Chairman’s Address

61st Annual General Membership Meeting

George C. W. Gatch

CEO, Global Funds Management and Institutional, J.P. Morgan Asset Management

May 1, 2019

Marriott Wardman Park Hotel

Washington, DC

As prepared for delivery.

Thank you, Yie-Hsin [Hung, GMM chair and New York Life Investment Management CEO], for that introduction and for the tremendous job you have done in organizing and leading this year’s General Membership Meeting. I know I speak for ICI’s Board of Governors and members when I say that this year’s program is outstanding. Yie-Hsin, you and your committee have done a fantastic job.

And let me say “thank you” to all of you in attendance, as well as to our sponsors. You have come together for three great days of insights, education, and camaraderie. We have a lot to look forward to.

In March, it was my honor to be the first chairman in ICI’s 79-year history to preside over our Executive Committee on European soil. Together in London with senior leaders from across our industry, we spent a full day discussing ICI’s international activities, hearing from regulators, European legislators and thought leaders, and debating the future of global finance.

Mind you—being in London in March of 2019 was quite the experience.

When we met, the original deadline for Brexit was just three weeks away. The UK government couldn’t come to terms with an exit deal. The turmoil, the tension, it was palpable, it was the theme of every conversation and a critical consideration for the global fund industry.

As we all know, the Brexit deadline got pushed off. But Brexit isn’t the only major source of uncertainty and anxiety on the global scene today.

We have trade tensions among the United States, Europe, and China. We have questions arising on both sides of the Atlantic about the security and economic arrangements that have promoted peace and prosperity in the developed world for the past 70 years. Nationalism is on the rise, and globalization—the idea of greater integration among economies and peoples—seems to be in retreat.

A few years ago, we were all convinced that the world is flat—moving inexorably toward greater integration. Now, it’s safe to say that the world is bumpy, at best, as we dodge potholes and speed bumps on that path.

And yet, in our Executive Committee meeting, within the room, it could not have been clearer that for our funds, for our investors, for our industry—globalization is an unstoppable trend.

Just think about the forces that will shape funds, and drive the demand for our services, in the decades ahead:

- The growing need for securities markets to support innovators and entrepreneurs;

- The expansion of the middle class in Asia and Latin America and its need for savings and investment vehicles;

- The aging of those same populations and the pressures already bearing down on underfunded public and private pension schemes;

- The hunger among savers around the globe for smart, professional, diversified, and well-regulated investment management;

- And the growing demand for portfolios that capture the potential and growth of all economies—not just in a few markets.

These trends will create new opportunities for fund investing. They will also place new demands on our firms, our people, our business models, and our relations with regulators.

As Yie-Hsin pointed out, we’ll explore many of these forces over the next three days. As we kick off, I want to look at how globalization is shaping our industry on three levels:

- Among our investors;

- For our companies as managers;

- And for all of us collectively, as we face the world through our trade association, ICI.

I’m well aware that at this moment, in this city, in our fraught political climate, it’s not easy to argue that the future is global. Connections among nations are fraying; tensions are rising. The momentum toward that flat world seems to have stalled.

But I fully believe

- that globalization is unstoppable;

- that the integration of our economies around the world is inevitable; and

- that the flows of goods and information and capital will inexorably overwhelm any barriers that nations erect.

Think about it. The word “globalization” has only been in vogue since 1983, when Harvard’s Theodore Levitt wrote about “The Globalization of Markets.” But the urge to reach out and explore; to bring home the exotic products of other lands; to create networks of production and trading and investment—that urge is as old as human history.

Phoenician traders sailing around the Mediterranean; caravans plying the Silk Road; Polynesian explorers questing across the vast waters of the Pacific. They were driven to knit the world more tightly together—with nothing more than wind power and camels and canoes.

How can we, in the world of digital and mobile everything, global supply chains, and instantaneous capital flows, think that the basic human urge to connect can be stopped?

There is no turning back on the path to globalization.

Finance is more global than ever. Investors increasingly are looking for opportunities across borders—net cross-border purchases of portfolio assets hit $2.5 trillion in 2017. Those flows are binding financial markets more tightly together: research by J.P. Morgan’s Guide to the Markets shows that equity markets are increasingly correlated. Whether a stock is in the Dow, the DAX, the Nikkei, or the FTSE, its price more and more tends to reflect the forces of global supply and demand.

The fund industry has played a vital role in giving investors access to financial markets around the world.

