ETFs: Growth, Regulatory Developments, and Persistent Misperceptions

Jennifer Choi

Chief Counsel, ICI Global

24 June 2019

FundForum International

Copenhagen

As prepared for delivery.

Well, another excellent session to add to a morning full of them.

Hats off to the folks at Fund Forum International for hosting this first-ever Inside ETFs Growth Strategies Summit. And of course, kudos to you all for making a point to arrive early for additional insights ahead of the main event.

Just to quickly get to know each other, I’m Jennifer Choi from the Investment Company Institute.

As a leading association representing regulated investment funds around the world, ICI works every day to advance the interests of our members—and the hundreds of millions of investors they serve.

Every day, we’re in London, Hong Kong, Washington, or somewhere in between:

- monitoring and analyzing fund industry trends;

- promoting public understanding of funds and the benefits of fund investing;

- emphasizing the role of robust capital markets in strengthening economies and enhancing retirement saving;

- advocating for public policies that protect investors and expand their opportunities; and

- helping our members navigate the complexities of compliance in our ever-evolving regulatory environment.

As you might imagine, ETFs make up a large and growing part of our efforts.

My role in all this? I’m chief counsel of ICI Global, which is responsible for ICI’s work on international issues for both our US and non-US members.

But don’t worry. I haven’t flown 4,000 miles to deliver some lengthy lawyerly lecture. Only my law students are subject to those.

Instead, I’d like to zoom out from the in-depth discussions we’ve been having so far, and take you on a brisk spin around the ETF landscape—on a guided three-stop tour to give you a better sense of how the landscape looks today.

At these three stops, we’ll look at the state of play in the industry, with a focus on Europe.

We’ll explore the global regulatory environment that has emerged from the industry’s growth.

Most important, we’ll examine some worrying, persistent misperceptions in the United States that threaten to confuse ETF policy discussions going forward—and see where the folks pushing them have gone wrong.

Okay, first stop: the state of the industry.

It’s no secret that the rise of ETFs has been extraordinary. Today, they’re accessible in more markets, listed on more exchanges, sponsored by more companies, and owned by more people than ever before. Nothing suggests that any of these trends will slow down soon.

Investors value these funds for a variety of reasons. They can be traded during the day, their prices are transparent, they’re tax-efficient, and they’re an easy way into hard-to-reach markets and asset classes.

Worldwide ETF assets now stand at $5.4 trillion, more than 25 times the amount only 15 years ago. That’s just massive growth—and a staggering sum for an industry not even 30 years old.

The United States leads in market share—thanks in part to its head start in introducing ETFs, and in part to its larger regulated fund industry overall.

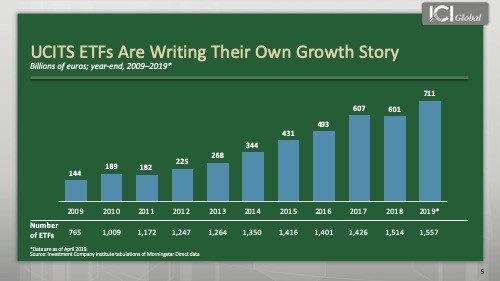

But here in Europe, UCITS ETFs have been writing their own growth story, with more than 1,500 funds now holding more than €700 billion in assets. That’s more than twice the number of funds—and nearly five times the assets—that Europe’s ETF industry had less than a decade ago.

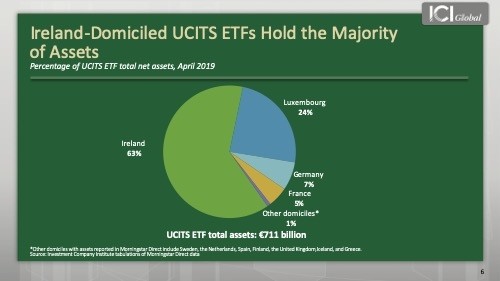

Where are these assets located?

Well, as you can see here, Ireland is by far the major player, with about 63 percent of the European market. In fact, UCITS ETFs in just four countries—Ireland, Luxembourg, Germany, and France—account for almost all the assets.

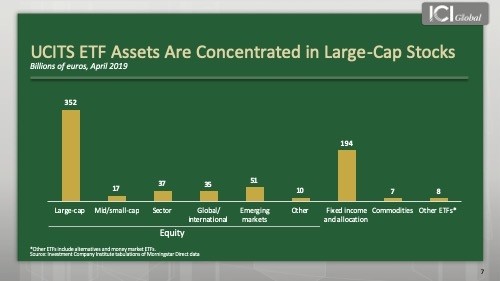

In what types of funds are these assets concentrated?

Of course, exotic or experimental products draw most of the excitement in ETF circles, but tried-and-true strategies still draw the most investor cash. Half of UCITS ETF assets are invested in plain old large-cap stocks, and more than a quarter are invested in fixed-income and allocation products.

