ICI Viewpoints

U.S. and European Fund Investors Continue to Take Long View on EM Economies

In an ICI Global Research Perspective last year, we showed that U.S. and European registered funds held $1.7 trillion in emerging market (EM) stocks and bonds at the end of 2014 (this total counts Hong Kong, Singapore, South Korea, and Taiwan as emerging markets). Of that, $1.27 trillion was estimated to be in equities and $431 billion was in bonds. We also showed that this $1.7 trillion was spread widely, across 80 different EM countries, and that fund net purchases of EM securities explained little of the variability of capital flow to EM countries.

This ICI Viewpoints updates our analysis through 2015, demonstrating that though EM countries experienced large net capital outflows in 2015, those outflows were driven primarily by entities other than registered funds.

The Economic and Financial Backdrop for 2015

Economic growth in emerging markets slowed considerably in 2015, falling to 4.0 percent. According to the International Monetary Fund (IMF), this growth was the slowest pace since 2009. Not surprisingly, EM equity and bond prices fell sharply. In 2015, returns on U.S. registered funds that invest primarily in EM equities (EM equity funds) were -13.9 percent, while U.S. registered funds that invest primarily in EM bond funds (EM bond funds) posted returns of -5.7 percent.

Reflecting these developments, ICI data show that in 2015, U.S. registered EM equity and bond funds recorded outflows of $6 billion and $11 billion, respectively. To put these outflows in context, it is helpful to consider a wider range of registered funds, other geographic markets, and other global financial market participants.

U.S. and European Registered Fund Holdings of EM Securities Still Dominated by Equity

At the end of 2015, U.S. and European registered funds held $1.5 trillion in EM equities and bonds (see Figure 1). This $1.5 trillion includes the holdings of registered EM funds, as well as the holdings of registered funds that invest in both emerging and developed markets. The bulk of that—$1.08 trillion (72 percent)—was in equities. The remainder, $414 billion (28 percent), was in bonds.

Figure 1: U.S. and European Regulated Fund Holdings of Emerging Market Securities

