ICI Viewpoints

What’s in a Name, Redux: For Bond Mutual Funds, “Corporate” Matters

Policymakers around the globe are studying the turmoil in March 2020 related to the COVID-19 pandemic to determine what happened and why. Similar work is being done by academics and other analysts. Bond mutual funds have been one area of focus, and policymakers will be considering the data to assess whether structural reforms might be warranted.

But as policymakers do so, it is critical that they view the data on regulated funds through a lens of deep institutional knowledge. Otherwise, false assumptions, misinterpretations of data, or misunderstanding of institutional details could lead to policy recommendations that risk altering the fundamental structure of bond mutual funds to the detriment of millions of US households. Indeed, misinterpretations are already apparent. Gaps in understanding how regulated funds operate are adding to a flawed narrative about what happened last March—and are distorting analysis of the corporate and Treasury bond markets.

Investment Grade Bond Funds Are Not “Investment Grade Corporate Bond Funds”

A powerful example of this is policymakers’ continuing misunderstanding about the term investment grade bond fund versus investment grade corporate bond fund. This is not semantics: the one-word difference—corporate—is key to a clear understanding of funds’ experiences last March.

Leading up to March 2020, some observers had expressed concerns that “investment grade corporate bond mutual funds” could pose risks to financial stability. Commentators worried that assets in funds of this type had grown substantially in the past few years, and that investors in these funds might redeem heavily during a financial crisis. If so, the narrative proceeded, such funds might be forced to dump corporate bonds into the market at fire-sale prices, potentially amplifying the crisis.[1]

But as we explained in a January 2019 ICI Viewpoints post, these concerns were exaggerated because analysts were confusing and conflating the terms investment grade corporate bond fund and investment grade bond fund.[2] As our 2019 clarification noted, the one-word difference is important.

Investment grade corporate bond mutual funds, as the name suggests, would likely hold the bulk of their assets in investment grade corporate bonds. By contrast, investment grade bond funds—the actual category of funds that ICI tracks—would typically hold investment grade corporate bonds, but could also hold a very large percentage of their assets in Treasury and agency bonds, which are also investment grade.

Academics and others were not careful about this distinction. They mislabeled the assets in investment grade bond mutual funds, which totaled nearly $2 trillion at that time, as being assets in “investment grade corporate bond funds.” This mislabeling invited policymakers to infer that such funds held nearly $2 trillion in corporate bonds, which was not the case. In fact, such funds held just $550 billion in corporate bonds.

Investment Grade Bond Funds and Investment Grade Corporate Bond Funds: Still Not the Same

Despite ICI’s 2019 clarification, since March 2020, some observers have continued to make the same error, confusing and conflating investment grade corporate bond funds and investment grade bond funds. This distinction is an important predicate for understanding how various types of bond mutual funds manage their liquidity, a topic some policymakers—such as the Financial Stability Board—will be studying in coming months.[3]

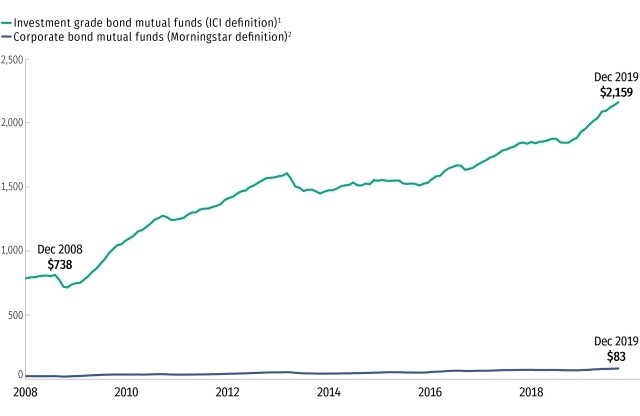

A range of oft-cited papers about funds’ experiences during the COVID-19 turmoil evince this confusion.[4] For example, one report dated October 1, 2020, states that “net assets of long-term mutual funds that invest primarily in corporate bonds have risen substantially since 2008: investment grade corporate bond mutual funds rose to $2.159 billion in 2019 from $738 billion in 2008” and that “one contributor to the dysfunction was the very substantial redemptions in investment grade corporate bond mutual funds in March” [emphasis added].[5]

This is misleading. The asset levels cited by the report are sourced from ICI. Our data, however, do not include an investment grade corporate bond fund category. As Figure 1 shows, the asset levels are in fact for ICI’s investment grade bond funds category—a label that doesn’t include the modifier corporate. Morningstar does report assets for a category called “corporate bond,” which captures funds that invest primarily in investment grade corporate bonds. The total assets in funds within this Morningstar category are very small, however, totaling just $83 billion in December 2019, just before the onset of the COVID-19 financial market turmoil.

