ICI Viewpoints

Talkin’ ’Bout the Generations: ICI Research on Mutual Fund Ownership by Generation

Talk about the differences between generations is a hot topic in today’s cultural conversation. And the Millennial and Baby Boomer generations are in the middle of a little generational warfare. But when it comes to owning mutual funds, are there really that many differences between the generations? What types of funds do people from each generation own? And what types of accounts do they hold?

ICI research can tell us a lot about ownership of mutual funds by different generations. In “Profile of Mutual Fund Shareholders, 2019,” ICI examines the results of our Annual Mutual Fund Shareholder Tracking Survey, which gathers information on the demographic and financial characteristics of mutual fund–owning households in the United States. This comprehensive study, most recently conducted in the summer of 2019, gives us a close look at mutual fund ownership across generations.

What types of funds do the different generations hold?

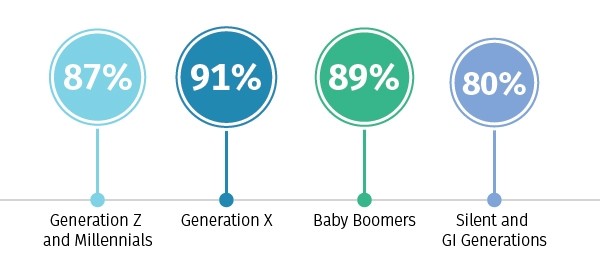

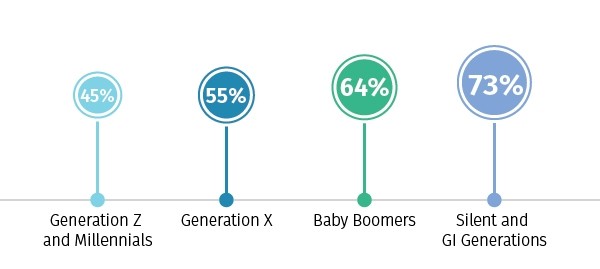

Equity Mutual Funds Most Popular in All Generations

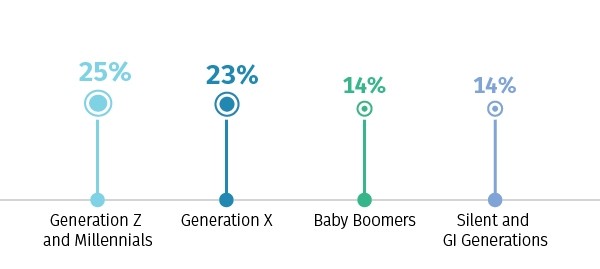

Regardless of the type of account mutual funds are held in, equity mutual funds remained the most frequently owned type across the generations of mutual fund–owning households. Ownership of money market funds tended to be higher, the older the generation.

Equity fund ownership

Money market fund ownership

What kinds of accounts do the different generations have?

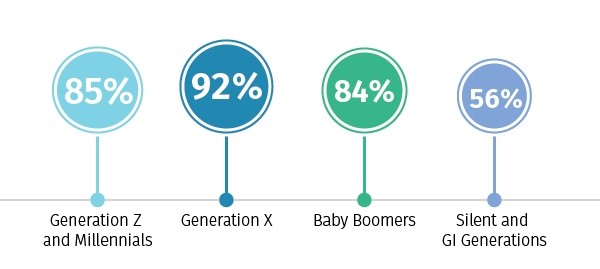

Tax-Advantaged Retirement and Education Accounts Are Popular Across Generations

Mutual fund–owning households often have tax-advantaged savings vehicles such as defined contribution (DC) retirement plan accounts, individual retirement accounts (IRAs), or education-targeted savings accounts.

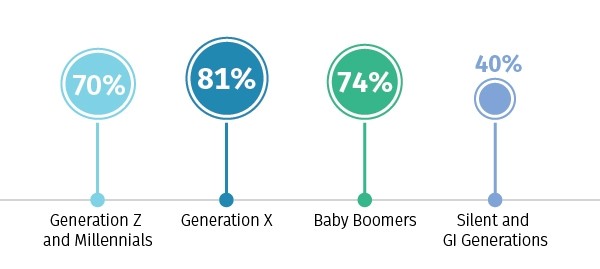

Defined contribution plan ownership

Overall, more than eight in 10 mutual fund–owning households have DC retirement accounts in 2019. Broken down by generation, we’ve found that ownership of DC retirement plan accounts is highest among households in their working and saving years.

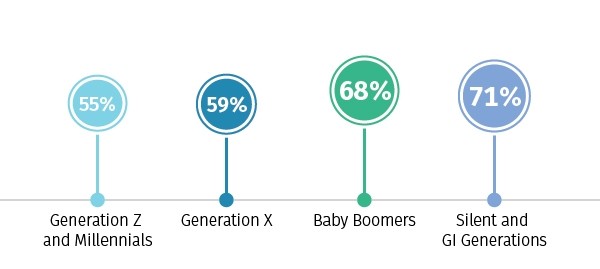

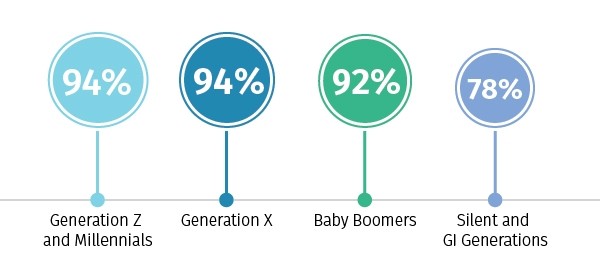

Individual retirement account ownership

More than six in 10 mutual fund–owning households have traditional IRAs or Roth IRAs, on average, but IRA ownership tends to be higher among older generations.

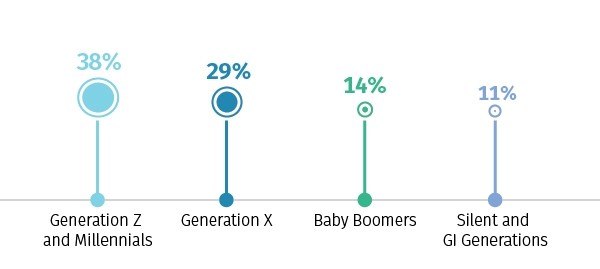

Education-targeted savings ownership

Overall, one-fifth of mutual fund–owning households own Coverdell Education Savings Accounts, 529 prepaid tuition, or 529 college savings plans in 2019. Ownership of education-targeted savings program accounts tends to be higher among younger generations.

What is the primary goal of saving across generations?

Majority of Mutual Fund Investors of All Generations Are Focused on Retirement Saving

Mutual fund–owning households across all generations indicate saving for retirement is one of their financial goals. When asked about their financial goals, retirement was the most common goal selected, and was the most likely to be chosen as their primary financial goal. Younger generations are more likely to indicate that saving for education is a financial goal.

Retirement as the primary goal

Retirement as a goal

Education as a goal

If you’d like to learn more about this topic, explore the full paper—“Profile of Mutual Fund Shareholders, 2019.” Some of the findings from this survey are also summarized in “Ownership of Mutual Funds, Shareholder Sentiment, and Use of the Internet, 2019” and “Characteristics of Mutual Fund Investors, 2019.” For more information on who invests in mutual funds and why, check out this video.

Michael Bogdan is an Associate Economist at ICI.

Candice Gullett is an editor at ICI.