FT Future of Asset Management Summit: Strategies for the Next Decade

Closing Remarks

Paul Schott Stevens

President and CEO

Investment Company Institute

17 September 2020

As prepared for delivery.

Thank you, Colby [Smith]. And hello, everyone. I think I can safely speak for all of us here in saying what a terrific program we’ve been able to enjoy today.

Hats off to the folks at the Financial Times for hosting, to my fellow presenters for sharing their insights with us, and of course, to all of you in attendance for your thoughtful contributions to the discussions. It’s an honor to add my voice to the discourse.

The theme of this summit—the future of asset management—is as important as any in global finance today. I am confident that the regulated funds that the Investment Company Institute represents and the millions of investors they serve will play a major role in how this future plays out.

But starting in January—for the first time in more than 16 years—I’ll no longer be directly involved in it. In a few short months, I’ll be retiring from my position as ICI’s president and CEO.

As I was preparing these remarks, I got to thinking more deeply about this.

My tenure leading ICI has spanned more than one-fifth of the history of the US regulated fund industry, which celebrated its 80th anniversary last month. That also happens to be one-fifth of the history of ICI itself, which will turn 80 on October 1st—two weeks from today.

Over these 16-plus years, the asset management industry has seen a whole lot: remarkable growth, continuing innovation, and some stiff challenges. Some perspective on our recent past, as seen from my post at ICI, and what it may mean for our future—these are what I hope to impart in my remarks today.

To begin, I think it would be useful to set the scene, by considering the industry’s prodigious growth over time.

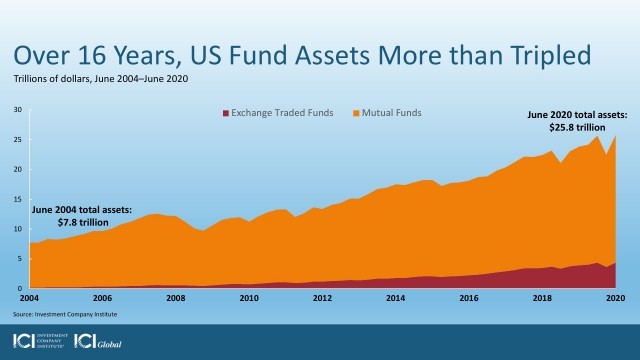

As you can see in this visual, US mutual fund and ETF assets more than tripled—soaring from less than $8 trillion at the end of June 2004 to nearly $26 trillion at the end of this June. That’s good for average growth of almost 8 percent[1] a year.

Funds have made great headway in other markets as well, and regulated funds domiciled outside the United States have been authoring their own growth story.

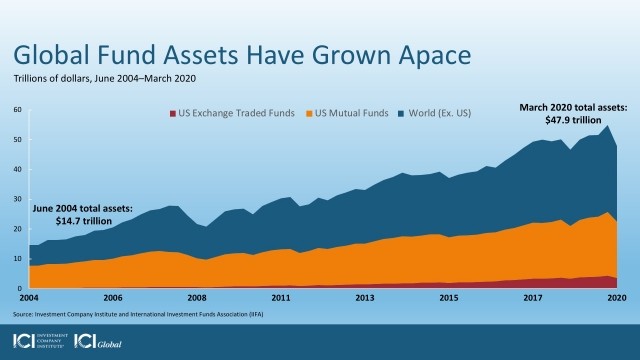

This slide adds non-US fund assets to the picture. And as you can see, the growth of regulated funds outside the US has been equally impressive.

Even at the end of this March—immediately after the sharpest downturn in the history of US equity markets—regulated funds across the globe held nearly $48 trillion. Again, that’s more than triple their assets at the end of June 2004, and almost 8 percent[2] annual growth.

What do these trendlines tell us? Over time, regulated funds have grown to assume an increasingly important role in financial intermediation, and now rank among the most successful aggregators and allocators of capital in the history of modern finance.

