ICI Viewpoints

America’s Fiscal Challenge

Friends and colleagues sometimes ask me, “What keeps you awake at night?” In recent months, it’s the nightmarish level of debt that the federal government is accruing.

Put all politics aside: it is impossible to deny that Americans face an acute problem of budgetary overreach. Even before the financial crisis, our position as the world’s leading economy made us forgetful of basic principles of fiscal discipline—particularly the notion of balancing spending and revenues over the course of an economic cycle.

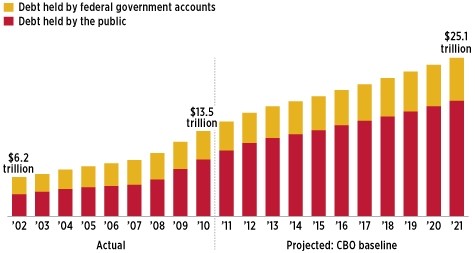

The financial crisis, recession, and slow recovery have set our budgets on a course toward disaster. Our federal budget deficit has topped $1.3 trillion in each of the last two years—and prospects for improvement are slim. While policymakers have managed to avert a government shutdown with a budgetary agreement for the current fiscal year, the long-term challenge remains. Even under the optimistic “baseline” projected by the Congressional Budget Office (CBO), continuing deficits will contribute to a near doubling of the federal debt outstanding over the next decade—from less than $14 trillion in 2010 to $25 trillion in 2021. Alternative CBO forecasts with more realistic assumptions put the budget far more deeply into the red—adding trillions of dollars to the national debt.

Federal Debt Outstanding Projected to Nearly Double

Federal government debt outstanding, trillions of dollars, 2002–2021

Source: Congressional Budget Office, “The Budget and Economic Outlook,” January 2011

And we still face the imminent retirement of the Baby Boom generation, whose oldest members are just now turning 65. The burden of providing for the income and health needs of retirees, now and in the future, has created a huge unfunded liability for America.

What are the consequences of this burden of debt? Under the most hopeful CBO forecast, interest alone on the national debt will reach about $800 billion in 2021. Put another way, $30 out of every $100 paid in individual income taxes will go just to servicing the debt. And these projections assume that global financial markets will continue to absorb a rapidly growing supply of U.S. Treasury securities. More likely, the growing debt burden and the growing risk of default—whether outright or through inflation—will diminish markets’ appetite to finance America’s debt. In turn, the government’s borrowing costs will rise, driving up deficits and accelerating the growth of debt.

Now, as the late economist Herbert Stein was fond of saying, “If something cannot go on forever, it won’t.” And in the wake of the election, Washington seems willing at least to discuss applying the brakes to slow our spending spree. Much of the attention has been focused on partisan battles over relatively minor spending cuts in the current fiscal year’s budget. But we have also seen the unveiling of serious, substantial plans designed to reduce the federal budget deficit and curb the trajectory of public debt.

We have much at stake in the success of these efforts. The debt spiral could lead to a crisis or to a prolonged period of stagnation. In either case, the climate for long-term investing, and the interests of the millions of fund investors we serve, will be seriously undermined.

One reform plan was issued by the National Commission on Fiscal Responsibility and Reform, cochaired by former Clinton chief of staff Erskine Bowles and former Republican Senator Alan Simpson. Bowles and Simpson will appear on May 6 at ICI’s General Membership Meeting to discuss their proposals and the prospects for serious reform of our country’s budget and tax policies. ICI is pleased to help advance this vital national debate. As Simpson and Bowles bluntly observe, “America cannot be great if we go broke.”

Paul Schott Stevens was President and CEO of ICI.