ICI Viewpoints

Traditional and Roth IRAs Offer Choice and Flexibility

Individual Retirement Accounts Offer a Variety of Ways to Save

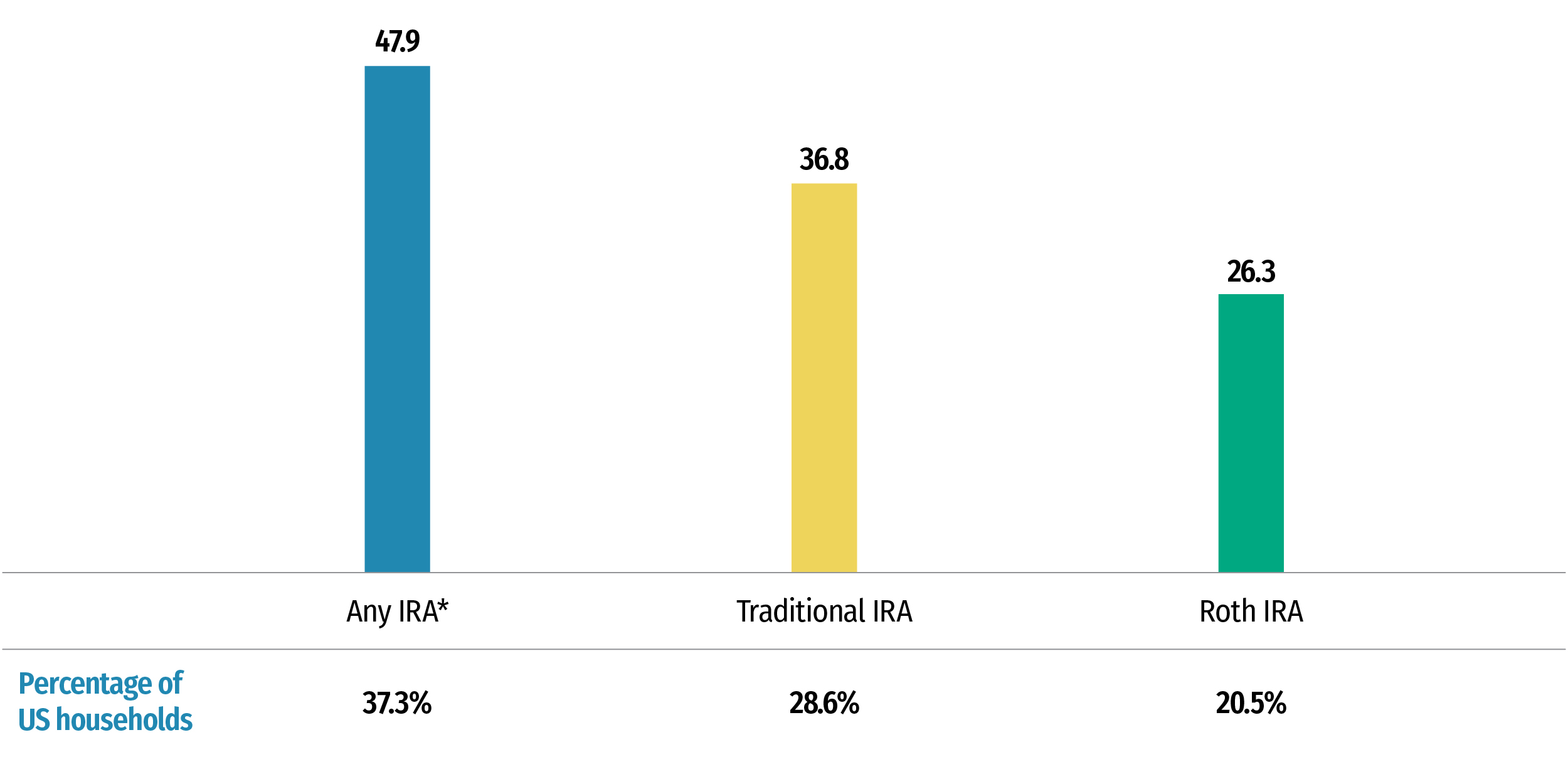

With $12.2 trillion in assets, individual retirement accounts (IRAs) represent more than one-third of total US retirement market assets and more than one-tenth of all US household financial assets. In mid-2020, 47.9 million US households, or 37.3 percent, owned IRAs (Figure 1).