Over the past three decades, the world has opened up for investors. One country after another has removed capital controls and opened its markets. In the 1980s, the predecessor to today’s MSCI All Country World Index encompassed just 21 markets. Today, that index covers 57 jurisdictions—58 when you count the phased introduction of China’s equities. The world of opportunities for investors keeps expanding.

American investors have responded. In the 1980s, US fund investors had just 3 percent of their long-term fund assets in global strategies. Today, that share is closer to 20 percent. And, given the rapid growth of fund investing through retirement accounts, Americans today have a lot more riding on global markets than their parents did 30 years ago.

Even with that growth, Americans may be under-invested in foreign markets.

Yes, American savers may have one-fifth of their assets in other markets—but the US market accounts for only about half of the global equity indexes. The domestic share of Americans’ portfolios is still 50 percent greater than the US share of the world’s market capitalization.

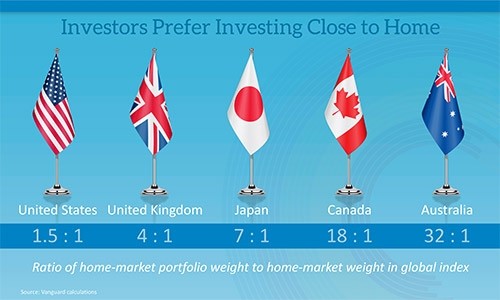

We all know that as home-market bias—and that, too, is a global phenomenon. In fact, according to Vanguard data, the mismatch between investors’ allocation to stocks in their home country and the size of the home market is four-to-one in Britain; seven-to-one in Japan; 18-to-one in Canada; and a whopping 32-to-one in Australia.

Clearly, there’s still room for investors to take advantage of global opportunities—especially as countries around the world develop and claim a larger share of the global economy.

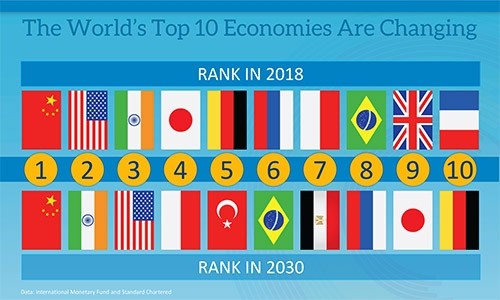

Here are some projections for what the world’s major economies will look like by 2030—just a little more than a decade from now—from Standard Chartered, the London-based bank:

- China—already, by some measures, the world’s largest economy—will almost triple its gross domestic product.

- India will surge in growth to surpass China in population and become the world’s second-largest economy.

- Indonesia, Turkey, Brazil, and even Egypt will multiply their GDPs and take their places among the world’s top 10 economies.

- Meanwhile, today’s mature economies—the United States, Japan, and Germany—will continue to grow, but not fast enough to maintain their share of global output.

Investors will need to go where the growth is occurring—and as asset managers, we will, too.

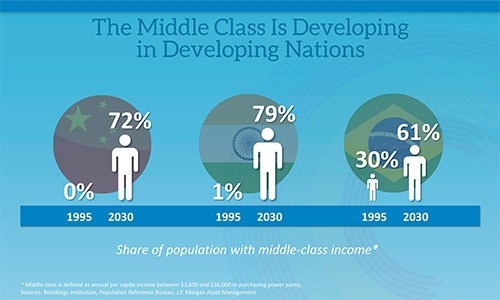

As these markets develop, more and more of their citizens will attain middle-class incomes and lifestyles in these rapidly developing markets.

We know from our experience that fund investing develops as an economy develops—the more incomes rise, the more a population demands the diversified, transparent, and cost-effective investing that funds provide. We’ll see that demand increasing in India, China, Brazil, and many other countries.

In fact—we’re already seeing accelerating demand. Boston Consulting Group reports that growth in assets under management accelerated in every region of the world in 2017—with notable jumps in Latin America, the Middle East and Africa, and throughout the Asia-Pacific region.

Let me just mention one other driver for fund investing in many nations—the aging of their populations.

In the United States and Europe, the share of the population that will be 65 or older will rise by 50 percent over the next 30 years.

In India, there will be twice as many elderly people, relative to the full population, in 2050.

In China—the share of the population aged 65 or older will be two-and-a-half times larger.

And in Brazil, the elderly population will nearly triple.

In these and many other countries, pay-as-you-go pensions aren’t going to be able to carry the strain of aging populations.

More and more countries are looking at the model of defined contribution retirement savings—built on fund investing—that has helped American workers achieve a 600 percent increase in retirement assets per household, after inflation, since 1975.

