News Release

Closed-End Funds’ Total Assets Rose, But Demand for New Bond Fund Shares Slowed in 2014

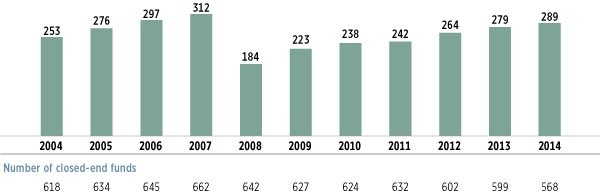

Washington, DC, April 30, 2015—Total assets of closed-end funds (CEFs) increased to $289 billion at year-end 2014, up $10 billion from year-end 2013. Demand for new bond CEF shares, however, slowed substantially during the same time frame, according to an updated annual study released today by the Investment Company Institute (ICI).

The study, “The Closed-End Fund Market, 2014” analyzes data on CEFs, a type of registered investment company that issues a fixed number of shares that trade intraday on stock exchanges at market-determined prices. The data show total assets of closed-end funds rising since 2008.

Closed-End Funds’ Total Assets Rose in 2014

Billions of dollars; year-end, 2004-2014

Market Factors Dampened Demand for New Shares of Bond CEFs

In 2014, net issuance of CEF shares declined considerably to $4.8 billion, from $13.7 billion in 2013, as investor demand for bond CEFs continued to wane. Net issuance of bond CEFs fell to $427 million in 2014 from $10.2 billion in 2013. Increased market volatility, expectations of rising long-term interest rates, and wider discounts on many existing bond CEFs likely played a role in tamping down net share issuance of bond CEFs in 2014. In contrast, equity CEFs saw $4.3 billion in net issuance in 2014, up from $3.6 billion in 2013.

Bond CEFs Make Up Majority of CEF Total Assets, but Share Has Fallen

Traditionally, bond CEFs have comprised the majority of CEF assets and that continued to hold true at year-end 2014. Bond CEFs had a 59 percent of share of the total CEF market, down from 67 percent a decade earlier. During the same period, continued demand for equity closed-end funds and recent years’ gains in equity prices have increased equity CEFs’ share of the market, to 42 percent of all closed-end fund assets, up from 41 percent in 2013 and 32 percent a decade ago.

Competitive Dynamics Are at Play in the Closed-End Fund Market

The ICI study illustrates the competitive dynamics of the CEF market. Data show:

- No single CEF sponsor has dominated the market. In particular, of the largest 25 CEF sponsors in 2004, only 15 remained in this group at year-end 2014.

- Only 11 sponsors offer more than 10 CEFs, whereas 41 sponsors offer only one CEF, and 38 sponsors offer two to five funds.

- The Herfindahl-Hirschman Index number for the closed-end fund industry at year-end 2014 was 729. This index weighs both the number and relative size of firms in the industry. An index number smaller than 1,000 indicates that an industry is unconcentrated. An index number greater than 1,800 indicates an industry is highly concentrated.