ICI Viewpoints

Money Market Funds’ Prudent Response to European Challenges

The ongoing debt crisis in the eurozone poses challenges for portfolio managers of U.S. prime money market funds, as those managers actively continue to adjust their holdings to meet new developments. The latest monthly data on money market funds’ holdings demonstrate that these funds are carefully managing their risks in Europe, and have been gradually reducing eurozone holdings for some time now.

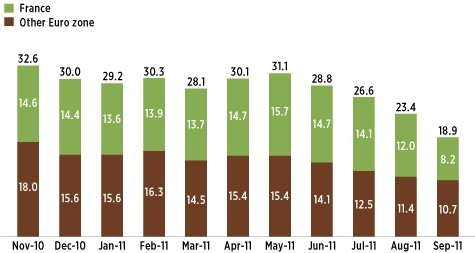

New data show that U.S. prime money market funds reduced their exposure to issuers in the eurozone—the 17 countries that use the euro as their currency—by $54 billion in September. As a result, securities of eurozone issuers accounted for 18.9 percent of total assets of U.S. prime money market funds at the end of September, down from 23.4 percent in August and 26.6 percent in July. As the chart shows, eurozone holdings’ share of money market fund portfolios began to decline steadily this summer as credit concerns increased, after remaining fairly stable for several months.

U.S. Prime Money Market Funds’ Holdings of Eurozone Issuers

Percent of prime funds’ total assets, end of month

Note: Data exclude prime money market funds not registered under the Securities Act of 1933.

Sources: Investment Company Institute tabulation of publicly available Form N-MFP data prior to May 2011; ICI tabulation of data provided by Crane Data thereafter

But these prudent moves, intended to maintain minimal credit risk in money market funds’ portfolios, have opened up a new—and contradictory—complaint: that U.S. money market funds are contributing to the European crisis because their pullback is squeezing banks’ funding. For example, Eric Rosengren, President of the Federal Reserve Bank of Boston, in a recent speech, expressed concerns about U.S. money market funds’ role in “dollar shortages.” And The Economist wrote last week that “American money-market funds have almost completely withdrawn dollar funding from European banks over the past few months.”

However, the data certainly do not bear out the notion that money market funds have withdrawn all funding from European banks (see table below). And the gradual nature of the reduction suggests that any “shortages” more likely reflect the unwillingness of some European banks to pay higher rates or to offer shorter-term paper as credit concerns mounted. The lack of demand for three-month dollar funds at the tender by the European Central Bank (ECB) this week indicates that eurozone banks are finding other ways to meet their short-term needs for U.S. dollar funding. More generally, U.S. money market funds were just a small part of a months-long, market-wide withdrawal from deteriorating financial conditions and rising credit concerns for eurozone sovereigns and banks.

Prime Money Market Funds’ Holdings by Home Country of Issuer

September 30, 2011

| Country | Billions of dollars | Percentage of total assets |

| World Total | $1,302.2 | 100% |

| Europe | 531.2 | 40.8 |

| Eurozone | 245.6 | 18.9 |

| France | 106.7 | 8.2 |

| Germany | 68.8 | 5.3 |

| Netherlands | 58.6 | 4.5 |

| Belgium | 7.6 | 0.6 |

| Austria | 2.3 | 0.2 |

| Spain | 1.1 | 0.1 |

| Luxembourg | 0.5 | 0.0 |

| Non-eurozone | 285.7 | 21.9 |

| UK | 125.6 | 9.6 |

| Sweden | 68.9 | 5.3 |

| Switzerland | 63.9 | 4.9 |

| Norway | 22.9 | 1.8 |

| Denmark | 4.4 | 0.3 |

| Americas | 562.8 | 43.2 |

| United States | 435.9 | 33.5 |

| Canada | 126.6 | 9.7 |

| Chile | 0.3 | 0.0 |

| Asia and Pacific | 197.6 | 15.2 |

| Australia/New Zealand | 103.5 | 7.9 |

| Japan | 93.6 | 7.2 |

| India | 0.5 | 0.0 |

| Korea | 0.0 | 0.0 |

| Supranational | 0.5 | 0.0 |

| Unclassified | 10.0 | 0.8 |

Source: Investment Company Institute tabulation of data provided by Crane Data

By design and regulation, U.S. money market funds cannot be a source of long-term funding for European banks or any other issuers. Instead, fund managers are required to invest in high quality, short-term U.S. dollar securities, with an average portfolio maturity of 60 days or less. Managers have a fiduciary duty to manage risks on behalf of their shareholders. Their actions with respect to their eurozone exposures over the past two years have reflected that fiduciary duty.