- Traditional IRAs are the oldest and most common type of IRA. Accounting for 84 percent of all IRA assets, traditional IRAs are a key component of the US retirement system. Traditional IRAs were created by Congress to provide a contributory retirement savings vehicle (originally for individuals not covered by retirement plans at work) and as a place to roll over accumulations from employer-sponsored retirement plans. In mid-2020, 36.8 million US households, or 28.6 percent, owned traditional IRAs.

- Roth IRAs, which were first available in 1998, are the second most frequently owned type of IRA, held by 26.3 million US households, or 20.5 percent. Roth IRAs account for about 10 percent of all IRA assets. Congress created Roth IRAs to provide a contributory retirement savings vehicle on an after-tax (nondeductible) basis with qualified withdrawals distributed tax-free. Individuals may also invest in Roth IRAs through conversions—in a conversion, taxes are paid on assets in a non-Roth IRA that move into a Roth IRA.

Figure 1

Millions of US Households Own IRAs

*Households may own more than one type of IRA, including employer-sponsored IRAs.

Sources: Investment Company Institute Annual Mutual Fund Shareholder Tracking Survey and US Census Bureau; see “The Role of IRAs in US Households' Saving for Retirement, 2020,” ICI Research Perspective

US Households Fund Their Traditional and Roth IRAs in Different Ways

IRAs are typically opened with either contributions or rollovers.