By selected country of holding, December 31, 2015

|

Total holdings |

Equity holdings |

|

Bond holdings |

||||||

| Country | Millions | Millions | Percent | Millions | Percent | ||||

| China | $287,040.4 | $269,884.4 | 24.91 | % | $17,156.0 | 4.14 | % | ||

| India | 135,064.0 | 126,357.1 | 11.66 | 8,706.9 | 2.10 |

|

|||

| South Korea | 121,462.8 | 106,660.5 | 9.84 | 14,802.4 | 3.57 |

|

|||

| Hong Kong | 91,768.6 | 85,724.7 | 7.91 | 6,043.9 | 1.46 |

|

|||

| Taiwan, Province of China | 85,639.1 | 85,311.6 | 7.87 | 327.5 | 0.08 |

|

|||

| Mexico | 80,877.6 | 33,685.2 | 3.11 | 47,192.4 | 11.39 |

|

|||

| Brazil | 74,879.6 | 47,747.3 | 4.41 | 27,132.3 | 6.55 |

|

|||

| Russia | 55,939.9 | 35,327.4 | 3.26 | 20,612.5 | 4.98 |

|

|||

| South Africa | 53,149.3 | 40,380.6 | 3.73 | 12,768.8 | 3.08 |

|

|||

| Indonesia | 44,802.7 | 21,147.3 | 1.95 | 23,655.4 | 5.71 |

|

|||

| Other Europe | 44,571.3 | 24,600.3 | 2.27 | 19,971.0 | 4.82 |

|

|||

| Poland | 36,992.0 | 9,819.0 | 0.91 | 27,173.0 | 6.56 |

|

|||

| Singapore | 35,360.7 | 32,047.2 | 2.96 | 3,313.5 | 0.80 |

|

|||

| Israel | 30,158.3 | 27,571.9 | 2.54 | 2,586.5 | 0.62 |

|

|||

| Turkey | 28,924.4 | 14,081.8 | 1.30 | 14,842.6 | 3.58 |

|

|||

| Malaysia | 26,324.9 | 12,412.9 | 1.15 | 13,912.0 | 3.36 |

|

|||

| Thailand | 26,180.5 | 20,493.2 | 1.89 | 5,687.3 | 1.37 |

|

|||

| Philippines | 19,653.4 | 13,099.8 | 1.21 | 6,553.6 | 1.58 |

|

|||

| Chile | 15,881.1 | 9,389.2 | 0.87 | 6,491.9 | 1.57 |

|

|||

| Hungary | 15,835.7 | 4,713.4 | 0.44 | 11,122.3 | 2.69 |

|

|||

| Colombia | 14,380.6 | 2,509.1 | 0.23 | 11,871.5 | 2.87 |

|

|||

| Argentina | 12,728.2 | 7,407.3 | 0.68 | 5,320.9 | 1.28 |

|

|||

| Peru | 12,207.0 | 2,761.9 | 0.25 | 9,445.1 | 2.28 |

|

|||

| All other EM countries | 147,206.4 | 49,733.2 | 4.59 | 97,473.2 | 23.54 |

|

|||

| Total | 1,497,685.0 | 1,083,522.6 | 100.00 | 414,162.5 | 100.00 |

|

|||

Note: Equity and bond holdings may not add to the total because of rounding. Countries listed represent those with total holdings greater than $10 billion. This table includes the newly industrialized countries of Hong Kong, Singapore, South Korea, and Taiwan for illustrative purposes.

Source: EPFR Global

The estimated holdings of U.S. and European registered funds in EM stocks and bonds fell by $206 billion in 2015. Almost three-quarters of this drop was attributable to the sharp decline in emerging market equity prices.

Registered Funds Sold a Relatively Small Amount of EM Equities in 2015

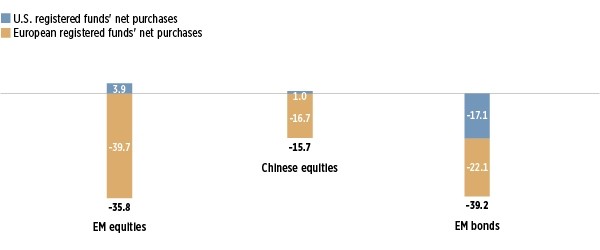

Estimates indicate that U.S. and European registered funds sold modest amounts of EM equities in 2015—just under $36 billion on net (see Figure 2). That amounted to just 2.9 percent of their holdings of EM equities at the end of 2014.

Figure 2: U.S. and European Funds’ Net Purchases of Emerging Market Securities

Funds’ net purchases of emerging market securities, billions of dollars, 2015

Note: Data include mutual funds and exchange-traded funds (ETFs). The -$35.8 billion in net purchases of EM equities includes net purchases of Chinese equities.

Source: EPFR Global

Funds’ sales of EM equities were influenced by economic and financial developments in China. Chinese stock markets varied widely during 2015, rising 60 percent in dollar terms from the end of 2014 to June 12, 2015. Over the remainder of 2015, however, the Chinese stock market declined sharply. Overall, in 2015 the Chinese stock market advanced just 5 percent in dollar terms. Of the $36 billion in EM equities that U.S. and European registered funds sold in 2015, about half ($16 billion) reflected sales of Chinese equities.

Interestingly, in 2015, despite the downturn in emerging equity markets, U.S. registered funds on net added to their holdings of emerging market equities—$4 billion on net—including $1 billion in net purchases of Chinese equities.

In 2015, U.S. and European registered funds on net sold an estimated $39 billion of EM bonds, equaling 9.2 percent of those funds’ holdings of EM bonds at the end of 2014. In dollar terms, these sales were fairly evenly split between U.S. ($17 billion) and European ($22 billion) registered funds.

Putting Registered Funds’ Net Sales into Context

In total, U.S. and European registered funds sold $75 billion in EM equities and bonds in 2015. How significant was that for emerging market economies?

One way to judge is to compare these sales to the total capital flowing across the borders of emerging economies. According to a recent Institute of International Finance (IIF) report, EM economies experienced net capital outflows totaling $735 billion in 2015 (this includes foreign direct investment flows, banking flows, and portfolio flows). At most, U.S. and European registered funds accounted for 10 percent of those outflows ($75 billion/$735 billion)—an amount that would be even smaller if, as is likely, registered funds sold some of the $75 billion in emerging market securities to market participants in other developed countries.

In other words, the large capital outflows that emerging market countries experienced in 2015 were driven overwhelmingly by market participants other than registered funds in the United States and Europe.

The IIF suggests that the vast majority of the $735 billion in capital outflow from emerging markets was related to China—in large measure reflecting the efforts by Chinese corporations to pay down U.S. dollar–denominated bank debt, to avoid the prospect of further appreciation in the U.S. dollar.

Chris Plantier is a senior economist in ICI’s Research Department.