ICI Viewpoints

Featured Chart: Americans Say Retirement Saving Incentives Should Be a National Priority

Stresses on the U.S. government budget have resulted in a reexamination of national priorities with respect to taxes and government spending. Against that backdrop, our survey of 3,000 U.S. households for our recent research report—America’s Commitment to Retirement Security: Investor Attitudes and Action—contained a new question. Households were asked: “Do you agree that continuing to provide incentives to encourage retirement saving should be a national priority?”

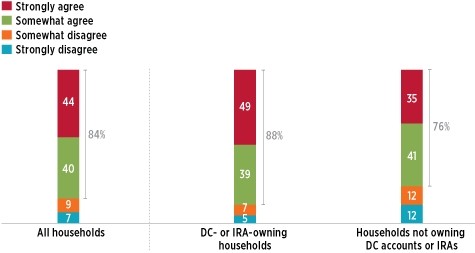

The response was clear. Eighty-four percent of U.S. households agreed that continuing these incentives should be a national priority. Agreement was higher (88 percent) among households owning defined contribution (DC) accounts or individual retirement accounts (IRAs), but more than three-quarters of households without such retirement accounts agreed. Here’s how the survey numbers break down.

A Majority of Households Agree That Incentives for Retirement Savings Should Be a National Priority

Percentage of U.S. households by ownership status, fall 2011

Note: The sample is 2,968 households, of which 1,869 owned DC accounts or IRAs and 1,099 did not.

Source: ICI tabulation of GfK OmniTel survey data (November and December 2011)

In response to other questions, 85 percent of all U.S. households disagreed with the idea of eliminating the tax advantages of DC accounts, and 83 percent opposed any reduction in workers’ account contribution limits.

Households also indicated they appreciate many other features of DC plan savings, in addition to the tax incentives. A vast majority of households with DC accounts indicated that their plan offers a good lineup of investment options and that payroll deduction made it easier to save. Results from our recent survey of DC plan recordkeepers confirm this commitment to saving: in the first three quarters of 2011 only 2.2 percent of DC plan participants stopped contributing to their plans.

You can find the full report, along with other studies and related materials, at our 401(k) Resource Center.

Sarah Holden is the Senior Director of Retirement and Investor Research at ICI.