News Release

403(b) Plans Offer Diverse Array of Investment Options

BrightScope/ICI Study Also Finds Total Costs of 403(b) Plans Decreased from 2009 to 2012

Washington, DC, June 30, 2015—Employees of educational institutions and other nonprofit employers who participate in 403(b) plans enjoy many investment options in their plans, according to a research study by BrightScope and the Investment Company Institute released today.

The new study, “The BrightScope/ICI Defined Contribution Plan Profile: A Close Look at ERISA 403(b) Plans,” examines 403(b) plans—which are defined contribution (DC) plans similar to 401(k) plans—offered to such employees. Another key finding of the report is that the average total plan cost of 403(b) plans, as measured by BrightScope, decreased from 2009 to 2012.

The study draws on information collected in the BrightScope Defined Contribution Plan Database, which sheds light on DC plan design across many dimensions. These include the number and type of investment options offered; the presence and design of employer contributions; features of automatic enrollment; and changes to plan design over time. In addition, industrywide fee information is matched to investments in DC plans, allowing analysis of the cost of DC plans. This study focuses on 403(b) plans governed by the Employee Retirement Income Security Act of 1974 (ERISA) filing audited Form 5500 reports (typically plans with 100 participants or more).

Average Number of Core Investment Options in ERISA 403(b) Plans

Source: BrightScope Defined Contribution Plan Database

“403(b) plans play a critical role in the retirement marketplace,” said Brooks Herman, head of data and research at BrightScope. “This study reveals that plan design features of 403(b) plans governed by ERISA are as dynamic as those found in 401(k) plans and that 403(b) plan sponsors design their plans to generate accumulations that will provide participants with substantial retirement savings.”

“This research spotlights a less well understood area of the U.S. retirement system,” said Sarah Holden, senior director of retirement and investor research at ICI. “The broad array of investment options available to ERISA 403(b) plan participants, and the large incidence of employer contributions that we found, attest to strong plan design features and employers’ support for employees’ retirement well-being.”

ERISA 403(b) Plans Offered Nearly Two Dozen Core Investment Options

Though less well-known than 401(k) plans, 403(b) plans represent a $0.9 trillion market. BrightScope and ICI have analyzed 403(b) plans that are regulated under ERISA and are required to file an audited Form 5500 report with the Department of Labor annually. Typically plans with 100 participants or more are required to file this report. The ERISA 403(b) plans included in this study held $271 billion in assets.

Findings about ERISA 403(b) plans’ investment options and asset allocations include:

- Mutual funds were the largest share of plan assets (47 percent) in ERISA 403(b) plans in 2012.

- Variable annuities held 27 percent of assets, and fixed annuities were 26 percent.

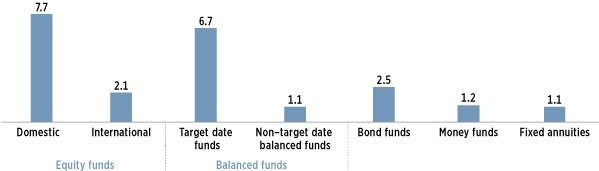

- The average ERISA 403(b) plan offered 23 core investment options, including 10 equity funds, three bond funds, and seven target date funds.

- Nearly all plans offered at least one equity fund and one bond fund, about 70 percent of plans offered a suite of target date funds, and 84 percent offered fixed annuities.

- Forty-three percent of ERISA 403(b) assets were in equity funds, 15 percent in balanced funds, including target date funds, and more than 8 percent in bond funds.

- Index funds are widely available in ERISA 403(b) plans and represented about 14 percent of ERISA 403(b) plan assets in 2012.

Total Plan Costs for ERISA 403(b) Plans Decreased

The BrightScope measure of total ERISA 403(b) plan costs—which includes administrative, advice, and other fees from Form 5500 filings, and asset-based investment management fees—has decreased since 2009, looking at snapshots of 403(b) plan fees:

- In 2012, the average total plan cost was 0.75 percent of assets, down from 0.80 percent in 2009.

- The average participant was in a lower-cost plan, with a total plan cost of 0.58 percent of assets in 2012, down from 0.68 percent in 2009.

- The average dollar was invested in a plan with a total plan cost of 0.51 percent in 2012, down from 0.59 percent in 2009.

Other key findings of the BrightScope/ICI study include:

- About four out of five employers that sponsor ERISA 403(b) plans contributed to their plans, with 31 percent of plans using a simple match formula in which the employer matches a certain percentage of employee contributions up to a maximum percentage of employee salary.

- Mutual fund expenses in ERISA 403(b) plans tend to be lower in larger plans and have trended down over time. For example, the average asset-weighted expense ratio for domestic equity mutual funds was 0.81 percent for plans with less than $1 million in assets, compared with 0.48 percent for plans with more than $1 billion in assets.