And that’s another challenge—and another opportunity—for us all.

The good news is, our industry is rising to these challenges. We are taking a global approach across our firms.

Among the 25 largest US fund managers, almost one dollar out of every six dollars of fund assets under management is domiciled outside of the United States. That’s up from less than one dollar in 10 just 15 years ago.

We manage our businesses in a global market for investing talent. Our firms locate portfolio managers and fund administrators throughout the world—wherever the best talent can operate most efficiently.

We build strong fiduciary cultures to tie these teams together and ensure that we always operate at the highest level of compliance and investor focus.

And we are organized for global investing. At my firm, J.P. Morgan Asset Management, our equity investors work across regions and sectors to develop a comprehensive view on the companies they cover. For example, the US auto analyst works with our materials analyst in London and our semiconductors analyst in Asia to understand the global supply chain for automakers.

More and more, our portfolio managers and analysts are following their industries across regions, seeking investment opportunities wherever they arise. The companies that we follow operate in global markets—and so must we.

Our global approach brings responsibilities as well.

The principles of investing are universal. We see that every day.

But the culture of investing is not as widespread as it should be.

In some markets, investors cling to the security of risk-free returns, holding large amounts in savings accounts but not taking advantage of the power of growth by getting invested in markets. In others, trading volumes are significantly higher, and the notion of long-term investing has not yet displaced the short-term trading mentality.

For the sake of our investors, we must commit ourselves to advancing investor education and to promoting financial literacy. We’ve done it before—right here in America. But there’s always more to do. We can build strong savings and investment cultures—while respecting cultural differences—in the markets that make up our future.

As asset managers, we have an important ally in our efforts to bring fund investing to all corners of the world.

That ally is our association—the Investment Company Institute.

ICI has long advocated for regulation to facilitate efficient cross-border investing and fund management. But with the creation in 2011 of a dedicated international arm—ICI Global—the Institute has raised its game significantly.

Operating out of London, Hong Kong, and Washington, ICI Global has brought ICI’s deep understanding of the regulation, the economics, and the operation of funds to policy debates in Brussels, in Hong Kong, in Mumbai and Sydney.

ICI now has members headquartered on six of the globe’s seven continents. We haven’t figured out how to plant the flag in Antarctica—yet. More than 100 ICI members offer non-US funds; 12 members have only non-US funds.

Working with its members, the Institute sets priorities aimed at four crucial goals:

- Making the benefits of fund investing available to more citizens in more countries;

- Empowering those investors to reach across borders and take advantage of investment opportunities wherever they can be found;

- Discouraging policies that would threaten the value that funds bring to markets and investors; and

- Enabling fund managers to tap all the talent they can find and deploy their expertise efficiently—wherever it takes them.

That means engaging with regulators in every major capital. It means forming partnerships with other trade bodies. ICI enjoys strong relationships with other fund associations around the globe. It means interacting with academic organizations and facilitating dialogue with other market participants. And it means contributing ICI’s own research and thought leadership to advance key debates.

ICI Global has served its members with advocacy on tax policy, addressing FATCA and tax issues that fund investors face in Korea, India, Switzerland—even at the United Nations.

It has championed delegation and cross-border fund management as Brussels has struggled to cope with Brexit.

It has promoted fund passports and market access in the Asia-Pacific region.

It has educated members around the world about growing cybersecurity risks, and linked members with law enforcement to help limit the threats.

It has promoted sensible retirement policies to foster long-term investing.

And it has resisted the threat of bank-like regulation for our funds and our markets.

In a world that’s growing increasingly bumpy, with new protectionist barriers arising, with capital markets under regulatory pressure, the need for consistent, investor-friendly regulation is greater than ever.

And so is the need for ICI’s advocacy. We can all be grateful—and proud—that this organization is out there working on behalf of our funds and their investors.

Everywhere we look today, we see more borders and more barriers. Trade and immigration are flashpoints in every region. The world is indeed getting more bumpy.

In this environment, our role as fund managers is clear. We need to make the benefits of fund investing available to investors everywhere. We need to tap investment talent and growth opportunities wherever we find it—and make it available, efficiently and seamlessly, to our shareholders.

We are a global industry, and there’s no turning back.

Indeed—why would we want to?

Yes, it is a challenging time. But I have never been more optimistic. Individuals need our products and services now more than ever.

The world offers a bright future for those who can navigate the bumps—bring that global world to their investors—and help them realize their financial goals.

Thank you for your attention.