ICI Viewpoints

Five Key Points on 401(k) Plan Fees from ICI Research

Thanks to innovation and a competitive market, 401(k) mutual fund fees keep falling. ICI has a window into this information through our study of the cost of providing 401(k)s, in which we take a close look at the expenses and fees of mutual funds incurred by 401(k) plan investors, and in related research on fund fees through a collaborative research effort between ICI and BrightScope.

The reports found that:

401(k) plan participants investing in mutual funds tend to hold lower-cost funds than mutual fund investors as a whole. Reasons for this include: (1) some plan sponsors choose to cover a portion of 401(k) plan costs, allowing them to select lower-cost funds or fund share classes; (2) both plan sponsors and plan participants make cost- and performance-conscious decisions; and (3) professional financial advisers tend to play a more limited role in these plans.

Expense ratios that 401(k) plan participants incur for investing in mutual funds have declined substantially since 2000. Continued competition among mutual funds—both inside and outside the 401(k) plan market—places downward pressure on the expense ratios of the mutual funds in 401(k) plans. Additionally, economies of scale also contribute to this downward trend in expense ratios. There are fixed costs associated with offering a 401(k) plan that are often paid for, at least in part, through expense ratios on the plan’s investment options. With larger plans, these fixed costs can be spread over more participants and a larger asset base, allowing plan sponsors to select lower-cost investments.

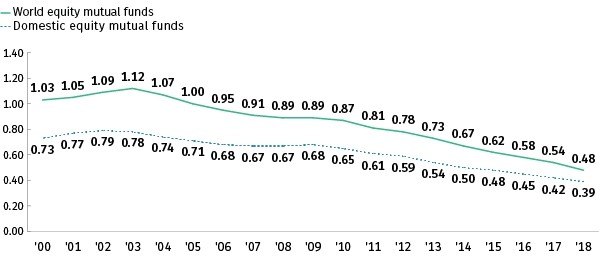

This long-term downward trend is shown for equity, bond, and hybrid mutual funds, but it persists when, for example, equity mutual funds are separated into domestic and world equity mutual funds. Figure 1 shows the average expense ratios incurred by 401(k) plan investors on their domestic and world equity mutual funds. At year-end 2018, the average domestic equity mutual fund expense ratio incurred by 401(k) investors was 0.39 percent, about half its level of 0.73 percent in 2000. Similarly, the average world equity mutual fund expense ratio incurred by 401(k) investors was 0.48 percent at year-end 2018, less than half the 1.03 percent in 2000.

Expense ratios vary by investment objective. (See Figure 1.) Expense ratios tend to be higher for funds that invest in equities around the world because such funds tend to cost more to manage—information may be less readily available for certain countries (and therefore managers spend more time doing research) or access to certain markets may be difficult (or costly) to obtain. (For more information, see “Trends in the Expenses and Fees of Funds, 2018.”)

Figure 1: Domestic and World Equity Mutual Fund Average Expense Ratios Incurred by 401(k) Investors

401(k) asset-weighted average expense ratio, percent

Sources: Investment Company Institute, Lipper, and Morningstar

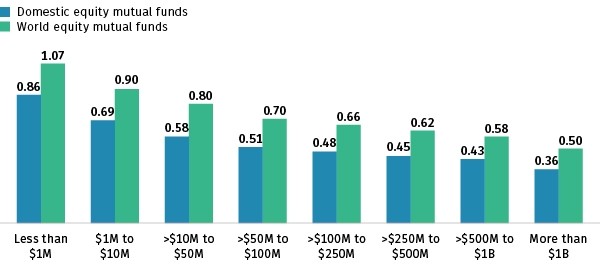

Not only do average expense ratios incurred by 401(k) plan investors differ by investment objective, they also differ by the size of the 401(k) plan itself. BrightScope and ICI’s collaborative report analyzing plan-level data of large 401(k) plans found that as the size of the plan increases, average expense ratios of mutual funds tend to fall. For example, the asset-weighted average expense ratio for domestic equity mutual funds held in 401(k) plans, which was 0.86 percent in plans with less than $1 million in plan assets in 2016, steadily falls to 0.36 percent in plans with more than $1 billion (Figure 2). Similarly, the asset-weighted average expense ratio for world equity mutual funds held in 401(k) plans, which was 1.07 percent in plans with less than $1 million in plan assets, decreases to 0.50 percent in plans with more than $1 billion.

Figure 2: Average Expense Ratios of Mutual Funds Tend to Fall as 401(k) Plan Size Increases

Asset-weighted average expense ratio as a percentage of plan assets, 2016

Note: For information about the sample of 401(k) plans presented, see Exhibit 4.5 in The BrightScope/ICI Defined Contribution Plan Profile: A Close Look at 401(k) Plans, 2016.

Source: BrightScope Defined Contribution Plan Database

For More Information

ICI closely studies the mutual fund and retirement markets, including trends in mutual fund expenses and fees (industrywide, in 401(k) plans, and in IRAs) and trends in employer matches and employee investment choices. ICI also has a wealth of information on American mutual fund–owning households, such as what they consider when selecting mutual funds.

Also, follow us on social media—Twitter, Facebook, and LinkedIn—to receive information about top news stories on the industry, notices of ICI releases, and stories on retirement.

James Duvall is an Economist at ICI.

Steven Bass is an Economist at ICI.