ICI Viewpoints

The Real Lessons to Be Learned from 1994’s Bond Market

A recent “Heard on the Street” column in the Wall Street Journal (“Heeding 1994's Bond-Market Lesson,” July 27, 2014) is correct in saying that there’s a lesson to be learned from the 1994 bond market—but it draws the wrong lesson. It’s simply incorrect to state that bond funds and their investors make the market more vulnerable to shocks.

The data show that mutual fund investors do not panic or redeem heavily, even in periods of market turmoil—and 1994 is a prime example. In March, the month with the heaviest outflows in that turbulent year, the number of funds with negative outflows increased only slightly.

Similarly, in October 2008—by which time bond mutual funds had taken a larger share of the bond market—very few funds had outflows of more than 5 percent of their assets.

And in the most recent bond market disruption—from May to August 2013, when long-term bond interest rates spiked by more than 1 percentage point—the cumulative outflow from bond mutual funds totaled less than 3 percent of assets. Notably, the outflows from bond funds followed—and did not precede—declines in bond returns.

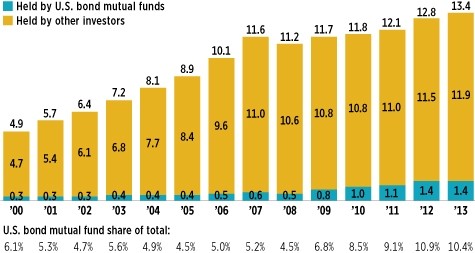

Yes, bond mutual fund holdings of the U.S. corporate debt market have increased since 2000. A more careful calculation, however, shows that their share of U.S. corporate debt is closer to 11 percent than to the Journal’s figure of 19.4 percent. Investment grade bond funds—which the Journal counts as composed solely of corporate bonds—actually contain Treasury and government agency bonds as well. When the calculation is properly limited to corporate bonds, funds’ share of the market falls by more than one-third from the Journal’s figure.

U.S. Bond Mutual Funds Hold a Small Share of Outstanding Corporate Bonds*

Trillions of dollars; year-end, 2000–2013

View a larger version, including data from 1994–2013

*Includes foreign bonds held by U.S. residents.

Source: Investment Company Institute and Federal Reserve Board

In either case, the growth of bond funds has been driven substantially by the demographics of aging retirement savers, reinforcing the notion that bond fund investors represent “patient money.” These investors are holding bonds for the same reason that pension funds hold bonds—because they want fixed-income assets, usually for the longer term.

In the face of adversity, mutual funds—including bond mutual funds—have proven resilient time and time again. The data provide compelling evidence of this, and the character of the tens of millions of bond fund investors—individuals focused on retirement and other long-term goals—bear this evidence out. That’s a good lesson for us all.

Brian Reid was Chief Economist of the Investment Company Institute.