News Release

401(k) Investors Continued to Diversify in 2011

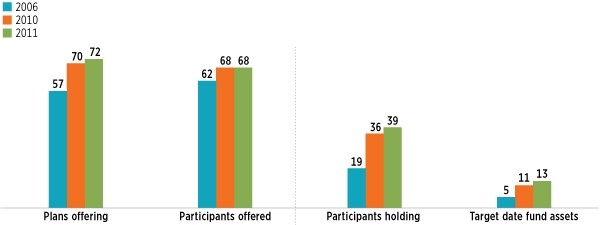

Nearly Three-Quarters of 401(k) Plans Include Target Date Funds

Washington, DC, December 20, 2012 - 401(k) savers continued to seek diversified portfolios in 2011, with 61 percent of 401(k) participants’ assets invested in equity securities and 34 percent in fixed-income securities, on average, according to the annual update of a joint study released today by the Employee Benefit Research Institute (EBRI) and the Investment Company Institute (ICI).

Target Date Funds Play Role in Diversification

The study, 401(k) Plan Asset Allocation, Account Balances, and Loan Activity in 2011, also finds target date funds are playing an increasingly important role in that diversification with 72 percent of 401(k) plans offering target date funds in their investment lineup at year-end 2011, compared with 70 percent at year-end 2010 and 57 percent at year-end 2006. At year-end 2011, 13 percent of the assets in the EBRI/ICI 401(k) database was invested in target date funds, up from 11 percent in 2010 and 5 percent in 2006. In addition, 39 percent of 401(k) participants held target date funds at year-end 2011, compared with 36 percent in 2010 and 19 percent in 2006

Target Date Funds Claim a Growing Share of 401(k) Market

Percentage of total; 2006, 2010, and 2011

Note: “Funds” include mutual funds, bank collective trusts, life insurance separate accounts, and any pooled investment product primarily invested in the security indicated.

Source: Tabulations from EBRI/ICI Participant-Directed Retirement Plan Data Collection Project

“When planning their retirement savings strategy, participants increasingly use tools such as target date funds, which are designed to offer a mixed investment portfolio of equity and fixed-income securities that automatically rebalances to be more focused on income over time, to get diversification,” said Sarah Holden, senior director of retirement and investor research at ICI and coauthor of the study. “The study’s findings highlight that 401(k) participants, particularly recent hires, are opting to diversify their account balances, either actively or as a result of plan design.”

The study finds that more new or recent hires invested their 401(k) assets in balanced funds, including target date funds. For example, 51 percent of the account balances of recently hired participants in their twenties was invested in balanced funds at year-end 2011, up from 44 percent in 2010 and 24 percent in 2006. At year-end 2011, 40 percent of the account balances of recently hired participants in their twenties was invested in target date funds, compared with 35 percent in 2010 and 16 percent in 2006.

“A growing number of employers have taken advantage of plan design enhancements such as automatic enrollment, contribution acceleration, and qualified default investment alternatives, including target date funds, that can help participants make better savings decisions,” noted Jack VanDerhei, EBRI research director and coauthor of the study. “That impact is particularly noticeable in the data regarding new hires and younger workers.”

401(k) Loan Activity Steady in 2011; Loan Amounts Outstanding Edged Up

The study shows at year-end 2011 that 21 percent of all 401(k) participants who were eligible for loans had loans outstanding against their 401(k) accounts, unchanged from the prior two years. Loans outstanding amounted to 14 percent of the remaining 401(k) account balance, on average, at year-end 2011, unchanged from year-end 2010, though loan amounts outstanding increased slightly from those at year-end 2010.

Average 401(k) Account Balance Varies by Age, Tenure, Salary

The EBRI/ICI study provides a snapshot of the 401(k) account balances at their current employers for the large cross section of 401(k) plan participants in the EBRI/ICI database. Active 401(k) plan participants include young workers and those who are new to their jobs, as well as older participants and those who have been with their current employers for many years.

Age, tenure, and a number of other factors impact an individual’s account balance at any point in time. The 401(k) account balance for an individual’s current job is typically a component of a bigger retirement picture for the U.S. workforce. Among 401(k) participants in their fifties or sixties, the average account balance of the longest-tenured participants was more than eight times larger than that of those who are new to their jobs.

At year-end 2011, the average 401(k) participant account balance was $58,991 and the median account balance was $16,649, with wide variation reflecting the many variables in retirement saving, including participant age, tenure, salary, contribution behavior, rollovers from other plans, asset allocation, withdrawals, loan activity, and employer contribution rates.

The full analysis is being published in the December 2012 EBRI Issue Brief and ICI Research Perspective, online at www.ebri.org and www.ici.org/research/perspective. It was written by ICI’s Holden; EBRI’s VanDerhei; Luis Alonso, EBRI director of information technology and research databases; and Steven Bass, ICI associate economist, based on the EBRI/ICI database of employer-sponsored 401(k) plans, the largest of its kind and a collaborative research project undertaken by the two organizations since 1996. The 2011 EBRI/ICI database includes statistical information on about 24 million 401(k) plan participants, in 64,141 plans, holding $1.415 trillion in assets, covering nearly half of the universe of 401(k) participants.

EBRI, established in 1978, is an independent, nonpartisan, nonprofit organization committed exclusively to data dissemination, policy research, and education on economic security and employee benefits. EBRI does not take policy positions and does not lobby. www.ebri.org.

ICI, founded in 1940, is the national association of U.S. investment companies, including mutual funds, closed-end funds, unit investment trusts, and exchange-traded funds. Members of ICI manage total assets of $13.8 trillion and serve more than 90 million shareholders. www.ici.org.