ICI Viewpoints

More Unfounded Speculation on Bond ETFs and Financial Stability

A recent column in the Financial Times warns of “another accident in waiting” in the growth of fixed-income exchange-traded funds (ETFs)—described as “financial alchemy” that converts illiquid bonds into “baskets” that “trade moment to moment on the stock exchanges.” This “illusory” ETF liquidity will disappear, the author warns, when investors “want to move en masse, and quickly, when the going gets less good.”

There they go again. The column commits at least three fundamental errors.

First, the FT column’s central premise is this statement: “No investment vehicle should promise greater liquidity than is afforded by its underlying assets.”

Yet a 30-year Treasury bond promises greater liquidity than a claim on $10,000 of Uncle Sam’s assets that can’t be redeemed until 2045. A share of Citigroup stock promises greater liquidity than a 1-in-3 billion ownership stake in Citi’s loan portfolio. A pork belly future certainly promises much greater liquidity than 40,000 pounds of bacon—not to mention fewer shipping hassles and refrigeration challenges.

Since long before Wall Street traders gathered in 1792 under a buttonwood tree, financial markets have been creating instruments precisely because they promise greater liquidity than their underlying assets. ETFs may be relatively new—but that doesn’t make their function any different.

Second, the Financial Times ignores the major source of activity in ETFs. It’s not the underlying markets—it’s the secondary market where ETF shares trade.

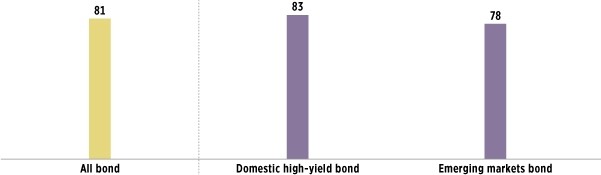

Our research shows that most activity in bond ETFs occurs on the secondary market—ETF investors trading ETF shares with one another—rather than on the primary market, where underlying securities are used to create and redeem ETF shares. For bond ETFs, on average, more than three-quarters of the daily trading activity occurs on the secondary market (see the figure below).

Even for narrow asset classes, such as domestic high-yield bond ETFs or emerging markets bond ETFs, the bulk of the activity is in the secondary market. Investors involved in many of these ETF secondary market trades generally are not motivated by arbitrage (i.e., the desire to exploit differences between the market price of the ETF and its underlying value). These investors do not interact with the ETF directly and do not create transactions in the underlying bond market because they only exchange ETF shares.

Most Bond ETF Activity Is in the Secondary Market

Percentage of secondary market activity relative to total activity;* daily, January 3, 2013–June 30, 2014

* Total activity is the sum of primary and secondary market activity.

Sources: Investment Company Institute and Bloomberg

What would happen to ETF investors if the underlying bond market locked up? ETF shares could still trade in the secondary market. Indeed, bond ETFs probably would provide price discovery for the underlying market. Investors could continue to express their opinions about what those bonds might be worth by trading the bond ETFs.

Finally, the columnist’s claim that ETF investors will “move en masse, and quickly, when the going gets less good” was tested during the summer of 2013—and disproven. During that summer, bond prices moved sharply downward as the Federal Reserve indicated it might begin to curtail its massive bond-buying program. From May to July 2013, the nominal interest rate on the 10-year Treasury bond rose 90 basis points.

As our research has shown, bond ETF shares were not redeemed to the funds en masse, and secondary market liquidity in bond ETFs did not disappear. In fact, in terms of dollar value traded, there was more demand for liquidity by sellers and more liquidity available from buyers during that period. Even narrower asset classes, such as domestic high-yield and emerging markets bond ETFs, had ample liquidity in the secondary market during the summer of 2013.

Data like these—based on actual market experience—seem to be overlooked by many participants in the debate over financial stability. Fund investors deserve better than unfounded speculation and hypothetical scare stories.

Shelly Antoniewicz is the Deputy Chief Economist at ICI.

Mike McNamee is ICI's chief public communications officer.