ICI Viewpoints

ICI Research Shows That Commodity Mutual Funds Are Not Driving Commodity Markets

Investors benefit greatly from funds that provide investors exposure to a broad basket of commodities—from energy to precious metals to agricultural products. These investments offer valuable portfolio diversification, because commodities prices historically have not been strongly correlated with stock or bond returns. And as raw materials for the goods that businesses and consumers buy, commodities offer investors an opportunity to protect themselves from inflation.

Despite these benefits, we’ve seen a few political leaders seeking to blame rising oil prices on mutual fund investors. They charge that investors’ expanded use of commodity investing—through relatively new products such as commodity mutual funds—is responsible for rising and volatile prices. They attack such funds as “speculators.”

These critics are wrong on the facts, and, as a new ICI research report shows, wrong on the economics. I had the opportunity today to discuss this new research in my remarks before ICI’s General Membership Meeting.

In the report, ICI Senior Economist Chris Plantier reviews how careful studies by a range of academics have demonstrated that the so-called financialization of commodities markets is not driving price developments in individual markets. Nor is it increasing volatility.

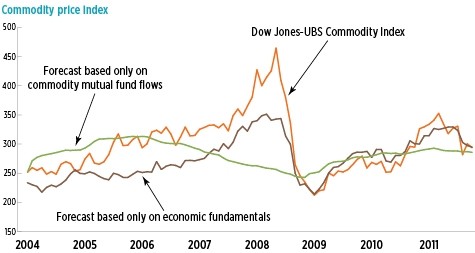

Chris’s paper also looks specifically at the impact of investment flows into commodity mutual funds on commodity prices. As Chris explained in his Viewpoints post last month, and as you can see in the figure below, there is no impact.

Forecasts: Economic Fundamentals Versus Commodity Mutual Fund Flows

Monthly, 2004–2011*

*Data and dynamic forecasts are from February 2004 to November 2011.

Note: The correlation coefficient between the Dow Jones-UBS Commodity Index and the forecast based on economic fundamentals is 0.80. It is -0.05 for the forecast based on flows.

Source: Bloomberg

The blue line on this chart illustrates the Dow Jones-UBS Commodity Index from 2004 through 2011. Note the elevated price levels prior to the financial crisis, the drop during the recession, and the price recovery since—just what you would expect if commodity prices were driven by economic fundamentals.

In fact, that’s what’s going on. Our paper uses statistical techniques to predict how the value of the U.S. dollar and growth in emerging markets would affect commodities prices. As you can see by the red dotted line, those two economic factors alone explain most of the change in commodities prices. And this doesn’t even include other fundamental factors—such as crop failures, political uncertainties in the Middle East, or inflation fears.

Chris’s study also considers whether flows into commodity mutual funds could explain commodity prices. What’s clear from this figure is that those flows don’t explain much. There’s scarcely any connection between flows to commodity mutual funds and prices in commodity markets. And that’s not surprising—how much impact could $48 billion in commodity mutual fund assets have on markets where trillions of dollars worth of goods and derivatives are exchanged?

Sadly, we don’t expect facts and evidence to persuade all of the critics. There’s too much political payoff in finding scapegoats for high prices of gasoline and other commodities.

Two things, however, are certain. Commodity mutual funds are not driving commodity markets. And penalizing those funds unjustly will only hurt millions of average American investors.

Paul Schott Stevens was President and CEO of ICI.