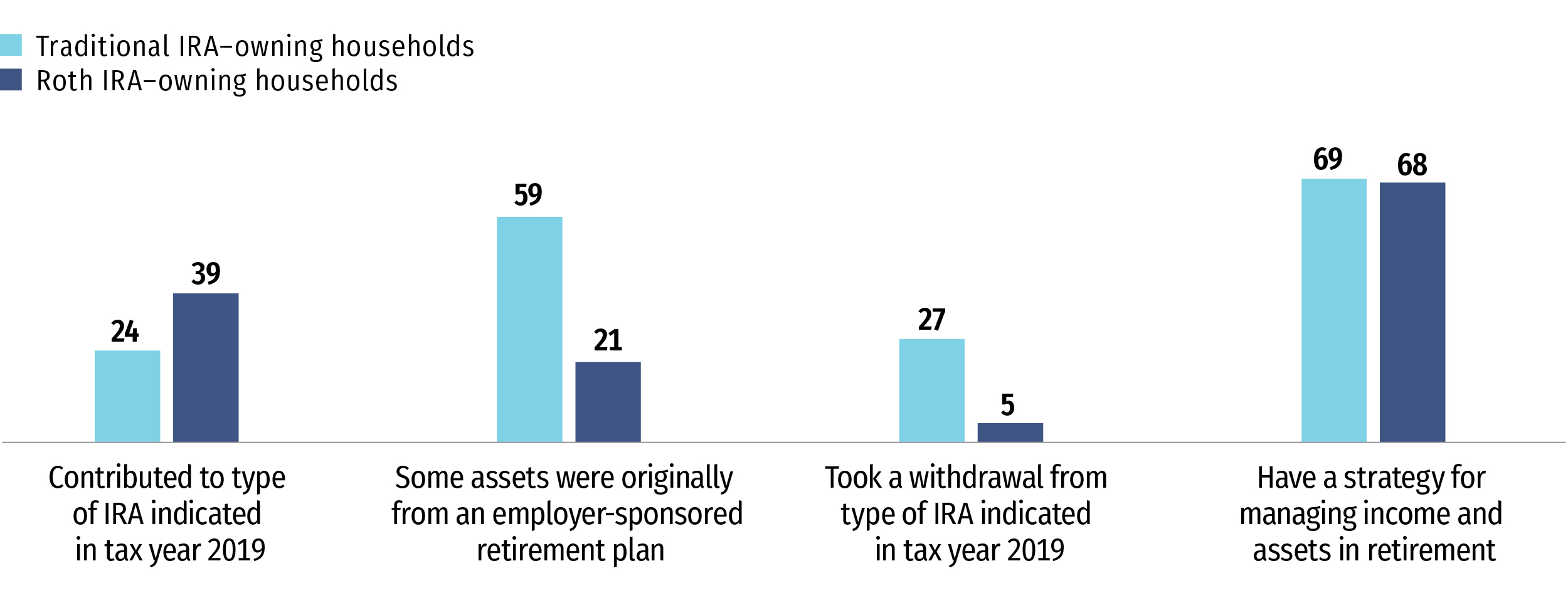

- Contributions. Results from a nationally representative survey of US households that own traditional or Roth IRAs show that Roth IRA owners were more likely than traditional IRA owners to have made contributions. Thirty-nine percent of households owning Roth IRAs in mid-2020 made contributions in tax year 2019, compared with 24 percent of households owning traditional IRAs (Figure 2).

- Rollovers. With the proliferation of retirement accumulations that can be rolled over, whether from defined contribution (DC) accounts or as lump-sum distributions from defined benefit (DB) plans, many households that own traditional IRAs have rollovers from employer-sponsored retirement plans. Rollover activity, which helps many Americans preserve their retirement savings, has fueled recent IRA growth. IRS Statistics of Income data show rollovers of $517 billion from employer-sponsored (DC or DB) retirement plans to traditional IRAs in 2018. In mid-2020, about 22 million US households (or 59 percent of all US households owning traditional IRAs) reported that their traditional IRAs included rollover assets. By contrast, rollovers play a less important role in Roth IRAs. IRS Statistics of Income data indicate rollovers of about $13 billion into Roth IRAs in 2018, and only 21 percent of Roth IRA–owning households in mid-2020 report that their Roth IRAs contain amounts originating from employer-sponsored retirement plans.

Figure 2

Activities of US Households Owning IRAs

Percentage of IRA-owning households by type of IRA, 2020

Note: Households may own more than one type of IRA, including employer-sponsored IRAs.

Source: Investment Company Institute IRA Owners Survey; see “The Role of IRAs in US Households' Saving for Retirement, 2020,” ICI Research Perspective

IRAs Provide Access to a Wide Variety of Investments, Including Mutual Funds

Whether opened with rollovers or contributions, whether traditional or Roth, IRAs offer investors access to a world of investing. Earnings and capital gains on investments held in IRAs compound tax-free while in the accounts. IRAs can be opened through investment professionals—such as financial advisers, full-service brokerages, or insurance company representatives—or directly through mutual fund companies or discount brokers.

