News Release

403(b) Plans Offer Diverse Investment Opportunities

New BrightScope/ICI Research Examines Makeup of 403(b) Plan Designs

Washington, DC, May 23, 2016 - More than 90 percent of 403(b) retirement plans offered by private-sector employers are now using a variety of plan features designed to boost participation among employees, a joint research study released today by BrightScope and the Investment Company Institute (ICI) has found. 403(b) plans are tax-advantaged retirement savings plans offered by educational institutions and other nonprofit employers.

The study, “The BrightScope/ICI Defined Contribution Plan Profile: A Close Look at ERISA 403(b) Plans, 2013,” examines the elements of different 403(b) retirement plans, including automatic enrollment of employees into the plan, employer contributions, and participant loans. The report analyzes 403(b) plans covered by the Employee Retirement Income Security Act of 1974 (ERISA) that had 100 participants or more and at least $1 million in plan assets.

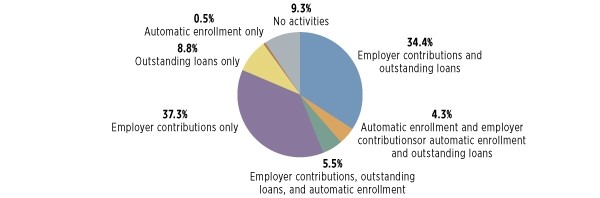

ERISA 403(b) Plan Sponsors Use a Variety of Plan Designs

Percentage of ERISA 403(b) plans with selected plan activity combinations, 2013

Note: The sample is nearly 6,000 403(b) plans with 100 participants or more and at least $1 million in plan assets. See Exhibits 1.8 and A.1 in the report for additional detail.

Sources: BrightScope Defined Contribution Plan Database and Investment Company Institute tabulations of U.S. Department of Labor 2013 Form 5500 Research File

“With nearly $1 trillion in assets in 2015, 403(b) plans have grown to be a significant component of the U.S. retirement system,” said Sarah Holden, ICI senior director of retirement and investor research. “For the first time, we’re looking at the different combinations of features in ERISA 403(b) plans to better understand how nonprofit employers are helping their employees plan for retirement.”

These features combine to encourage participation in 403(b) plans: automatic enrollment highlights the path to saving, employer contributions provide an immediate financial incentive, and loans provide flexibility. Of the nearly 6,000 large ERISA 403(b) plans analyzed, 80 percent offered employer contributions, half had participant loans, and 10 percent included automatic enrollment for employees. A little more than one-third of these plans offered both employer contributions and participant loans. Overall, about 6 percent of ERISA 403(b) plans included in the sample offered all three features.

ERISA 403(b) Plans Have Extensive Investment Options

To determine the makeup of investment options offered through these retirement accounts, the BrightScope/ICI study separately examined ERISA 403(b) plans with at least $1 million in assets that filed audited Form 5500 reports with the U.S. Department of Labor—approximately 4,000 plans. Through this research, the study found that ERISA 403(b) plans offered an average of 25 core investment options to participants in 2013. On average, 403(b) plans offered savers the choice of 11 equity funds, three bond funds, and eight target date funds. Nearly all plans offered at least one equity fund and one bond fund. About 70 percent of plans offered a suite of target date funds, and 88 percent offered fixed annuities.

“The typical 403(b) plan design offers a robust investment lineup to provide participants a range of investment risk, return, and styles,” said Brooks Herman, head of data and research at BrightScope. “For employers, the ability to customize the design of their 403(b) plans to provide features that employees desire can help attract and retain quality workers.”

Other findings about large ERISA 403(b) plans’ investment options and asset allocations include:

- The BrightScope measure of total ERISA 403(b) plan costs—which includes administrative, advice, and other fees from Form 5500 filings, and asset-based investment management fees—has decreased since 2009. In 2013, the average plan had a total plan cost of 0.73 percent of assets, down from 0.82 percent four years earlier.

- Mutual funds were the largest share of plan assets (49 percent) in ERISA 403(b) plans in 2013. Variable annuities (including variable annuity mutual funds) held 28 percent of assets, and fixed annuities held 23 percent of assets.

- Forty-six percent of ERISA 403(b) assets was in equity funds, 18 percent was in balanced funds (including target date funds), and 7 percent was in bond funds.

- Index funds are widely available in ERISA 403(b) plans and represented about 17 percent of ERISA 403(b) plan assets in 2013.