News Release

ISS MI BrightScope/ICI Report Reveals 403(b) Plan Sponsors Support Retirement Saving and Investing

Washington, DC, April 18, 2024—Employers’ commitment to their 403(b) plan participants is evident in the report “The BrightScope/ICI Defined Contribution Plan Profile: A Close Look at ERISA 403(b) Plans, 2020,” released today by ISS Market Intelligence (MI) and the Investment Company Institute (ICI). Analyzing plan year 2020 data for large 403(b) plans filing the Form 5500 under the Employee Retirement Income Security Act of 1974 (ERISA), the report finds that nearly one-third of large ERISA 403(b) plan participants were in plans that put their employees on the path to retirement saving with automatic enrollment.

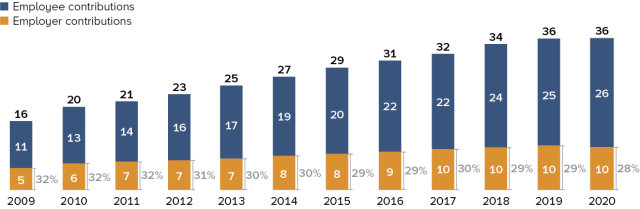

Employer contributions represent a significant portion of contributions flowing into large ERISA 403(b) plans, a trend that has persisted over the past decade. In 2020, 83 percent of large ERISA 403(b) plans offered employer contributions. Among the large ERISA 403(b) plans with employer contributions 35 percent had automatic employer contributions, 58 percent had simple matches, and 14 percent had both features. The remaining 21 percent had tiered matches and other types of employer contributions.

“Employer contributions signal the commitment that 403(b) plan sponsors have to their employees’ retirement saving, providing a significant boost to participants’ account balances,” highlighted Sarah Holden, ICI Senior Director of Retirement and Investor Research. “Employer contributions encourage plan participation, and matching contributions incentivize employee contributions.”

Employers Make Significant Contributions to Large ERISA 403(b) Plans

Billions of dollars, plan year

Note: The results include plans that filed Form 5500 Schedule H (typically plans with 100 participants or more). In plan year 2020, the sample is 5,913 large ERISA 403(b) plans. Employee contributions contain contributions from others, which include rollovers into 403(b) plans. Employer contributions include de minimis noncash contributions.

Source: Investment Company Institute tabulations of US Department of Labor Form 5500 Research File

The report further revealed the diverse array of investment choices made available in large 403(b) plans. In 2020, the average large ERISA 403(b) plan offered a selection of 27 core investment options. Among these, approximately 11 were equity funds, two were bond funds, and 10 were target date funds. Nearly all plans included offerings in domestic equity, international equity, and domestic bond funds. Moreover, a significant 88 percent of large ERISA 403(b) plans included target date funds, and target date funds were 30 percent of large ERISA 403(b) plan assets. Investments include active as well as index funds, with the vast majority of large ERISA 403(b) plans including index funds in their lineups.

“The analysis indicates that 403(b) plan sponsors responsibly curate their investment menus, including a wide array of professionally managed, cost-effective, and diversified investments,” explained Brooks Herman, Managing Director, BrightScope at ISS MI. “This range of offerings reflects recognition of the importance of aligning investment options with the needs and preferences of plan participants who vary in age and willingness to take investment risk.”

Other key findings of the study include:

- ERISA 403(b) plans represent an array of nonprofits, often hospitals or educational services. About half of ERISA 403(b) plan participants are in hospital plans, which held 38 percent of ERISA 403(b) plan assets in plan year 2020. Another 23 percent of ERISA 403(b) plan participants were in educational services, holding nearly half (44 percent) of ERISA 403(b) plan assets.

- Large ERISA 403(b) plans often have combinations of employer contributions, participant loans outstanding, and automatic enrollment. In 2020, 42 percent of large ERISA 403(b) plans both offered employer contributions and had participant loans outstanding, 25 percent offered employer contributions only, and 2 percent had automatic enrollment and outstanding loans. Nearly 13 percent of large ERISA 403(b) plans had reported evidence of all three activities. Larger plans tended to be more likely to have evidence of all three activities.

- Mutual funds were the most common investment vehicle in large ERISA 403(b) plans, with 66 percent of large ERISA 403(b) plan assets in 2020. Fixed annuities held 16 percent of assets, and variable annuities held 18 percent.

- The measures of large ERISA 403(b) total plan costs have decreased since 2009. The average participant was in a lower-cost plan, with a total plan cost of 0.51 percent of assets in 2020, down from 0.68 percent in 2009, while the average dollar was invested in a plan with a total plan cost of 0.42 percent in 2020, down from 0.59 percent in 2009.

About the Study

The BrightScope/ICI Defined Contribution Plan Profile: A Close Look at ERISA 403(b) Plans, 2020 analyzes 403(b) plans in the Department of Labor 2020 Form 5500 Research File, and more than 6,300 audited 403(b) plans in ISS Market Intelligence’s BrightScope Defined Contribution Plan Database, which typically have 100 participants or more. A 403(b) plan is an employer-sponsored defined contribution (DC) retirement plan that enables employees of public schools and universities, nonprofit employers, and church organizations to make tax-deferred contributions from their salaries to the plan.

About ISS Market Intelligence

ISS Market Intelligence (MI) is a leading provider of data, insights, and market engagement solutions to the global financial services industry. ISS MI empowers asset and wealth management firms, insurance companies, distributors, service providers, and technology firms to assess their target markets, identify and analyze the best opportunities within those markets, and execute on comprehensive go-to-market initiatives to grow their business. Clients benefit from our increasingly connected global platform that leverages a combination of proprietary data, powerful analytics, timely and relevant insights, in-depth research, as well as an extensive suite of industry-leading media brands that deliver unmatched market connectivity through news and editorial content, events, training, ratings, and awards.

Complete results of the annual BrightScope/ICI study are posted on www.ici.org/research/retirement/dc-plan-profile. To learn more about ISS Market Intelligence, visit www.issmarketintelligence.com.