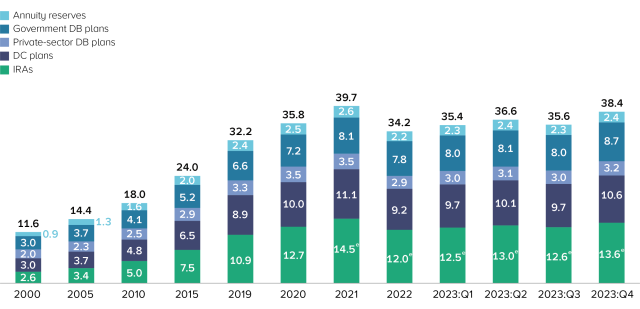

Retirement Assets Total $38.4 Trillion in Fourth Quarter 2023

Washington, DC; March 14, 2024— Total US retirement assets were $38.4 trillion as of December 31, 2023, up 7.8 percent from September and up 12.4 percent for the year. Retirement assets accounted for 32 percent of all household financial assets in the United States at the end of December 2023.

US Total Retirement Market Assets

Trillions of dollars, end-of-period, selected periods

e Data are estimated.

Note: For definitions of plan categories, see Table 1 in “The US Retirement Market, Fourth Quarter 2023.” Components may not add to the total because of rounding.

Sources: Investment Company Institute, Federal Reserve Board, Department of Labor, National Association of Government Defined Contribution Administrators, American Council of Life Insurers, and Internal Revenue Service Statistics of Income Division

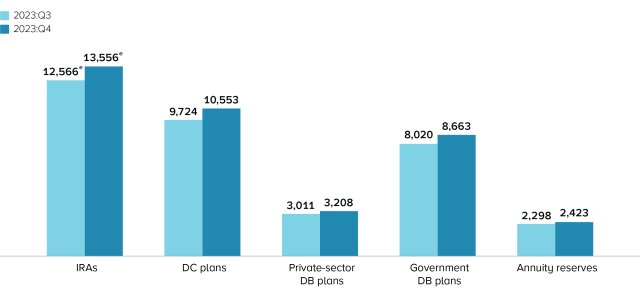

Assets in individual retirement accounts (IRAs) totaled $13.6 trillion at the end of the fourth quarter of 2023, an increase of 7.9 percent from the end of the third quarter of 2023. Defined contribution (DC) plan assets were $10.6 trillion at the end of the fourth quarter, up 8.5 percent from September 30, 2023. Government defined benefit (DB) plans—including federal, state, and local government plans—held $8.7 trillion in assets as of the end of December 2023, an 8.0 percent increase from the end of September 2023. Private-sector DB plans held $3.2 trillion in assets at the end of the fourth quarter of 2023, and annuity reserves outside of retirement accounts accounted for another $2.4 trillion.

Retirement Assets by Type

Billions of dollars, end-of-period, 2023:Q3–2023:Q4

e Data are estimated.

Sources: Investment Company Institute and Federal Reserve Board

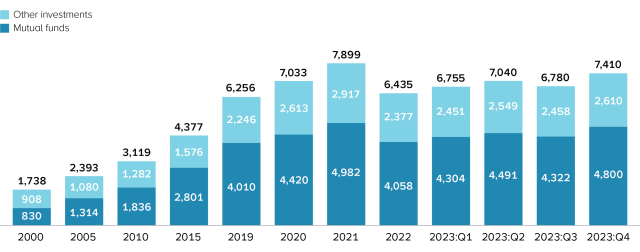

Defined Contribution Plans

Americans held $10.6 trillion in all employer-based DC retirement plans on December 31, 2023, of which $7.4 trillion was held in 401(k) plans. In addition to 401(k) plans, at the end of the fourth quarter, $595 billion was held in other private-sector DC plans, $1.3 trillion in 403(b) plans, $430 billion in 457 plans, and $843 billion in the Federal Employees Retirement System’s Thrift Savings Plan (TSP). Mutual funds managed $4.8 trillion, or 65 percent, of assets held in 401(k) plans at the end of December 2023. With $2.8 trillion, equity funds were the most common type of funds held in 401(k) plans, followed by $1.3 trillion in hybrid funds, which include target date funds.

