgency, which makes Tokyo an ideal place to hold a summit on how to create successful retirement systems that can help people in a wide range of jurisdictions build adequate resources.

ICI in the US and ICI Global internationally have done a great deal of work in this space. One of our core missions is to document the role that DC plans and regulated funds can and do play in helping meet retirement savings challenges.

We have advanced this mission by studying the evolution of retirement systems in different countries and promoting dialogue among regulators, academics, and the fund industry through our previous Global Retirement Savings Conferences in Hong Kong and Geneva.

As a result of this work, we have noted many themes that current national debates over pension policy have in common. Perhaps the most important theme is that more and more countries are examining DC systems and considering how these systems can help their citizens save for the future.

In the United Kingdom, Chile, New Zealand, Australia, and elsewhere, DC systems have replaced or supplemented government-provided retirement schemes and defined benefit plans.

Why is that? What makes DC plans so attractive?

Each country has its own circumstances. In the United States, DC plans are popular because they offer retirement savers many advantages. They empower individuals by helping them build savings over their working lives. They convey ownership of retirement assets to workers. They are transparent. They also are portable and accrue value throughout a participant’s working life.

During our first panel we will hear about DC systems. Specifically, we will learn about the US, UK, and Japanese experience with these systems, and how each country has designed, integrated, and reformed them.

As our panelists discuss their experiences, it is important to keep in mind that each country’s DC system is different because every country has its own unique history, culture, institutional framework, domestic economy, and capital markets, all of which may influence its approach toward retirement planning.

Thus, I want to make clear that the ideas and viewpoints that emerge from one country’s experience certainly are not meant to be prescriptions for any other nation.

Instead, they are meant to be part of an open dialogue, to help us all learn from one another about how different societies are meeting the same challenge.

During our second panel, we will talk more about funds and their roles in DC systems. In particular, we will learn about the Japanese, UK, and US experience with funds, including how some funds, such as lifecycle funds, are helping savers diversify their investments.

The role of regulated funds is an important part of that dialogue, because these funds—as part of DC plans—can play a crucial role in helping meet global retirement savings challenges.

Let me illustrate this with some ICI data and research.

If you look at worldwide total net assets of regulated funds, the key takeaway is that there has been a global increase in those assets of more than 700 percent in the past 20 years.

You can also see that while the United States and Europe have relatively large fund sectors, the potential in Asia Pacific is very clear.

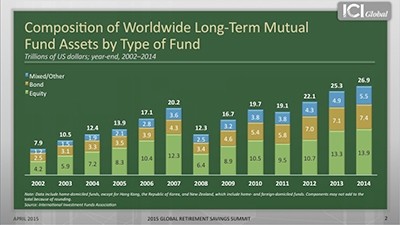

If you look at worldwide long-term mutual fund assets by type of fund, excluding money market funds, there is an array of mixed funds, bond funds, and equity funds. But the story here is an equity investing story. That is to say a story where the growth of investments held over a longer period of time is an important part of the objective.

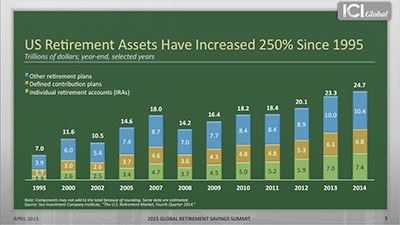

And certainly we can see that in the context of the US retirement system, where US retirement assets have increased by 250 percent since 1995.

Now these are all the assets that Americans have put aside for retirement, in both public and private DB systems, in DC systems of all kinds, and in individual retirement accounts.

Of the $6.8 trillion in DC plan assets in the United States, 55 percent are invested in regulated funds.

US fund companies have a long history of interacting with investors and can provide valuable insights into how to reach, educate, and serve retirement savers.

It’s no accident that investors place a high degree of confidence in regulated funds as long-term savings vehicles.

ICI has been surveying US households for a long period of time, including throughout the financial crisis, and eight in 10 households believe that funds can help them meet their long-term savings goals.

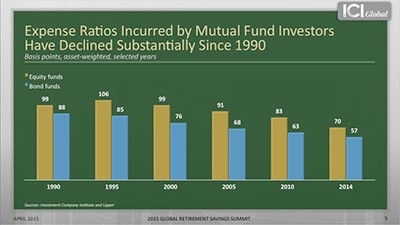

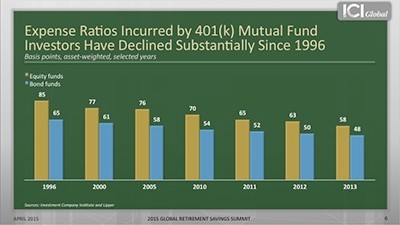

One other important aspect of US investing—and it is not simply in the retirement arena but in our fund marketplace at large—is the effect of strong competition on shareholder costs.

The expenses incurred by mutual fund investors have declined substantially since 1990, both with respect to bond and equity funds.

I think part of the reason why our investors have strong confidence in funds as long-term retirement savings vehicles, is because expense ratios incurred by investors have declined substantially.

These are some findings from the US perspective, but the use of funds as a retirement savings vehicle is common in many other jurisdictions around the world, which provides a global perspective that can inform policymakers as they consider needed reforms to their pension systems.

Indeed, we hope that global perspective will help make today’s conference most valuable and worthwhile for all of you.

A wide-ranging perspective is exactly what we can expect from our distinguished keynote speaker—Dr. Naoyuki Yoshino.

Professor Yoshino is dean of the Asian Development Bank Institute, or ADBI, and professor emeritus at Keio University.

He obtained his PhD from Johns Hopkins University and has been a visiting scholar at the Massachusetts Institute of Technology and other major universities as well.

In addition to his academic career, Dr. Yoshino has had a rich and varied professional life, serving in numerous other important roles as an adviser on financial matters to the government of Japan.

He currently serves as chief advisor of the Financial Research Center at the Financial Services Agency and chair of asset management for pension funds at the Ministry of Health, Labour, and Welfare.

Throughout his career, Dr. Yoshino has worked on and written extensively about a variety of economic issues, including Japan’s monetary policy and the country’s banking system, as well as Japan’s pension system and the need for financial education.

Ladies and gentlemen, please join me in welcoming Dr. Naoyuki Yoshino.