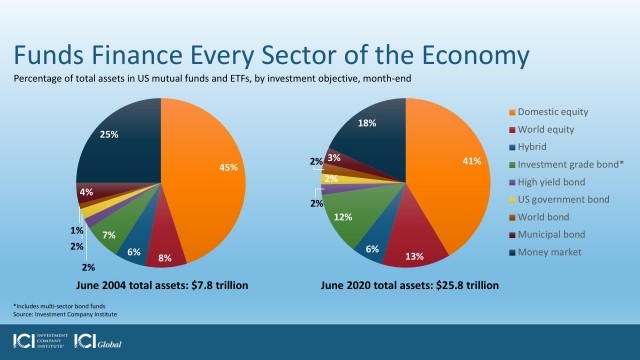

Here’s one more chart for you, showing where US mutual funds and ETFs are channeling that capital. The proportion of assets in each sector has shifted over the years. For example, world equity and investment-grade bond funds have seen the broadest expansion, while money market funds have seen the sharpest contraction.

In whatever way you slice it, though, the story is clear: regulated funds are financing every sector of the economy on an ever-growing scale.

By any standard, the industry has logged a remarkable record just during my time leading ICI. But many of the factors that are driving the industry’s success were around long before my tenure.

Factors like

- the strict regulatory frameworks that protect investors in the United States, Europe, and beyond;

- the sharp scrutiny that an industry of our size and importance receives and should expect; and

- the highly innovative and competitive marketplace in which funds and fund investing has thrived.

These factors help foster and support the confidence of millions of investors—the confidence that underpins all our success.

Now, success at this level—success for this long—doesn’t come without answering a few questions along the way. Indeed, our industry has had to answer far more than a few. But for me, four stand out as the most pivotal.

The first of these questions emerged in the months before I returned to ICI as president and CEO, and addressing it became my top priority immediately upon taking the reins.

This question went to our integrity—and that crucial element of investor confidence. It asked: Would the improper conduct of a few in the industry compromise the reputation of the many?

Some of you will recall that a small number of funds had allowed insider clients to exploit temporary price discrepancies by quickly trading in and out. And that another few had let favored customers trade after the markets closed—usually based on late-breaking news—at the prices prevailing before the close. Certain broker-dealers and hedge funds were implicated as well.

The revelations of these abuses cut deep—not just because of the harm they inflicted on everyday investors, but because they struck at the very heart of the relationship we seek to establish and maintain with all our shareholders.

You see, when investors buy into our funds, they aren’t just asking us to manage their money. They’re counting on us—they’re choosing us among the dozens of competing financial products on the market—to be, if you will, the caretakers of their future. They look to our funds to help them achieve their most important long-term financial goals.

In return for this great trust, we must always maintain a culture deserving of it—a culture that puts investors’ interests above all else, in everything we do.

We have always thought one of ICI’s most important missions is to support and maintain a culture of this kind. That’s why, once the abuses were revealed, ICI supported comprehensive, forceful, and effective government responses—and rallied our members behind them.

Culture and integrity matter. That is not going to change.

The second pivotal question arose in those harrowing days of 2007 and 2008 that so many of us remember all too well. In the wake of the global financial crisis, how would funds and their investors acquit themselves?

The answer here is simple, and the history is remarkably consistent. But we seem to have trouble making many in the policy community focus on the evidence.

As major investors in global markets, regulated funds and their shareholders have a compelling interest in maintaining the stability of the financial system. To be sure, the crisis exposed weaknesses in the financial system, and ICI and its members engaged closely with regulators as they worked to make it stronger, safer, and more resilient.

Many of the regulators leading the response had deep understanding of the banking sector—but little experience with asset management or regulated funds.

Understandably, they approached their work on this banking model—one that fundamentally misapprehends the behavior of funds and their investors.

This misunderstanding was most evident in two related ways: a theory purporting that long-term regulated fund investors panic and “run” in times of market stress, and proposals to impose bank-style regulation to prevent this from happening.

Well, it’s true that banks have seen their fair share of runs. But there is no analog in the modern annals of long-term regulated funds.

ICI looked at the behavior of fund investors during the great financial crisis—the worst market downturn since the Great Depression—and found that they exhibited the same behavior they had in every other bout of major market volatility over the half-century before.

As the markets went south, investors either redeemed modestly or purchased fund shares, just as they tend to do in calmer market environments.

In our many submissions to the US Financial Stability Oversight Council and the multi-national Financial Stability Board, we have explained the many factors that we believe account for this behavior. Most important, perhaps, is what our investors have told us year after year in ICI surveys: they buy fund shares to meet their long-term financial needs, not to take advantage of short-term market trends. And their behavior bears this out.

