News Release

Majority of New 401(k) Participants Rely on Balanced, Target Date Funds

Annual EBRI/ICI 401(k) Study Also Shows Equities Continue to Be the Dominant Investment Among Plan Participants

Washington, DC, December 18, 2014—The evolution of 401(k) plan designs has resulted in a significant increase in the use of balanced funds, including target date funds, by recently hired 401(k) plan participants in 2013 compared with recently hired participants 15 years ago, according to a newly updated annual report by the Investment Company Institute (ICI) and the Employee Benefit Research Institute (EBRI).

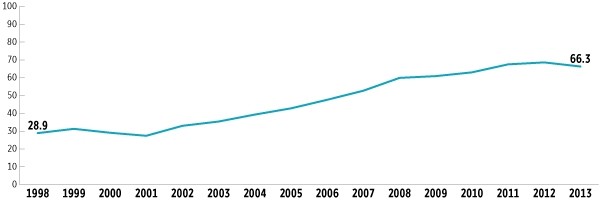

The study, “401(k) Plan Asset Allocation, Account Balances, and Loan Activity in 2013,” found that nearly two-thirds of recently hired 401(k) participants were invested in balanced funds at year-end 2013, compared with less than one-third of recently hired participants at year-end 1998. In addition, among recent hires investing in balanced funds, more than three-quarters had invested more than 90 percent of their 401(k) account in balanced funds at year-end 2013.

“These data suggest that regulatory changes have helped make it easier for employers to design their plans to cater to the wide array of 401(k) plan investors, ranging from folks who want to do it themselves—constructing a portfolio from the investments offered—to those who are invested in target date funds for professional asset allocation, diversification, and rebalancing over time,” noted Sarah Holden, ICI senior director of retirement and investor research. “This evolution in plan design has resulted in increased diversification across asset categories, on average, for 401(k) plan participants.”

New 401(k) Plan Participants Have Increased Use of Balanced Funds over Time

Percentage of recently hired participants holding balanced funds, 1998–2013

Note: Balanced funds include mutual funds, bank collective trusts, life insurance separate accounts, and any pooled investment product holding a mix of equities and fixed-income securities (including target date and lifestyle investments).

Source: Tabulations from EBRI/ICI Participant-Directed Retirement Plan Data Collection Project

Target date funds have played a large part in the increased role of balanced funds. At year-end 2013, recently hired 401(k) plan participants had 41 percent of their 401(k) plan assets invested in balanced funds, with 32 percent invested in target date funds. The research finds that overall, across the entire 26.4 million 401(k) plan participants in the EBRI/ICI 401(k) database, target date funds represented 15 percent of plan assets, and 41 percent of 401(k) plan participants overall held target date funds.

“Target date funds provide a convenient investment choice for 401(k) participants to automatically diversify at least a portion of their retirement portfolios and maintain age-appropriate asset allocations even during volatile financial markets,” said Jack VanDerhei, EBRI research director. “The growing use of these funds in recent years, especially among new 401(k) participants, has been accompanied by a marked decrease of young participants with zero equity exposure. The increased use of target date funds has also been associated with a decrease in older participants with high concentrations in equities as well as a continued reduction in the allocation to company stock among 401(k) participants.”

401(k) Investors Stick with Investments in Equities

The EBRI/ICI analysis shows that at year-end 2013, 66 percent of 401(k) plan participants’ accounts were invested in equities—through equity funds, the equity portion of target date funds, the equity portion of non–target date balanced funds, and company stock—and that 90 percent of 401(k) plan participants held at least some equities in their accounts. Although equity funds represented the largest share of 401(k) plan assets, target date funds, which often are invested to a significant degree in equities, also are playing an important role. The report shows younger 401(k) plan participants had higher allocations to equities—accounting for more than three-quarters of 401(k) assets among participants in their twenties or thirties—compared with older participants. Participants in their sixties had a little more than half of their 401(k) assets invested in equities.

Other key findings of the study include:

- 401(k) loan activity held steady in 2013. The study shows that at year-end 2013, 21 percent of all 401(k) participants who were eligible for loans had loans outstanding against their 401(k) accounts, unchanged from the prior four years (2009−2012), although slightly elevated compared with the levels seen prior to the financial crisis (2006−2008).

- The average 401(k) account balance tends to increase with participant age and tenure. Age, tenure, salary, contribution behavior, rollovers from other plans, asset allocation, withdrawals, loan activity, and employer contribution rates affect an individual’s account balance at any point in time. For example, at year-end 2013, the average account balance among 401(k) plan participants in their sixties with more than 30 years of tenure was nearly $250,000. The average 401(k) participant account balance was $72,383.

Information About the EBRI/ICI Database

The study is based on the EBRI/ICI database of employer-sponsored 401(k) plans, the largest of its kind and a collaborative research project undertaken by the two organizations since 1996. The 2013 EBRI/ICI database includes statistical information on 26.4 million 401(k) plan participants in 72,676 plans, which hold $1.912 trillion in assets and cover about half of the universe of 401(k) participants.

EBRI, established in 1978, is an independent, nonpartisan, nonprofit research and education organization committed exclusively to data dissemination, policy research, and education on economic security and employee benefits. EBRI does not take policy positions and does not lobby.

ICI, founded in 1940, is the national association of U.S. investment companies, including mutual funds, closed-end funds, unit investment trusts, and exchange-traded funds. Members of ICI manage total assets of $17.4 trillion and serve more than 90 million shareholders.