News Release

The Average Expense Ratio Incurred by 401(k) Investors in Stock Funds Declined in 2010

Washington, DC, June 29, 2011 - 401(k) plan participants invested in stock mutual funds on average paid lower expense ratios in 2010, according to an annual report by the Investment Company Institute that examines the economics of providing 401(k) plans and the average expense ratios of mutual funds held in 401(k) plans. At year-end 2010, $1.8 trillion, or more than half, of the $3.1 trillion in 401(k) assets was invested in mutual funds, primarily in stock funds.

Average Expense Ratios of Stock Funds, Money Market Funds Declined in 2010

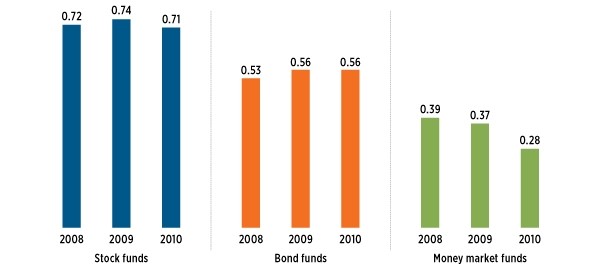

The Economics of Providing 401(k) Plans: Services, Fees and Expenses, 2010 finds that the expense ratios paid by 401(k) plan investors on their stock funds averaged slightly lower in 2010, compared with 2009. The asset-weighted average expense ratio paid by 401(k) investors on their stock funds dropped 3 basis points to 0.71 percent in 2010, after having declined in three of the previous five years.

401(k) Investors’ Average Mutual Fund Expense Ratios

Percent, 2008–2010

Note: The 401(k) average expense ratio is measured as a 401(k) asset-weighted average. The total expense ratio, which is reported as a percentage of fund assets, includes fund operating expenses and the 12b-1 fee. Sources: Investment Company Institute and Lipper

The asset-weighted average expense ratio paid by 401(k) investors on their bond funds remained unchanged at 0.56 percent in 2010, after having declined in four of the previous five years. The asset-weighted average expense ratio paid by 401(k) investors on their money market funds fell 9 basis points to 0.28 percent in 2010. This significant decline was attributable in large part to the effects of the low interest rate environment and the consequent fee waivers by many money market fund providers.

401(k) Investors Gravitate to Mutual Funds with Lower Expense Ratios, No-Load Funds

401(k) investors in mutual funds tend to hold lower-cost funds with below-average portfolio turnover. Eighty-two percent of mutual fund assets in 401(k) plans were held in stock funds at year-end 2010, and more than three-quarters of such stock fund assets were invested in funds with an expense ratio of less than 1 percent.

Another cost consideration for mutual fund investors is whether a fund has a “load,” or sales charge. Eighty-one percent of 401(k) assets held in mutual funds were in “no-load funds”—funds that do not have a sales charge. The remainder of mutual fund assets held in 401(k) plans was invested in load funds, but such funds typically waive their loads for retirement plan participants. Thus, for most 401(k) investors, the cost of owning mutual funds in their plans derives solely from the funds’ expense ratios.

“401(k) plan sponsors are aware of the costs associated with fund ownership, regularly evaluate investment options in their plans, and are seeking and getting good value in mutual funds,” said Sarah Holden, Senior Director of Retirement and Investor Research. “The drop in the average expense ratio incurred by 401(k) investors in stock mutual funds reflects cost-conscious decisionmaking by plan sponsors and plan participants, as well as the impact of rising stock values in 2010, which helped to spread fixed fund expenses across a larger asset base.”

The study details the many services that 401(k) plan sponsors receive, along with the complexities, regulations, and related costs of offering a plan. Plan fiduciaries who oversee the plan must ensure that costs for plan services are reasonable, and employers and employees generally share the costs of operating 401(k) plans. As with any employee benefit, the employer typically determines how the costs will be shared.

For related research on mutual fund fees, see Trends in the Fees and Expenses of Mutual Funds, 2010, which reports industry trends.