401(k) Plan Assets

Billions of dollars, end-of-period, selected periods

Note: Components may not add to the total because of rounding.

Sources: Investment Company Institute and Department of Labor

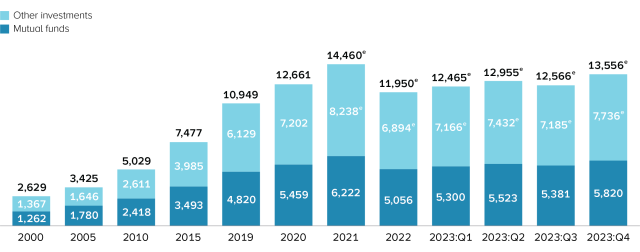

Individual Retirement Accounts

IRAs held $13.6 trillion in assets at the end of the fourth quarter of 2023. Forty-three percent of IRA assets, or $5.8 trillion, was invested in mutual funds. With $3.3 trillion, equity funds were the most common type of funds held in IRAs, followed by $1.1 trillion in hybrid funds.

IRA Market Assets

Billions of dollars, end-of-period, selected periods

e Data are estimated.

Note: Components may not add to the total because of rounding.

Sources: Investment Company Institute, Federal Reserve Board, American Council of Life Insurers, and Internal Revenue Service Statistics of Income Division

Other Developments

Retirement entitlements include both retirement assets and the unfunded liabilities of DB plans. Under a DB plan, employees accrue benefits to which they are legally entitled and which represent assets to US households and liabilities to plans. To the extent that pension plan assets are insufficient to cover accrued benefit entitlements, a DB pension plan has a claim on the plan sponsor.

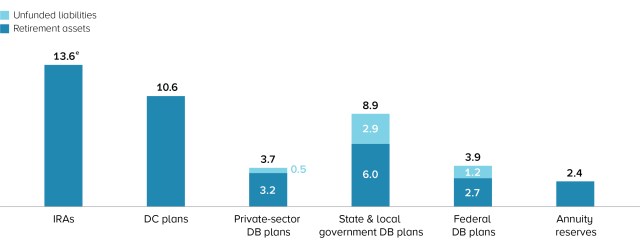

As of December 31, 2023, total US retirement entitlements were $43.0 trillion, including $38.4 trillion of retirement assets and another $4.6 trillion of unfunded liabilities. Including both retirement assets and unfunded liabilities, retirement entitlements accounted for 36 percent of the financial assets of all US households at the end of December.

Unfunded liabilities are a larger issue for government DB plans than for private-sector DB plans. As of the end of the fourth quarter of 2023, unfunded liabilities were 33 percent of benefit entitlements for state and local government DB plans, 31 percent of benefit entitlements for federal government DB plans, and 12 percent of benefit entitlements for private-sector DB plans.

US Total Retirement Entitlements

Trillions of dollars, end-of-period, 2023:Q4

e Data are estimated.

Note: For definitions of categories, see Tables 1 and 2 in “The US Retirement Market, Fourth Quarter 2023.”

Sources: Investment Company Institute and Federal Reserve Board

The quarterly retirement data tables are available at “The US Retirement Market, Fourth Quarter 2023.”

Technical Notes

The Investment Company Institute’s total retirement market estimates reflect revisions to previously published estimates.

The latest estimates incorporate newly available data on 2021 flows and year-end 2021 assets for 401(k) plans, other private-sector DC plans, and private-sector DB plans from the US Department of Labor Form 5500 microdata. Incorporation of the newly available information resulted in downward revisions to previously published estimates of 401(k) plan, other private-sector DC plan, and private-sector DB plan assets beginning in the first quarter of 2021.