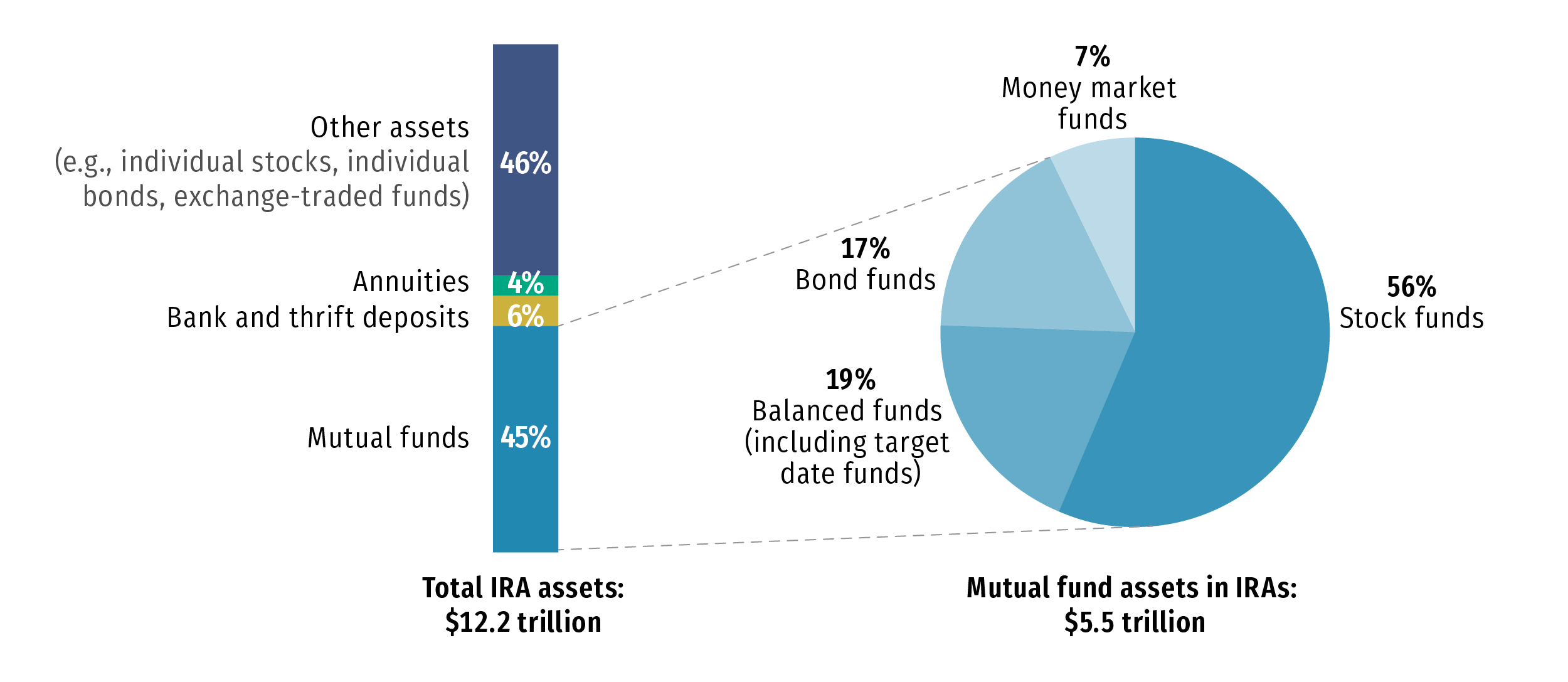

- Investments. Most IRA investors choose to hold stocks in their IRA portfolios, and many access the stock markets through mutual funds or exchange-traded funds (ETFs). Indeed, mutual funds were 45 percent of IRA assets at year-end 2020, with stock mutual funds representing 56 percent of those mutual fund holdings and balanced funds (which invest in stocks and bonds) another 19 percent (Figure 3).

Figure 3

More Than $12 Trillion Held in IRAs

Percentage of total, year-end 2020

Note: Components do not add to the total because of rounding.

Sources: Investment Company Institute and Federal Reserve Board; see “The US Retirement Market, Fourth Quarter 2020”

Rules Drive Different Patterns of Withdrawal Activity

Few households withdraw money from their IRAs in any given year, and most withdrawals are retirement related. Early withdrawals from either traditional or Roth IRAs typically face a 10 percent tax penalty on the taxable amount, and traditional IRA withdrawals typically are counted in taxable income. Older traditional IRA owners (previously aged 70½ or older, recently changed to aged 72 or older) are required to withdraw an annual amount based on life expectancy or pay a penalty for failing to do so; these withdrawals are called required minimum distributions (RMDs).

- Withdrawals. In tax year 2019, 27 percent of households owning traditional IRAs in mid-2020 reported taking withdrawals from their traditional IRAs (Figure 2), typically to fulfill RMDs. Indeed, 76 percent of households owning traditional IRAs in mid-2020 and taking withdrawals in tax year 2019 calculated their withdrawal amount based on the RMD. In contrast to traditional IRAs, Roth IRAs are not subject to RMDs during the lifetime of the original Roth IRA owner. As a result, withdrawal activity is much lower among Roth IRA investors. Only 5 percent of households owning Roth IRAs in mid-2020 reported taking withdrawals from these IRAs in tax year 2019.

Planning Ahead Is Important to Both Traditional and Roth IRA–Owning Households

Regardless of the type of IRA owned, more than two-thirds of IRA-owning households reported having a strategy for managing income and assets in retirement. In mid-2020, 69 percent of traditional IRA–owning households and 68 percent of Roth IRA–owning households said they have a strategy for managing income and assets in retirement (Figure 2). These households typically seek advice when building their retirement income and asset management strategy, usually from a professional financial adviser. IRA-owning households with a strategy for managing their income and assets in retirement reported that their strategy had multiple components, the most common being reviewing asset allocation, determining retirement expenses, and developing a retirement income plan.

Sarah Holden is the Senior Director of Retirement and Investor Research at ICI.

Daniel Schrass is an Economist at ICI.