ICI Viewpoints

Revised Fed Data Show Mutual Funds’ Share of Corporate Bond Market Is Small and Stable

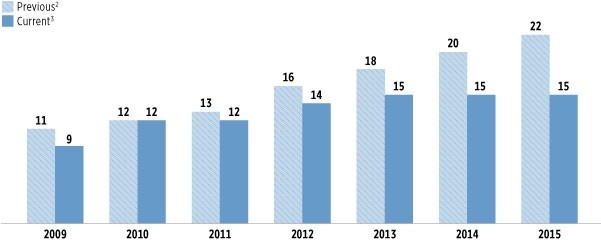

Discussions among regulators and the financial press about the role of bond mutual funds in financial stability risks have been fueled by concerns about the size and apparent growth in bond funds’ participation in corporate bond markets. But what if that role and its growth have been largely overstated?

New data published by the Federal Reserve show that, in fact, bond mutual funds’ share of the corporate bond market is much smaller than previously reported—and that, rather than growing rapidly, the share of corporate bonds held by these funds has been essentially flat since 2012.

Revised Data Show Mutual Funds’ Share of Corporate Bond Market1 Fairly Constant

Percent; year-end, 2009–2015

1 Bonds issued by domestic corporations and foreign bonds held by U.S. residents.

2 Calculated from Table L.213 (line 34/line 1, expressed as percent) in the Flow of Funds Accounts, Z.1 Financial Accounts of the United States, published by the Federal Reserve Board in March 2016.

3 Calculated from Table L.213 (line 34/line 1, expressed as percent) in the Flow of Funds Accounts, Z.1 Financial Accounts of the United States, published by the Federal Reserve Board in June 2016.

Previously reported data have been used to support the hypotheses that bond mutual funds pose systemic risks. For example, in its recent Update on the Review of Asset Management Product and Activities, the Financial Stability Oversight Council (FSOC) repeated its contention that bond mutual funds could be subject to destabilizing “runs” that would harm broader markets and the financial system. Further, FSOC said, “the magnitude of these potential risks, and hence both the likelihood and impact of any forced selling by mutual funds on broader markets, likely increases as mutual funds’ overall market share of less-liquid assets increases.”

The report goes on to note that, based on data published in the Flow of Funds Accounts by the Federal Reserve Board, mutual funds’ share of the US corporate bond market (i.e., domestic corporate bonds and foreign bonds held by US residents) doubled to 22 percent over the six-year period ending 2015 (shown in the figure above as the light blue bars).

ICI has demonstrated repeatedly that investors in long-term mutual funds, including those in bond funds, don’t “run.” And the Fed’s latest data revision shows both that bond mutual funds are a minor player in the corporate bond market—bond mutual funds’ share of the market rose from 9 percent in 2009 to 15 percent in 2015—and that their share has been basically flat since 2012 (shown in the figure above as the darker blue bars).

What happened? Government agencies are always seeking to improve the quality of the data they report. Recently, the Fed revised its approach for valuing corporate bonds held by mutual funds, to bring it more in line with international standards. During this revision process, the Fed addressed the fact that its Flow of Funds Accounts were substantially overstating mutual funds’ corporate bond holdings. One primary reason was that bond funds often hold bonds to maturity but the statistical process wasn’t removing bonds that had matured and thus were no longer on mutual funds’ books.

As a result, the Fed revised down mutual funds’ holdings of corporate and foreign bonds in the Flow of Funds Accounts over the period of 1991 to 2015, with the largest revisions occurring in the past five years. For example, for year-end 2015, mutual fund holdings of corporate and foreign bonds were revised down by $855 billion, from $2.6 trillion (the figure published in March 2016) to $1.7 trillion (the figure published in June 2016). The Fed's improved approach brings the Flow of Funds figures in line with the actual market value of the bonds that funds hold.

This revision dramatically alters the picture for mutual funds’ share of the corporate bond market. Regulators reviewing risks in bond mutual funds should take note.

Shelly Antoniewicz is the Deputy Chief Economist at ICI.