I should add that we can attribute the growth in UCITS ETF assets to more than just returns. Investors’ voracious appetite for these funds has played an even greater role.

According to Morningstar estimates, investors have poured a net €200 billion into UCITS ETFs since the end of 2015. That amounts to more than 70 percent of the total increase in UCITS ETF assets over that time period.

These are remarkable numbers, really—and people in the industry aren’t the only ones paying attention.

Indeed, we’re seeing impressive growth in many parts of the world—not just here in Europe—and it has awakened the curiosity of more than a few policymakers.

That’s why the regulatory environment is the second stop on our tour.

More and more these days, regulators around the world are making it a priority to study ETFs and their markets, to launch formal examinations of them, or to consider new rules governing them.

On the global stage, the International Organization for Securities Commissions—IOSCO—has identified ETFs as a priority area in its 2019 work program. IOSCO says this new ETF work will follow on its “earlier discovery work that considered potential investor protection and market integrity issues.”

IOSCO also is collaborating with another international body—the Financial Stability Board—on the FSB’s examination of potential financial stability risks arising from what it characterizes as ETFs’ “possible impact on market liquidity.”

Just two weeks ago, they conducted a joint workshop on ETFs—looking at arbitrage, automated trading, and liquidity management practices, among a wide range of other topics.

We at ICI Global look forward to engaging with both groups as work in this area moves along.

Over in the United States, the Securities and Exchange Commission is putting the finishing touches on a rule to modernize its ETF regulatory framework—a constructive endeavor that has earned ICI’s enthusiastic support.

Unlike here in Europe, US fund sponsors have long had to obtain orders from the SEC to launch an ETF exempting them from certain provisions of the law governing funds.

This long, expensive, and inconsistent process has subjected similar ETFs to varying conditions, and enabled some ETFs to enjoy advantages that others don’t.

By allowing nearly all US-registered ETFs to operate without having to obtain an exemptive order, the new rule will introduce some big benefits.

Like creating a fairer, more competitive market—and lowering the barriers to enter it.

Like saving firms the time and expense of applying for exemptive relief—and freeing up the SEC staff who review those applications to focus on more novel products that still must go through the exemptive process.

Taken together, these benefits will make the ETF regulatory framework more consistent, transparent, and efficient.

Out in Asia, Hong Kong’s Securities and Futures Commission released a paper in January 2018 examining the territory’s ETF market—ahead of “more concrete” policy changes in Hong Kong and further discussions on ETF regulation at the international level.

The SFC noted further that it’s working with ETF stakeholders, exchanges, and Mainland China authorities to enhance its market infrastructure and regulatory regime.

European regulators have been quite active as well.

In 2017, the Central Bank of Ireland released a paper focusing on ETF trading, structures, risks, and more—inviting comment from observers inside and outside the country to help inform the ETF conversation in Europe and beyond.

And France’s Financial Markets Authority—the AMF—issued a paper studying how growth in the country’s ETF assets might affect market liquidity and financial stability.

Both regulators remain at work in this space.

In a response to feedback on its paper last September, the CBI highlighted a need for more and better information about authorized participants, and noted continuing CBI and international regulatory attention to matters involving ETF liquidity.

And less than two weeks ago, AMF Chairman Robert Ophèle called for a “European approach” to ETF regulation, asserting that the rise of ETFs has created a need to “review our approach more radically.”

You know, we take examinations like these quite seriously—especially when authored by some of the world’s top policymakers—because the conclusions often signal what type of policies, if any, they might make.

We parse these reports with the keenest of eyes because, over the years, we’ve encountered a wide range of misperceptions about how ETFs work and their role in the financial markets—largely among academics, analysts, and members of the press.

Even as we’ve been working hard to correct these misperceptions, unfortunately they persist. So if you haven’t already come across them, you’re bound to at some point.

That’s why explaining the misperceptions—and busting them—is the third and final stop on our tour.

Now, these misperceptions have popped up in a number of countries and regions, but most often in the United States. So let’s walk through three examples from there.

First, we see claims that index ETFs own so much of the US stock market that they distort the prices of the securities they hold in their portfolios.

Yet the data show that US equity index ETFs hold a mere 7 percent of the US stock market. Even adding US equity index mutual funds, the share is still only 15 percent.

Moreover, another thing that’s often forgotten here is that index products aren’t all the same. They’re actually quite diverse—tracking a wide array of market caps, sectors, regions, and factors.

Investors make active decisions to choose among these index products, based on their tolerance for risk and on their beliefs about future expected returns.

A second misperception we see is the claim that high-yield bond ETFs create a so-called “illusion” or “mirage” of liquidity that could vanish during times of market turmoil.

Yet the data show just the opposite.

