News Release

Most Employers Make Contributions to Their 401(k) Plans, In-Depth BrightScope/ICI Study Finds

Extensive Plan Data Reveal Key Design Features and Trends

Washington, DC, December 20, 2016—A new in-depth study of 401(k) plans by BrightScope and the Investment Company Institute (ICI) finds that the great majority of employers that sponsor 401(k) plans—more than three-quarters—contribute to their plans, using a range of formulas when they provide matching contributions. The report, released today, also reveals that plans offer a wide variety of investment choices and that mutual fund fees in 401(k) plans have trended down.

The comprehensive study, “The BrightScope/ICI Defined Contribution Plan Profile: A Close Look at 401(k) Plans, 2014,” analyzes the most recent detailed data available from the Department of Labor on a wide range of private-sector 401(k) plans. The analysis first explores the presence of employer contributions across the universe of about half a million 401(k) plans. Next, focus shifts to details in plan design among more than 50,000 large 401(k) plans—each holding at least $1 million in plan assets and typically having 100 participants or more. The report studied plan sponsors’ combinations of automatic enrollment, employer contributions, and participant loans in those 401(k) plans. In addition, using a third sample—with detailed investment data compiled in the BrightScope Defined Contribution Plan Database on nearly 30,000 large 401(k) plans—the study examined trends in plan investment options and fees, providing additional insights into the 401(k) system.

“This study underscores how the 401(k) plan’s flexible structure permits employers to configure their own plan designs to encourage employee participation and meet the needs of their workforces,” said Sarah Holden, ICI’s senior director of retirement and investor research and a researcher on the study. “As the 401(k) market evolves, plan sponsors revisit and refine their plan designs and remain committed to promoting retirement saving, offering a wide range of investment choices, and often making contributions to the plans.”

Key Facts on Employer Contributions Based on the Study:

- Looking across the universe of 401(k) plans, the analysis finds that employers made one-third ($115 billion) of total 401(k) plan contributions in 2014.

- In nearly all (95 percent) of the large plans with 5,000 participants or more, the employer contributed in 2014, and more than three-quarters of small 401(k) plans with fewer than 100 participants featured employer contributions.

- Focusing on a sample of large 401(k) plans reveals that in 25 percent of 401(k) plans in the BrightScope database, employers contributed to the plan without regard to how much the employee contributed.

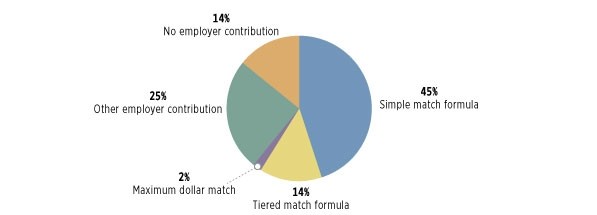

- Simple matching formulas are the most common type of employer contribution—found in 45 percent of 401(k) plans in the BrightScope database. Under the formula, an employer matches an employee contributions up to a fixed percentage of the employee’s salary (for example, 50 cents on the dollar on employee contributions up to 6 percent of pay).

- Fourteen percent of 401(k) plans in the BrightScope database had a tiered formula, with employers matching different levels of employee contributions at different rates, and 2 percent of employers matching up to a maximum dollar amount.

401(k) Plan Sponsors Use a Variety of Employer Contribution Designs

Percentage of 401(k) plans in the BrightScope database, 2014

Note: See Exhibit 1.6 in the report for details on the definitions and sample.

Source: BrightScope Defined Contribution Plan Database

Employers Design 401(k) Plans to Include Features That Employees Value

- Nearly all (97 percent) of the sample of more than 50,000 large 401(k) plans with 100 participants or more and at least $1 million in plan assets included at least one of the three activities explored in this research—automatic enrollment, employer contributions, and participant loans.

- Twenty-one percent of the 401(k) plans in the sample reported evidence of all three activities. Larger plans were more likely to have all three activities in their plans. The most prevalent combination of plan activities was employer contributions in plans that also had participant loans outstanding—observed in 47 percent of 401(k) plans in the sample.

Mutual Fund Fees, Total Plan Costs Continue Trending Down

Based on the data from the BrightScope database, the study found that mutual fund fees in 401(k) plans trended downward between 2009 and 2014. The study also found that fund expenses are typically lower in larger plans. For instance, the average asset-weighted expense ratio for domestic equity mutual funds was 0.82 percent for 401(k) plans with $1 million to $10 million in plan assets, compared with 0.39 percent for 401(k) plans holding more than $1 billion in plan assets.

“Fees in 401(k) plans continue to trend downward over time,” said Brooks Herman, head of data and research at BrightScope, a unit of Strategic Insight. “Increased transparency in the form of public disclosure have allowed plan participants and plan sponsors to judge the impact of fees on 401(k) savings.”

Key Findings on Investment Choices Offered Through 401(k) Plans:

- Mutual funds were the most common 401(k) investment vehicle, holding 46 percent of 401(k) plan assets in the sample in 2014. Collective investment trusts (CITs) held 26 percent of plan assets; guaranteed investment contracts (GICs) held 9 percent; separate accounts held 4 percent; and the remaining 16 percent was invested in individual stocks, bonds, brokerage, and other investments.

- Target date funds have become more common in 401(k) plans. In 2014, 76 percent of 401(k) plans in the sample offered target date funds, compared with 32 percent in 2006. During the same period, the share of participants who were offered target date funds rose from 42 percent to 77 percent.

- Index fund use in 401(k) plans also has increased. The share of 401(k) plans in the BrightScope database offering index funds rose from 79 percent to 89 percent from 2006 to 2014, and the percentage of plan assets invested in index funds rose from 17 percent to 29 percent during that period.