Figure 1

Investment Grade Bond Funds and Corporate Bond Funds: Not the Same

Billions of dollars, monthly

1 ICI defines investment grade bond mutual funds as funds seeking current income by investing at least two-thirds of their assets in investment grade debt, which includes holdings of Treasury and agency debt.

2 Morningstar’s corporate bond mutual fund category is defined by those funds holding “corporate bond portfolios [that] concentrate on investment grade bonds issued by corporations in US dollars, which tend to have more credit risk than government or agency-backed bonds. These portfolios hold more than 65 percent of their assets in corporate debt, less than 40 percent of their assets in non-US debt, less than 35 percent in below investment grade debt.” Morningstar’s category excludes funds elsewhere categorized as high-yield bond mutual funds or bank loan mutual funds.

Source: Investment Company Institute and Morningstar

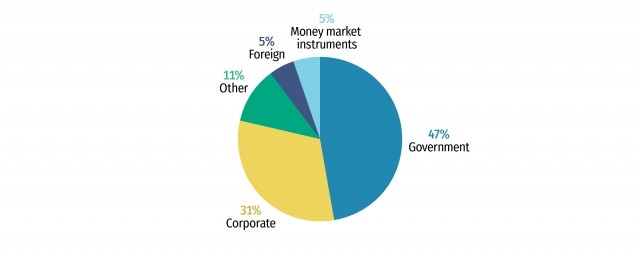

Although funds in ICI’s investment grade bond fund category do hold corporate bonds, they hold considerably more of their assets in government bonds or, in other words, in Treasury and agency bonds.[6] For example, as of December 2019, these funds held nearly half of their $2,159 billion of assets in government bonds, and just 31 percent in corporate bonds (Figure 2). Of the remaining 22 percent of their assets, 5 percent were in foreign securities (e.g., foreign sovereign bonds), 5 percent in money market instruments (e.g., bank deposits, Treasury bills, commercial paper), and 11 percent in other instruments (e.g., variable rate demand notes).

Figure 2

Portfolio Composition of Investment Grade Bond Mutual Funds

Percentage of funds’ assets, December 2019

Source: Investment Company Institute

This distinction is critical to understanding the experiences of investment grade bond mutual funds. These funds saw redemptions in March 2020 and, in part, met the redemptions by selling Treasury bonds. Some have argued that this development is novel and surprising.[7] On the contrary, given that these funds hold nearly half of their assets in Treasury and agency securities, it is quite natural that they would have sold Treasuries to help meet redemptions.

This is just one example of how important it is for policymakers and analysts to view the data on regulated funds through a lens of deep institutional knowledge. Otherwise, false assumptions or misinterpretations of institutional details of funds could lead to policy proposals that risk fundamentally altering the structure of bond mutual funds to the detriment of millions of US households.

Other Posts in This Series

[1] See, for example, Federal Reserve Board, Financial Stability Report, November 2018.

[2] See Sean Collins, “Corporate and Investment Grade Bond Funds: What’s in a Name?” ICI Viewpoints, January 4, 2019.

[3] See Financial Stability Board, Holistic Review of the March Market Turmoil, November 17, 2020: page 3.

[4] See, for example, Annette Vissing-Jorgensen, “Bond Markets in Spring 2020 and the Response of the Federal Reserve,” working paper, University of California Berkeley and NBER, August 26, 2020, suggesting that outflows “from bond mutual funds, especially investment grade corporate [emphasis added] bond funds contributed to both Treasury and corporate market price pressure,” but later discussing outflows from “riskier bond funds, especially investment grade funds (ICI data)” [note absence of the term corporate]. See also Federal Reserve Board, Financial Stability Review, May 2020, page 53; and J. Nellie Liang, “Corporate Bond Market Dysfunction During COVID-1 and Lessons from the Fed’s Response,” Hutchins Center Working Paper 69, October 2020.

[5] Liang 2020, pages 2–3.

[6] ICI defines investment grade bond mutual funds as funds that seek current income by investing primarily in investment grade debt securities. These funds could invest up to two-thirds of their assets in Treasury and agency bonds (ICI classifies mutual funds with more than two-thirds of their assets in government securities as government bond mutual funds).

[7] See, for example, Yiming Ma, Kairong Xiao, and Yao Zeng, “Mutual Fund Liquidity Transformation and Reverse Flight to Liquidity,” December 8, 2020, who argue, “In meeting redemption requests, bond funds followed a pecking order of liquidation by first selling their most liquid assets before illiquid ones. This is why the pronounced outflows [from bond mutual funds] generated concentrated selling pressure in traditionally liquid asset markets”—in other words, in the Treasury market.

Sean Collins is Chief Economist at ICI.