Even during the rockiest trading days, high-yield bond ETFs have time and again added substantial liquidity to the underlying market—providing both buyers and sellers with an efficient means of transferring risk while limiting the impact on prices of the underlying bonds.

What some people who make this claim fail to realize is that most trading activity in high-yield bond ETFs happens in the secondary market—which generally doesn’t create transactions in the underlying bonds, because only the ETF shares are changing hands.

We see this today—when high-yield bonds are rallying—just as we’ve seen it in earlier years, when they were taking a hit.

Another thing that people fail to realize is that market makers come in many forms—that many types of companies in the United States, not just authorized participants, act as liquidity providers.

The third misperception is perhaps the most alarming—people actually blaming market volatility on ETFs. The truth is, markets do often see more traffic during volatile spells, but ETFs drive very little of the volatility.

We saw this phenomenon play out at least twice in the US stock market just last year.

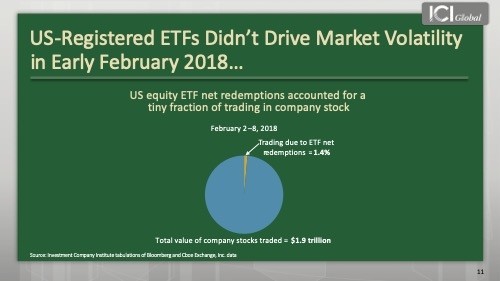

In early February—when broad equity indexes fell sharply and volatility spiked after years of relative calm—investors traded nearly $1.9 trillion in company stocks, or almost $400 billion more than during the week before.

Yes, that’s a lot of trading. And observers pointed at ETFs to explain the sudden downturn.

But check this out.

See that tiny sliver? That’s net redemptions from US equity ETFs, representing the direct interactions ETFs have with their underlying company stocks.

During this volatile week, these net redemptions amounted to just 1.4 percent of the total value of company stocks traded. Put another way, we’re talking about less than a penny and a half in ETF redemptions for every dollar in trading of company stocks.

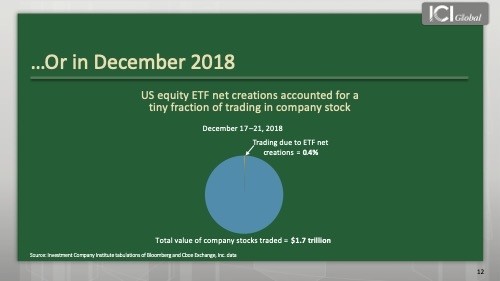

When volatility returned in full force during the fourth quarter, the story was similar.

As equity indexes dropped during the third week of December, more than $1.7 trillion in company stocks changed hands—or about 460 billion more than during the much calmer week before.

Again, the net issuance of US equity ETF shares accounted for a tiny fraction of the trading in company stocks. You might have to squint to see this one. It’s about 0.4 percent, or less than half a penny for every dollar in trading of company stocks.

In fact, this tiny fraction didn’t even amount to a net redemption.

That’s right. With the Dow suffering its worst calendar week in more than a decade and stocks nearing bear market territory, ETFs actually created new shares, on net.

In both these instances, what happened was totally normal. Investors traded ETF shares as a way to transfer risk—just as they do in calmer markets—and didn’t redeem heavily.

The big mistake we see here is similar to what we see among commenters in the high-yield bond space.

They’re basing their analyses on the secondary market, where the vast majority of transactions don’t affect the underlying securities markets that ETFs invest in. They should be looking at the primary market, where transactions do affect the underlying markets.

Of course, we all know what the real driver of market volatility is.

Going back to before ETFs even existed, every—and I mean every—major bout of market volatility has been set in motion by a macroeconomic event.

Just take a look at the spikes in this chart.

Black Monday, Russian default, dot-com bubble bursting, 2008 financial crisis, “Flash Crash,” Brexit. All the way up to our 2018 examples: inflation concerns in February, and trade tensions between China and the United States in December.

In none of these instances did ETFs—or any specific investment vehicle—have a material role.

We at ICI have never been much for the prognostication business. But we have every reason to believe that ETFs will continue to thrive in the coming years.

Whatever challenges might come their way, we’re confident that new sponsors and products will continue to emerge around the world—that more investors in more markets will be able to enjoy the many benefits that ETFs provide.

Should the growth continue, history shows that sharper regulatory scrutiny won’t likely be too far behind. And yes, probably the misperceptions as well.

The scrutiny we would welcome, as long as it’s based on data and evidence, rather than conjecture. The misperceptions? Well, the best I can tell you is that we would keep on fighting the good fight.

So that concludes our tour. But for many of you, your work with ETFs is far from over. It’s up to you to decide what this information means for your firm and how it might fit with your strategies and goals.

Whatever you make of it, you can be sure of at least one thing. ICI will continue working to advance the interests of ETFs—of all regulated funds—and their investors.

Hope to see you somewhere down the road. And thank you so much for your time.