ICI Viewpoints

Featured Chart: 401(k) Participants Hold Lower-Cost Mutual Funds

One key takeaway from ICI’s recent paper, The Economics of Providing 401(k) Plans: Services, Fees, and Expenses, 2012, is that 401(k) investors in mutual funds tend to hold lower-cost funds with below-average portfolio turnover.

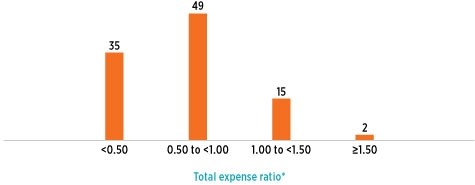

Consider equity funds, in which one-third of 401(k) plan assets are invested. Eighty-four percent of 401(k) plan equity fund assets were invested in mutual funds with expense ratios less than 1.00 percent (or $1.00 for every $100 in assets) at year-end 2012. Indeed, 35 percent of 401(k) equity fund assets were in mutual funds with expense ratios less than 0.50 percent.

401(k) Equity Mutual Fund Assets Are Concentrated in Lower-Cost Funds

Percentage of 401(k) equity mutual fund assets, 2012

* The total expense ratio, which is reported as a percentage of fund assets, includes fund operating expenses and the 12b-1 fee.

Note: Figures exclude mutual funds available as investment choices in variable annuities. Components do not add to 100 percent because of rounding.

Sources: Investment Company Institute and Lipper

What are the factors that contribute to 401(k) investors holding funds with relatively low average expense ratios?

- Competition: Both inside and outside the 401(k) plan market, mutual funds compete among themselves and with other financial products to offer shareholders service and performance.

- Price-sensitive investors: Shareholders are sensitive to the fees and expenses that funds charge. Indeed, assets tend to be concentrated in lower-cost funds, providing a market incentive for funds to offer their services at competitive prices.

- Price-sensitive plan sponsors: In the 401(k) plan market, performance- and cost-conscious plan sponsors also impose market discipline. Plan sponsors regularly evaluate the performance and fees of the plans’ investments.

The full paper has many more insights into the services and costs of 401(k) plans. For more retirement-related research, please visit the Research section of our website, as well as our 401(k) Resource Center.

Sarah Holden is the Senior Director of Retirement and Investor Research at ICI.