Let’s look in turn at how funds are managing these risks and how that is affecting Europe’s banks.

Steadily Reducing European Exposures

U.S. money market funds’ reduction in overall eurozone holdings in September was not a sudden move: they have working down their exposure to eurozone risks for more than a year. ICI surveys show that U.S. money market funds have held no public or private debt from Portugal or Greece since May 2010, and that these funds eliminated any holdings issued by Irish financial institutions earlier this year. Since last winter, money market funds have gradually reduced their exposure to Italian and Spanish banks. Based on Crane data, holdings of Italian and Spanish securities were reduced to zero and $1.1 billion, respectively, by the end of September.

The data show that funds are also limiting their risks by shortening the maturity of the European securities they hold, focusing their lending on securities that mature in 30 days or less. According to Crane Data, as of the end of September, 60 percent of U.S. prime money market funds’ holdings of French issuers will mature in 30 days or less, compared to 37 percent of their holdings at the end of June. Similar but smaller moves were seen in Germany and the UK. Shortening maturities reduces funds’ risks, because shorter-dated paper can be redeemed sooner if the issuer’s financial condition worsens. Also, shorter maturities help money market fund managers prepare for potential redemptions by fund investors.

These funds’ reduced European holdings are driven in part by their own declining assets. Assets in prime money market funds fell $182 billion from May to September, as fund investors redeemed shares during the period spanning the downgrade of U.S. government debt as well as growing concerns about Europe’s finances. When money fund investors redeem shares, fund portfolio managers must shed assets to meet those redemptions. In this case, fund managers chose to reduce their eurozone holdings.

This response makes sense given the deteriorating financial conditions in the eurozone. Premiums on credit default swaps for top European banks, which measure the market’s assessment of the probability of default, widened markedly in August. And on September 14, Moody’s Investors Service lowered the long-term debt and deposit ratings on two large French banks—Crédit Agricole and Société Générale. To be sure, Moody’s recently reaffirmed the short-term credit ratings—the ratings that apply to the securities money funds hold—of those French banks and a third, BNP Paribas. But money market fund managers are required to look beyond credit ratings in making their determination that securities in their portfolios pose minimal credit risks.

The Impact on European Banks

These prudent moves to reduce money market fund shareholders’ risks have raised concerns in some circles that U.S. money market funds could exacerbate the European banking crisis by squeezing the banks’ dollar-denominated funding. But this argument would suggest that investors should not react to evolving credit conditions in the market.

Not surprisingly, money market funds’ actions reflect a market-wide reassessment of European risks. Press reports indicate that hedge funds, U.S. banks, and certain sovereign wealth funds have been quietly reducing their exposures in Europe or have been unwilling to engage in derivatives transactions with certain European issuers. Also, banks within Europe have apparently become increasingly unwilling to lend to one another, as evidenced by a widening in the three-month Euribor-Overnight Index Swap spread, which compares the rate on three-month interbank loans in euros to the ECB’s expected overnight policy rate. Banks have also substantially increased their deposits at the ECB.

The significant increase in European banks’ borrowing from the ECB this summer—especially by Italian and Spanish banks—dwarfed the pullback by U.S. money market funds. From June to August, gross bank borrowing from the ECB in Spain and Italy increased by more than $100 billion—vastly outstripping the $19 billion reduction in money market funds’ lending to these banks over the same period. The ECB’s recent interventions in the Italian and Spanish government bond market further suggest that the withdrawal from Italy and Spain involved far more lenders than just U.S. money market funds.

Summing Up

Money market fund managers, faced with a fiduciary duty to manage risks on behalf of their shareholders and a deteriorating financial situation in Europe, have prudently reduced the amount and shortened the average maturity of their holdings of securities issued by European governments, banks, and other issuers. In doing so, funds are part of an ongoing market-wide reassessment of the current risks of investing in Europe.

Sean Collins is Chief Economist at ICI.

Chris Plantier is a senior economist in ICI’s Research Department.