As I said earlier, given the size and importance of the global fund industry, we should expect close scrutiny from regulators. At the same time, this process should be grounded in data—not speculation. And the policy prescriptions that emerge should be ones truly fit for purpose—not simply copied from the playbook of bank regulators.

Recall from my slide: funds are among the most efficient aggregators and allocators of capital yet devised, and they provide critical funding for economies around the world. Surely we can address stability concerns without putting at risk all the benefits that funds provide to investors and the economy.

In the wake of the pandemic and the events of March 2020, I suspect this debate will be renewed. But it is important that we get it right. It is also important that ICI and its members engage meaningfully in this process into the future.

The third pivotal question also finds us about a decade ago—as fund investing was becoming a global phenomenon, asset managers were expanding into new markets, and regulatory interest in funds was sharpening. Amid all these developments, could ICI step into a new global role on behalf of its members and their investors? This was the challenge our Board made to us in October 2011.

In some ways, of course, funds have focused on global investment opportunities since their inception. Indeed, we date the birth of mutual funds to a trust offered in Holland in the late 18th century, which was created so investors could diversify by buying international bonds—including bonds issued by the fledgling United States of America.

This trend clearly continues, with the exposure of US fund investors to world equities having grown substantially in recent years.

But that is only a part of much larger trend toward the globalization of fund investing. Nations around the world perceive the development of a successful fund sector as a crucial ingredient in growing their economy, diversifying sources of finance for businesses, encouraging start-ups, and providing resources for aging populations. Consider China’s recent market-opening measures, as just one example.

What an extraordinary opportunity for global asset managers—to help meet the needs of a whole new world of investors, by bringing them well-regulated, diversified, professional investment products that could capture the wealth-creating potential of economies across the globe.

There are countervailing forces, some quite powerful and worrisome, that may blunt or slow the globalization of economic life. But this trend concerning the expansion of fund investing will continue, I predict. And in that context, the work we do through ICI Global will continue to be of great importance.

Our unique global membership, our outreach to the global regulatory community, our work on issues of common interest like the contributions that funds can make in retirement systems, and our strong partnerships with sister associations in many different countries—these are accomplishments of which I am very proud. In less than a decade, we have made great strides in becoming a global organization. This work will continue.

The fourth and final pivotal question—you won’t be surprised to hear that it centers on the crisis we’re all still living with. As the pandemic turned our worlds upside down, how could regulated funds ensure they could continue to serve their investors?

Now, COVID-19 ushered in a new everyday reality for all of us. And for better or worse, it’s something that many of us have gotten used to. But in the early days of the crisis—when we saw those extraordinary events in the financial markets, when we all had to transform our approach to doing business—we were put to the test.

Those days feel like a long time ago now, but then and since our industry showed its strength.

In the 1939 movie The Wizard of Oz, the image of the great and powerful wizard tells Dorothy to pay no attention to “the man behind the curtain.” Too often we pay no attention to the men and women behind the curtain in our industry—that is, the people who maintain the vast infrastructure that serves funds and their investors. The wizard, of course, was a charlatan. By contrast, those who make fund investing possible are the real deal.

They include industry operations professionals and service providers, information technology and information security teams, risk managers, compliance officers, and business leaders. All the people who have focused intently on business continuity plans over many years.

ICI has worked closely with all these communities in the industry for decades. And true communities they are, dedicated to reducing risk for the neighborhood at large and working together through ICI to that end. In the process, we have helped reduce risks and realize enormous efficiencies in the US market, just as we hope to do in international markets.

The truly good news is how much all these efforts have paid off during the pandemic—a circumstance that imposed drastic changes on well-established patterns of work that no one could have contemplated. Clearly, we were not in Kansas anymore, and we may never quite return, but we have continued to deliver on our promises to our shareholders. Planning and resilience and community matter. They always will.

Maintaining a strong culture of integrity. Preserving a sound and appropriate framework of regulation. Bringing a global mindset to our challenges and opportunities. Working together to deliver on our promises to our shareholders. Above all, dedicating ourselves to serve their interests.

These I see as lessons of our recent experiences as an industry. I believe they are also lodestars by which we can plot our future course. The seas no doubt will prove tricky and storm-tossed at times. They always have. But if we steer by these values, I believe that future will be bright indeed.

Thank you once again for your time and attention.

Notes

[1] Compound annual growth rate of 7.8 percent.

[2] Compound annual growth rate of 7.6 percent.