ICI Viewpoints

Do U.S. Banks Rely Heavily on Money Market Funds? No.

Money market funds provide important short-term funding for the U.S. economy: these funds hold a total of $2.5 trillion in Treasury and agency securities, repurchase agreements, and other financial instruments.

In part, money market funds provide funding to the U.S. economy indirectly by providing funding to banks, both those domiciled in the U.S. and in Europe. These banks in turn may make loans to borrowers who need dollars.

The extent to which money market funds provide funding to banks has become a key topic in the debate about money market funds and systemic risks to the financial system. Experts have offered widely varying estimates on this issue, based on different approaches. In this post, we’ll take a closer look at two approaches, focusing on U.S. banks.

Approach #1: Money Market Funds Represent 22 Percent of U.S. Bank Short-Term, Wholesale Funding

Some observers estimate that money market funds represent a substantial source of U.S. bank funding—on the order of 25 percent.

In June 2012, the Senate Committee on Banking, Housing, and Urban Affairs held a hearing, “Perspectives on Money Market Mutual Fund Reforms.” Witnesses included regulators, state and private sector treasurers, industry representatives, and academics.

One of those witnesses was David S. Scharfstein, Professor of Finance and Banking at the Harvard Business School. In his testimony, Professor Scharfstein states that “A rough estimate is that prime [money market funds] provide about 25 percent” of short-term, wholesale funding for large global banks. Professor Scharfstein specified in a footnote that “short-term wholesale funding” was measured as the sum of “uninsured domestic deposits + primary dealer [repurchase agreements]+ financial [commercial paper].”

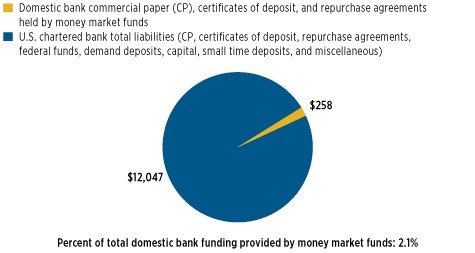

ICI estimates money market funds held $258 billion in U.S. bank instruments (i.e., domestic bank commercial paper, large certificates of deposit, and repurchase agreements) in June 2012. This represents a 22 percent share of U.S. banks’ short-term wholesale funding, which is close to Professor’s Scharfstein’s figure.

Money Market Funds’ Share of U.S. Chartered Bank Liabilities

Billions of dollars

Sources: Investment Company Institute tabulation of SEC Form N-MFP data (June 2012) and Federal Reserve Board

Approach #2: Money Market Funds Represent Less than 3 Percent of Total U.S. Bank Funding

It is unclear, however, that the first approach can meaningfully add to the debate about money market funds and systemic risks to the financial system. The reason is that U.S. banks are not particularly dependent on wholesale dollar funding. U.S. banks obtain funding in a number of other important ways, notably from a large base of retail deposits. Broadening U.S. banks’ funding base to include all of their liabilities—commercial paper, certificates of deposit, repurchase agreements, federal funds, demand deposits, capital, small time and savings accounts, and other miscellaneous liabilities—we calculate that money market funds contributed just 2.1 percent to U.S. banks’ total funding. In other words, money market funds’ holdings of bank instruments made up 2.1 percent of banks’ total liabilities. For banks with assets exceeding $10 billion, this ratio is 2.4 percent.

Money Market Funds’ Share of U.S. Chartered Bank Liabilities

Billions of dollars

Sources: Investment Company Institute tabulation of SEC Form N-MFP data (June) and Federal Reserve Board

Europe: Greater Reliance, But Not Close to 25 Percent

What about European banks? The situation isn’t directly parallel to the United States. Unlike U.S. banks, European banks do not have a large base of U.S.-based retail depositors they can rely upon for dollar funding. Accordingly, the ratings agency Fitch has presented evidence indicating that European banks rely more heavily on U.S. prime money market funds than do U.S. banks.

However, it is difficult to argue that U.S. prime money market funds are a key source of funding for European banks. Fitch reports that money market funds typically provide less than 5 percent of the total funding of European banks, a point buttressed in a recent paper by Professor Scharfstein and co-authors. That report, a Federal Reserve Board working paper, indicates that money market funding ratios for European banks are much less than 10 percent (see Table 3 on page 39).

Money market funds did provide more than $900 billion in short-term dollar financing to foreign banks in June 2012—a considerable amount, but only a small percentage of the total size of foreign banks. This funding supports lending that benefits the U.S. economy. For example, more than half of the primary dealers in U.S. Treasury debt auctions are foreign banks, many of which rely on money market fund financing to help them purchase U.S. government debt. Moreover, large global banks—including European ones—play a vital role in financing U.S. exports, traditionally a key priority for the U.S. government. Global banks also help in providing and structuring financing for U.S. state and local governments. It is worth keeping these benefits in mind when discussing the impact of further money market fund reforms.

For more on money market funds, please visit ICI’s Money Market Funds Resource Center.

Sean Collins is Chief Economist at ICI.

Chris Plantier is a senior economist in ICI’s Research Department.